Insight | June 26, 2023

Lower Middle Market Private Credit – A Golden Vintage

How challenges in the US banking system could create an opportunity for lower middle market private credit investors.

Key Themes

- Small banks are key providers of capital to lower middle market businesses but are reducing lending as deposit stability remains a concern and commercial real estate loan portfolio quality is in question.

- Many lower middle market businesses continue to demonstrate strong fundamentals, underpinned by industry-specific GDP growth, and have business models designed to weather economic cycles.

- Reduced bank lending and a continued need for growth capital will create a ‘capital vacuum’ for the lower middle market, potentially setting the stage for a record vintage in private credit.

Summary

The US economy has garnered significant attention over the past several months, as challenges in the US banking system, rising interest rates, and increased prospects of recession have populated the news headlines.

Banks with exposure to commercial real estate (‘CRE’) may be a particularly weak spot in the economy. Rising interest rates in concert with lower occupancy may drive near term CRE stress as looming maturities and lower cash flows will increase defaults. Surprisingly, Small Domestically Chartered Commercial Banks (‘Small Banks’)¹ hold a disproportionate share of CRE assets, with US$1.9 trillion of loans vs. Large Domestically Chartered Banks (‘Large Banks’)² only holding US$884bn (as depicted on Fig. 1). Small Banks act as a crucial financing source for lower middle-market businesses.

We believe a capital vacuum may be forming for the lower middle market, whereby banks pull back from Commercial & Industrial Loans (e.g. corporate lending, ‘C&I Loans’) to shore up their balance sheets, while many lower middle market companies continue to see strategic growth opportunities. The lower middle market will need to find alternate sources of growth capital.

Small Banks Potentially Headed for Workout

While the Fed’s actions have proven successful in causing inflation to start declining, its interest rate policy has had knock-on consequences in the banking sector. This has been exemplified by the failure of Silicon Valley Bank, Signature Bank, and First Republic, as rising rates and the fear of illiquidity caused deposit flight. It is possible that additional bank failures may continue.

The impact of rising interest rates on US banks is not trivial and opens the possibility of greater regulatory oversight. A recently published academic paper entitled ‘Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs’³ suggests that the potential impact of rising rates could be as high as US$2.2 trillion in unrealized losses on bank balance sheets, which would be very consequential for the economy if assets had to be marked-to-market.

Fig. 1 – Assets & Liabilities of Large and Small Domestically Chartered US Banks

Source: Federal Reserve H8. as of March 2023. For illustrative purposes only.

When Muzinich looks at the assets and liabilities of US banks, what stands out is the disparity in asset allocation within the CRE asset class; Small Banks hold ~29% of direct CRE loans on their balance sheet vs Large Banks with only 6%. Comparing that to the aggregate bank equity within Small Banks, a 10% CRE asset impairment could result in a nearly 30% reduction in equity vs. only 6% for Large Banks (please note this analysis excludes the impact of mortgage-backed security and other real estate linked holdings).

One way banks may manage their balance sheets in preparation for a challenging CRE environment is by reducing activity in C&I lending. We have already started to see this through the April 2023 Fed’s ‘Senior Loan Officer Opinion Survey,’ which shows 45%+ of banks have started to tighten their lending standards, a level not seen since the GFC and the ‘dot.com’ bubble (excluding COVID).

This presents a significant challenge for lower middle-market businesses which don’t have access to external capital outside of traditional banking relationships. While bank financings are generally limited to working capital and small term loans, filling the capital vacuum could require billions of dollars to support growth-related activities like acquisitions, inventory purchases, and equipment financings.

With 15 of 22 industries counted within Real GDP experiencing growth during FY’22⁴, FY’23 carries momentum for the overall US economy. Even if economic headwinds manifest into more definitive contractions, pockets of opportunity will remain. We believe that industries like IT services, healthcare, and government services will see demand outside of the traditional economic cycle and understanding the demand drivers/macro tailwinds will be imperative to investment selection over the medium term. The ‘tide will not lift all boats’ and private credit will need to selectively fill the void left by Small Banks.

