Insight | October 17, 2023

European High Yield – Opportunities for Active Managers

Increased convexity, limited supply and the return of dispersion we believe is resulting in a compelling opportunity in European high yield.

The European high yield market has experienced a strong year in performance terms and spreads have tightened. However, a higher for longer rates narrative, underpinned by elevated long-term inflation expectations, is increasing European macroeconomic uncertainty and therefore the outlook for European high yield. Nevertheless, while defaults are likely to move higher, the asset class is benefiting from several tailwinds which we believe should prove advantageous for the active manager.

The Hidden Benefits of Bond Price Convexity

With most high-yield bond prices trading well below 100, there is currently a significant amount of convexity (pull to par) in the asset class which can be captured in short-dated bonds.

While the 2025/26 wall of maturity is likely to result in an increase in defaults, it is also resulting in high yield issuers seeking early refinancing; issuers usually refinance at least one year before a bond’s maturity to reduce risk around market access. When the price of callable bonds is below 100, the yield to worst is equivalent to the yield to maturity (Fig. 1). We believe this feature could lead to a higher total return than the yield to worst. This additional convexity could provide another 50-100bps of spread, making valuations appear increasingly compelling.

Fig. 1 – Example - Callable Healthcare Bond

Source: Bloomberg data as of August 16th, 2023. Muzinich views and opinion for illustrative purposes only, not to be construed as investment advice.

Coupon Normalisation

We have had over a decade of zero to negative interest rates, with high yield average coupons falling from more than 7% in 2013 to c.3.5%.1 Recent rate rises have now led to coupon ‘normalization’ and the return of the higher yields that gave the asset class its name. At the end of September, the yield on the European high yield index stood at 7.15%.2 Over the next few years, we expect to see a steady increase in average coupon levels for the asset class to get back to the 7% level last seen in 2013.

