August 18, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

In our latest roundup of the key developments in financial markets and economies, we look back on yet another positive week for risk assets and more advice to the Federal Reserve from the US administration.

‘Risk-on’ was the prevailing mantra for investors last week, with our preferred sentiment gauge — the VIX — gliding below 15, a level reflective of revived confidence, certainty and fear-of-missing-out mentality.[1] Government bond yields edged higher, steepening slightly following a positive growth surprise in the UK,[2] accelerating US inflation,[3] and remarks from US Treasury Secretary Bessent that the Bank of Japan (BoJ) remains “behind the curve” in tackling inflation.[4]

Surprise, surprise

To the surprise of many investors and residents, the UK recorded the fastest growth among G7 nations during the first half of 2025.[5] In Q2, the economy expanded 0.3%, following a 0.7% rise in Q1, well above consensus expectations and the Bank of England’s forecast of 0.1%. Unlike Q1, temporarily boosted by the frontloading of taxes and tariffs, Q2 provided a clearer gauge of the underlying health of the economy. From the expenditure breakdown, government consumption was the main contributor, jumping 1.2%, reflecting the spending boost announced in the October budget. More worryingly, household consumption weakness continued, expanding just 0.1%.

On a monthly basis, output rose 0.4% in June, with broad-based gains across all key industries.[6] This will provide some relief to the government and Chancellor Rachel Reeves, who remain under the Sword of Damocles as they strive to maintain fiscal discipline. While it is too early to conclude the Bank of England will slow from its current quarterly easing strategy, the overnight interest rate swap market is now only pricing in a 60% probability of a 25 basis points (bps) rate cut in December.[7]

The price is wrong?

In a busy week of US data releases, pricing took centre stage as investors sought to gauge the economic impact of tariffs. Consumer prices came in line with expectations, with core CPI rising 3.1% year-on-year.[8] However, rather than driven by tariffs, the key factor was higher services prices, notably airfares and automobiles, with the former climbing by the highest level in three years.

Producer prices painted a different picture, rising significantly above expectations, suggesting that, so far, profits rather than consumers are bearing the cost of tariffs. The Producer Price Index climbed 0.9% month-on-month, its largest increase in over three years.[9]

Most of the components for the Federal Reserve’s preferred inflation gauge, core personal consumption expenditure, are drawn from last week’s pricing reports, with economists’ forecasts centred at 0.3% month-on-month - equivalent to 3.65% annualized - well above the Fed’s 2% target.[10]

Meanwhile, the key inflation report in Japan is out this week, with the consensus for a 3.1% year-on-year rise, down from 3.3%.[11] In a paradoxical twist to his advice to the BoJ, given the US’s own inflation issues, Scott Bessent urged the Fed to consider a 50bps policy cut in September.[12] The overnight interest rate swaps market, however, is currently pricing a 93% probability of only a 25bps reduction.[13]

Risky business

Credit markets showed a classic risk-seeking pattern last week, with high yield outperforming investment grade, emerging markets the top-performing sub-asset class, and inflows accelerating. Fund flow data showed gains of 0.47% and 0.39% into US and EU high yield, respectively, and 0.46% into EM hard-currency debt.[14]

EM credit received an additional boost via S&P Global’s one-notch upgrade of India to BBB.[15] The announcement surprised some investors given the prospect of higher US tariffs on India than its regional peers.

However, S&P took an optimistic view, arguing the tariff impact would be “manageable,” as domestic consumption accounts for 60% of India’s growth. Any one-off hit to activity, it noted, would likely be marginal, and not derail India’s long-term prospects. The agency forecasts Indian GDP will expand at an average annual rate of 6.8% over the next three years.

The upgrade was supported not only by robust economic growth but also a comprehensive monetary policy framework to keep inflation in check — CPI fell to 1.6% year-on-year in July, the lowest level in eight years — and the government’s commitment to fiscal consolidation, and improved spending quality through infrastructure expansion.[16]

The one asset class to buck the ‘animal spirits’ trend was commodities, which traded sideways ahead of the summit between Donald Trump and Vladamir Putin in Alaska on August 15 - the first meeting between US and Russian presidents since Russia’s invasion of Ukraine.

Both sides played down expectations, framing it as a step toward a second, more substantive meeting that could also involve Ukraine’s President Zelenskiy. Positive momentum from the summit could put pressure on energy and metal prices, given Russia’s role as a major global producer. Eastern and Western Europe would likely benefit from lower energy costs and increased supply, while China and India could lose some of their advantages from purchasing Russian energy at steep discounts.

Recession, what recession?