Fig. 2 – Domestic Banks Tightening Standards for C&I Loans

Source: FRED as of March 2023. For illustrative purposes only.

The Opportunity in Private Credit

Capital available to lower middle market-sized businesses is contracting as banks work through the rising interest rate environment and potential duress in CRE. This could culminate in a tightening of credit to the life blood of the US economy.

We believe that the dynamics in the US banking system present an opportunity for investors which could be considered a ‘golden vintage’ in private credit, particularly for the lower middle market given the acute issues with Small Banks.

Background on the Lower Middle Market

There are approximately 354.000 companies in the United States within the middle market⁵, with the lower middle market accounting for 180k+ (Revenues of US$10m-$100m; 51%+ of the middle market) of the sub-segment. Many of these companies are family owned and have historically sought financing from local or regional banks. With Small Banks accounting for US$772.3 billion in corporate loan assets⁶, the lower middle market is a meaningful component to the US economy and banking capital nationally.

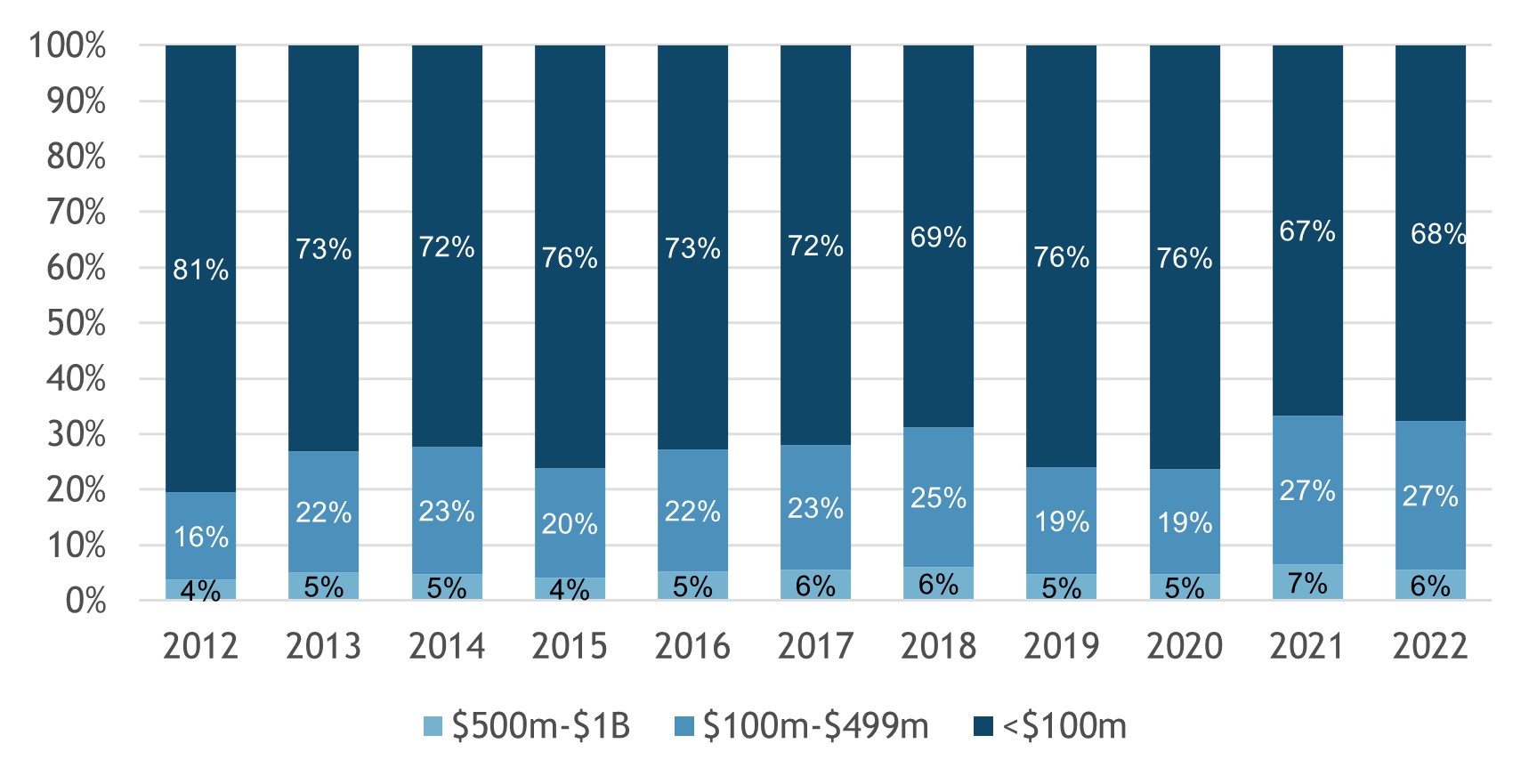

Fig. 3 – Transaction Volume by Enterprise Value

Source: Baird Annual M&A Outlook (January 2023). For illustrative purposes only.

From an investment opportunity perspective, the lower middle market is the most active segment with 2,800+ M&A transactions annually between 2012 and 2022 ⁷ on average, accounting for ~70% of total transaction volume between 2012-2022. Despite being the most active, purchase price multiples in the lower middle market are ~2x lower compared to larger businesses⁸, allowing for more modest leverage levels. Despite the more modest transaction leverage, debt pricing remains comparatively higher than for larger businesses, with a ~2%+ premium, as illustrated on Fig.4.

Fig. 4 – Historical Leverage & Spreads for the Lower Middle Market

Source: SPP’s Middle Market Leverage Cash Flow Market At A Glance – March 31, 2023. For illustrative purposes only.

The Opportunity for Private Credit

With credit tightening for the most active portion of the US market, private credit could be an obvious solution but what is the magnitude?