Defaults Likely to be Relatively Contained

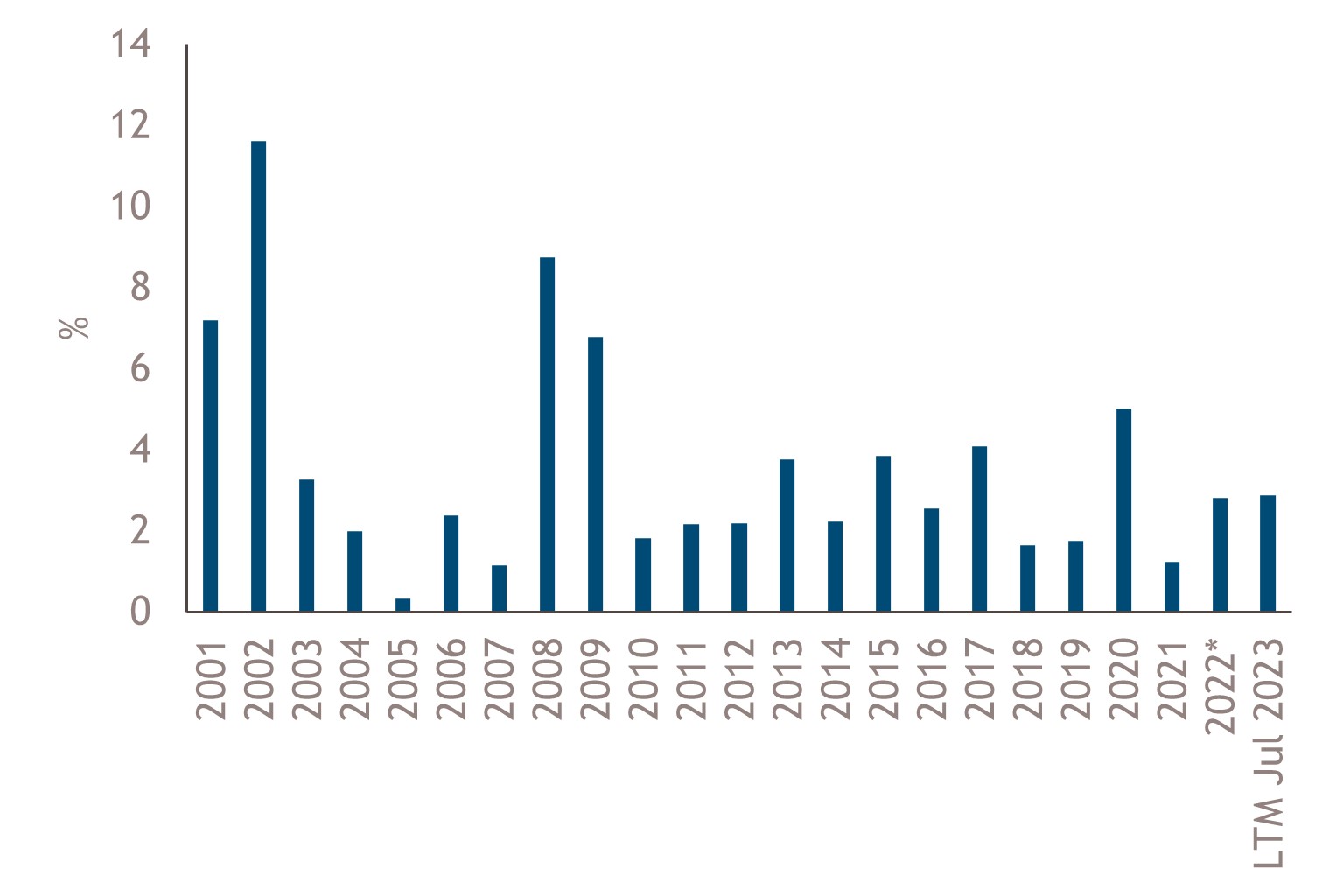

Fig. 2 - European High Yield Market Default Rate (%)

Source: Moody’s Europe Trailing 12-Month Issuer-Weighted Spec-Grade Default Rate Forecasts (LTM). Data as of July 31st, 2023. *Excludes Russian defaults. For illustrative purposes only

Source: Moody’s Europe Trailing 12-Month Issuer-Weighted Spec-Grade Default Rate Forecasts (LTM). Data as of July 31st, 2023. *Excludes Russian defaults. For illustrative purposes only

Since 2011 defaults have oscillated between 2 and 5% with 2020 being above average given the severity of the crisis for the travel and hospitality sectors. Looking ahead we see limited sector-wide fundamental trends likely to significantly impact default rates. Given the macro backdrop, defaults are moving higher, but this is largely confined to a small proportion of lower-quality and smaller issuers with limited financial flexibility. We believe the default rate could rise to 4-4.5%, in line with the higher range of the last twenty years excluding the great financial crisis.

Supportive Technicals

We believe the asset class is likely to remain well supported from a technical perspective given limited net new issuance. While gross issuance has rebounded since 2022 net issuance (as Fig. 3 demonstrates) has fallen dramatically, and year to date as of end August 2023 stood at just €1.5bn. This is in stark contrast to the €85.8bn full year of net issuance in 2021.

Fig. 3 – Net Issuance

Source: JP Morgan, European Credit Weekly, as of September 2023. For illustrative purposes only

Fig. 4 – Gross Issuance

Source: JP Morgan, European Credit Weekly, as of September 2023. For illustrative purposes only

The market is also shrinking due to the number of rising stars returning to the investment grade universe. Given the fact that those issuers returning to investment grade are normally large bond issuers with multiple bonds, the upgrade of only 3-4 issuers can have a meaningful impact on the overall market size; for example, a large automaker expected to move back into the IG market and represents c. 1.5% of the European high yield market alone. Limited net supply will therefore underpin demand.

