Analysis | September 8, 2022

China High Yield – Have We Reached the Bottom?

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

The China high yield market experienced a rapid recovery in August. What’s changed?

August was a notable month for Asia high yield, with the market up 3.13%,1 and the China high yield market up a staggering 9.5%.2 This was in sharp contrast to Western markets such as US high yield which fell 2.42%3 and European investment grade which was down 4.25%.4

This notable recovery may come as a surprise following a long period of volatility and negative price action, specifically around the Chinese property sector, which comprises a large proportion of both markets. What has brought about this rapid reversal in performance?

In our view, the key factor has been the significant amount of broad policy loosening that has lifted sentiment and improved the economic outlook across China.

1.Monetary Policy

In August, the People’s Bank of the Republic of China made several cuts to rates. It cut one of its key interest rates in a surprise move – with its one-year medium term lending facility loan (MLF) falling by 10bps from 2.85% to 2.75%. It also made two cuts to its benchmark lending rates; the one-year loan prime rate (LPR) from 3.7% to 3.65% and the 5-year LPR from 4.45% to 4.3%, thus reducing mortgage rates for first time buyers.

2.Fiscal Policy

Towards the end of August, the Chinese government announced RMB300bn of funding, much of it aimed at supporting infrastructure development projects, as part of a 19-point plan to boost economic growth.5

3.Looser Regulations

Six key provinces, which account for c. 45% of GDP, were asked by the national government to take the lead on providing economic stability. As part of this measure, local governments have been asked to adopt more flexible policies for homebuyers under the ‘one city one policy’ mandate. For example, deposit requirements were reduced and residency obligations were loosened in an effort to stimulate demand.6

4.Property Sector Funding

During August, the property sector benefited from two funding channels. The first from state owned entity China Bond Insurance Company, which regulators asked to guarantee onshore bond issuance for several private property developers.7 The second was an RMB200bn special loan facility for distressed property developers to ensure the completion of stalled building developments, specifically semi-completed housing projects.8

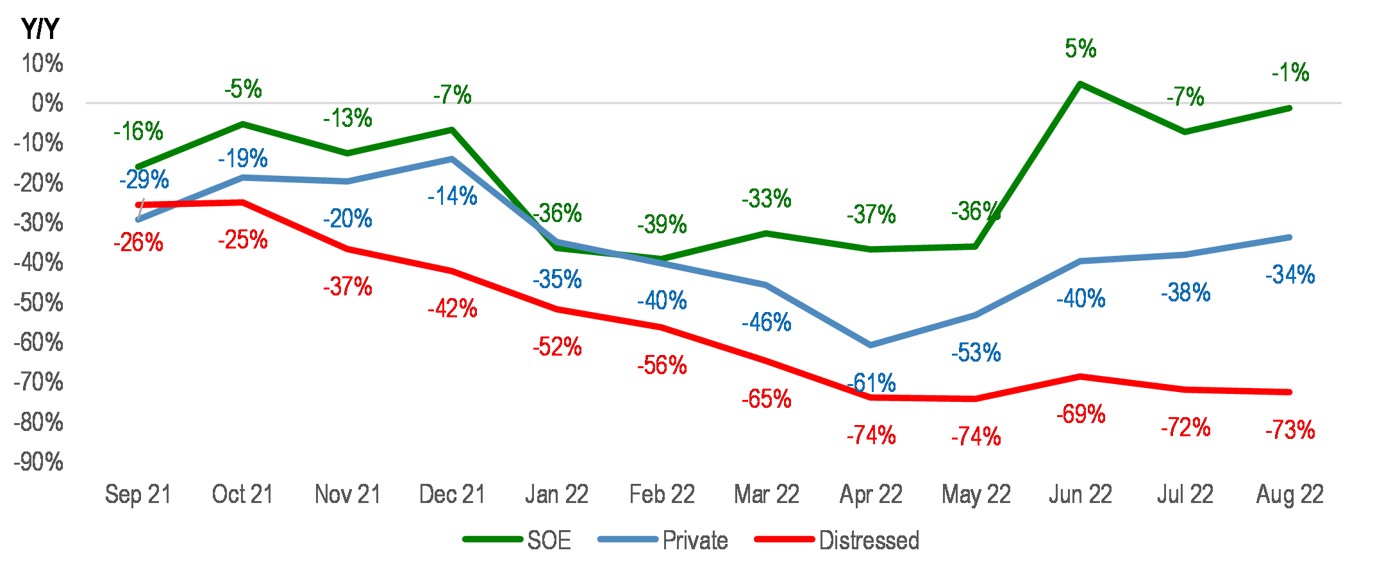

State-Owned vs. Privately-Owned Property Developers Recover from April Lows

Source: JP Morgan, China Property Report, 31st August 2022. Chart shows major developers’ contracted sales y/y growth by type. For illustrative purposes only.

Market participants clearly welcomed this unprecedented level of policy stimulus. Credit markets reacted favourably to the news and began to more accurately reflect underlying fundamentals.

Looking ahead, we believe the longer-term outlook for Asia remains positive. Unlike its Western counterparts, Asia is currently not experiencing any issues with inflation. Growth is also expected to pick up during the second half of the year, as we expect Chinese growth to normalise in 2023 to c. 5%. However, risks remain; our biggest concern is the country’s zero-Covid policy which could counteract any economic recovery. Nevertheless, while we continue to believe Asia credit offers a compelling investment opportunity, in our view it is very important to remain focused on bottom-up fundamental analysis prior to making any investment decisions.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of September 2022 and may change without notice.

Sources:

- ICE Platform, 31st August 2022 - ICE BofA Asia Dollar High Yield Corporate Index (ACHY)

- ICE Platorm, as of 31st August 2022 China carve out of the ICE BofA Asia Dollar High Yield Corporate Index (ACHY)

- ICE Platform, 31st August 2022 - ICE BofA US High Yield Cash Pay Index (J0A0)

- ICE Platform, 31st August 2022 - ICE BofA Euro Corporates Index (ER00)

- Bloomberg, 22nd August 2022

- CNBC, 17th August 2022

- Reuters, 16th August 2022

- Business Standard, 22nd August 2022

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

About the Author

Tracy Zhao, M.Ec.

Senior Credit Analyst, Emerging Markets - Asia

Tracy joined Muzinich in 2016. Prior to joining Muzinich, Tracy spent 2 years at Aozora Asia Pacific Finance focusing on Syndication Loans across a range of sectors in the Greater China region. Previously, she was an Equity Analyst with a private fund. Tracy earned a Bachelor’s Degree in Economics from Shanghai Jiaotong University and a M.Ec. from the University of Hong Kong.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Index Descriptions

ACHY – The ICE BofA Asian Dollar High Yield Corporate Index tracks the performance of sub-investment grade US dollar-denominated securities issued by Asian corporate issuers in the US domestic and eurobond markets.

J0A0 - The ICE BofA ML US Cash Pay High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt, currently in a coupon paying period that is publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

ER00 – The ICE BofA ML Euro Corporate Index tracks the performance of EUR denominated investment grade corporate debt publicly issued in the eurobond or Euro member domestic markets. Qualifying securities must have an investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of EUR 250 million.

Important Information

Muzinich & Co.", “Muzinich” and/or the "Firm" referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-09-07-9312