We sensitized a reduction of Corporate Loan assets on Small Bank balance sheets and compared it to Preqin’s North America Direct Lending Dry Powder estimate (~US$29bn; funds <US$1bn; as of May 25, 2023). The results are eye opening - with even a 5% reduction in corporate loan assets, the opportunity would exceed the current amount of estimated direct lending dry powder by 134%. Should there be a larger pullback, a significant amount of capital will need to be raised to address this imbalance and there could be a significant opportunity for private credit to fill the void at potentially more attractive risk-return levels than in recent historical periods.

Source: H.8 Report, Preqin, and Muzinich & Co analysis. For illustrative purposes only.

With strategic opportunities enhanced during challenging times, businesses will need financing partners to take advantage of growth situations, just at the time when Small Banks will be pulling back. This opens the door for private credit to fill the void.

A Golden Vintage for private credit could be upon us.

Sources:

1.Small domestically chartered commercial banks are defined as all domestically chartered commercial banks not included in the top 25, per the Federal Reserve H.8 report (March 2023 period).

2.Large domestically chartered commercial banks are defined as the top 25 domestically chartered commercial banks, ranked by domestic assets as of the previous commercial bank Call Report to which the H.8 release data have been benchmarked.

3.Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs? Report as of March 24, 2023.

4.Bureau of Economic Analysis as of March 30, 2023.

5.NAICS association as of March 30, 2023.

6.Federal Reserve Data Assets and Liabilities of Commercial Banks in the United States - H.8 as of March 2023.

7.Baird’s perspective on the Global M&A Environment – Global M&A Quarterly as of April 2023.

8.Idem

The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of June 2023 and may change without notice.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Important Information

Muzinich and/or Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. Muzinich views and opinions. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

This discussion material contains forward-looking statements, which give current expectations of a fund’s future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2023-06-08-11105