The Return of Active Management

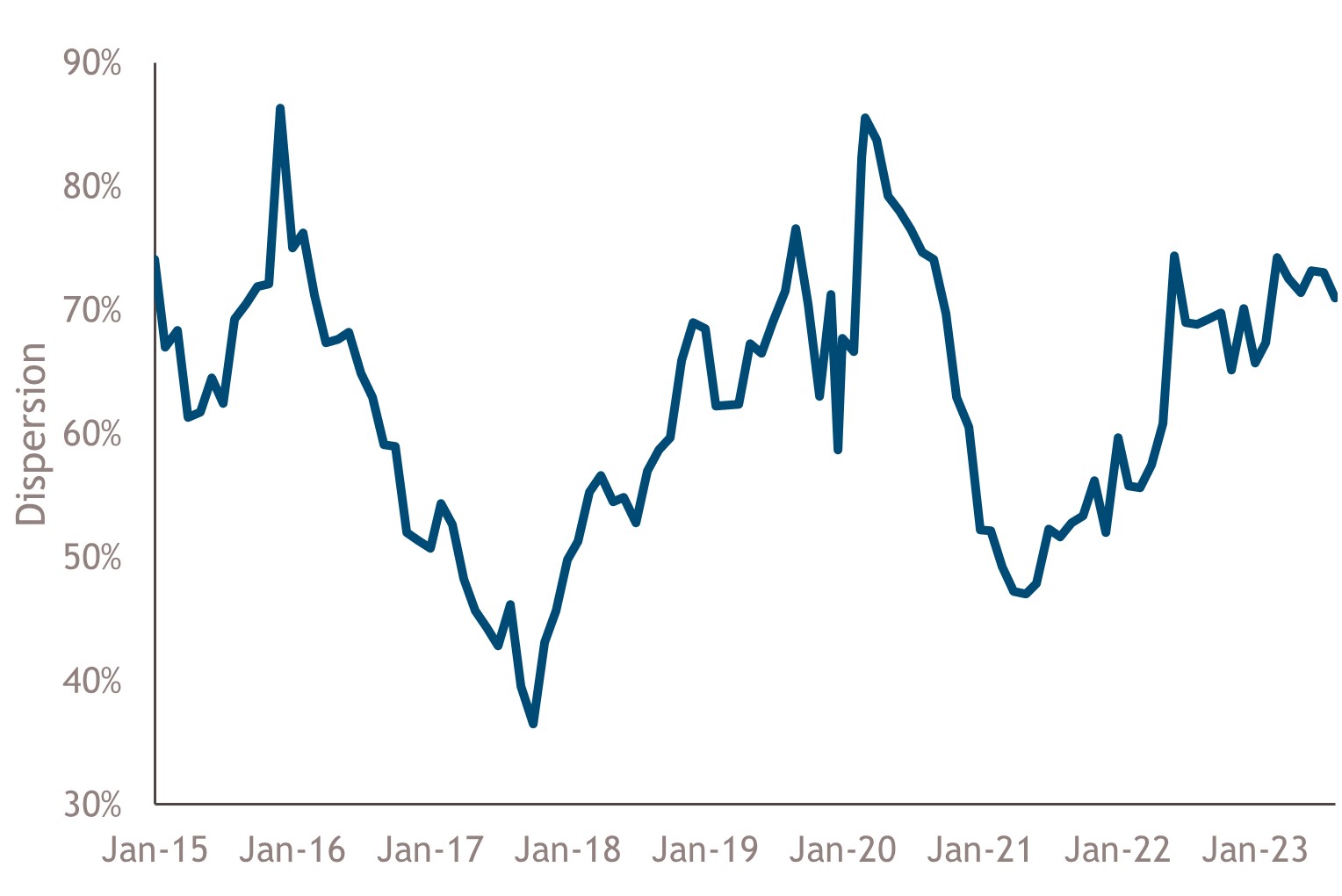

A decade of quantitative easing meant there was limited dispersion in terms of sector or issuer performance. The current return of dispersion means bond picking matters and active managers can add more value over the medium term.

Fig. 5 – High European High Yield Dispersion

Dispersion is measured as the % of bonds that trade at least 100bps tight or wide of the index average spread. Source: Bank of America Merrill Lynch HY Credit Chartbook, as of August 31st, 2023. For illustrative purposes only, not to be construed as investment advice.

While performance has been strong in 2023 within fixed income, we believe there is further upside to be found by active managers. However, as credit investors focused on building portfolios from the bottom up, we believe it’s important to be discerning in the credit selection process.

As we have mentioned, defaults are likely to pick up given the 2025/2026 wall of maturity where some issuers may be unable to access the primary market and refinance their bonds. The market is already anticipating this theme, which is why dispersion has risen between easily refinanceable issuers and more questionable credit profiles.

This can be particularly valuable within or between sectors. For example, the autos sector, which comprises c.12% of the market, has shown great resilience in challenging macroeconomic conditions and has improved margins despite falling production volumes. We have also seen positive ratings action in this sector. This compares with the chemicals sector (c. 3.5% of the universe),3 where we are seeing an increase in missed earnings and caution as end clients run down stock. Unlike passive investors, active managers already have the tools in place to construct a robust portfolio. Active investors can identify those sectors and bonds likely to do well and to avoid those likely to struggle, choose between fixed or floating rate instruments, old (lower) versus new (higher) coupon bonds.

Despite the uncertain macroeconomic backdrop, we are confident in the ability of the European high yield asset class to remain supported in the event of a recession. The return of higher coupons are well compensating investors for any additional risk, limited supply is likely to underpin prices and the convexity feature, which is a relatively unusual phenomenon, makes the asset class appear particularly appealing.

1.Source: ICE Data Platform, ICE BofA ML BB-B European Currency Non-Financial High Yield Constrained Index (HP4N), as of 6th January 2013 to 13th June 2020

2.Source: ICE Data Platform, ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index (HP4N), as of 29th September 2023

3.Source: ICE Data Platform, ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index (HP4N), as of 30th September 2023

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of October 2023 and may change without notice.

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Important Information

Muzinich and/or Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. Muzinich views and opinions. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

This discussion material contains forward-looking statements, which give current expectations of a fund’s future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2023-10-11-12081