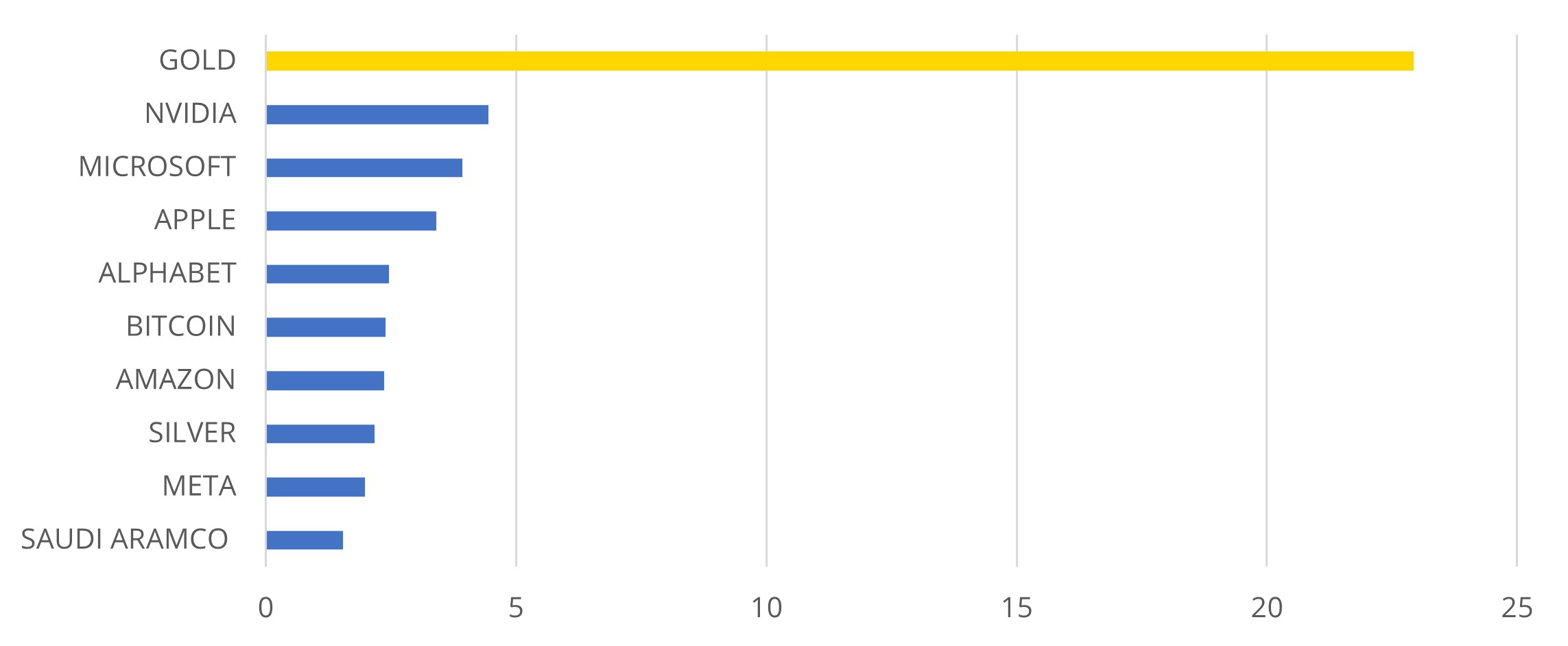

In currency markets, sterling stood out, buoyed by the UK’s surprisingly strong Q2 growth. But it was in digital currencies where animal spirits were in full force - Bitcoin hit a new all-time high on Thursday, briefly overtaking Amazon as the world’s sixth-largest asset by market cap (see ‘Chart of the Week).[17]

Equities continued to rise, with the FTSE and S&P 500 hitting fresh records, while the Bloomberg World Large & Mid Cap index gained over 1%. Q2 earnings season in the US has been robust: 81.6% of companies who have reported so far have beaten estimates—above the 5-year average of 78% and 10-year average of 75%.[18] Meanwhile, recession fears are muted, with the term ‘recession’ appearing in just 16 S&P 500 earnings calls, far below the 5-year average of 74 and 10-year average of 61.

The final indicator that animal spirts are returning came from US small business sentiment. The National Federation of Independent Businesses’ Small Business Optimism Index rose 1.7 points to 100.3 in July, beating expectations and indicating that companies believe conditions are improving.[19]

Chart of the Week: Nothing beats gold (market cap, US$ trillions)

Source: Bloomberg, as of August 15, 2025. For illustrative purposes only.

References

[1] CBOE, 'Chicago Board Options Exchange Volatility Index,' as of August 15, 2025

[2] Office for National Statistics, GDP Q2 2025, August 14, 2025

[3] Bureau of Labor Statistics, ‘Consumer Price Index Summary,’ August 12, 2025

[4] Bloomberg, ‘Bessent Says BOJ Is Falling Behind the Curve, Expects Hike,’ August 14, 2025

[5] Bloomberg, ‘UK growth tops G7 as government spending helps fuel economy, August 14, 2025

[6] Bloomberg, ‘Look beyond upside GDP surprise, details look soft,’ August 14, 2025

[7] Bloomberg, World interest rate probability,’ as of August 15, 2025

[8] Bureau of Labor Statistics, ‘Consumer Price Index Summary,’ August 12, 2025

[9] US Bureau of Labor Statistics, ‘PPI for final demand advances 0.9% in July; services rise 1.1%, goods increase 0.7%,’ August 14, 2025

[10] Citi, ‘July Core PCE tracking lower at 0.27%MoM after import prices,’ August 15, 2025

[11] Bloomberg, ECO JN function, as of August 15, 2025

[12] Bloomberg, ‘Bessent Says He’s Not Pushing Fed Cuts, Just Touting Models,’ August 14, 2025

[13] Bloomberg, World interest rate probability,’ as of August 15, 2025

[14] Standard Chartered, ‘EM flow dynamics – Supported by risk-on sentiment,’ August 15, 2025

[15] Reuters, ‘S&P lifts India's rating to BBB in first upgrade since 2007,’ August 14, 2025

[16] Ministry of Statistics and Program Implementation, ‘CPI July 2025,’ August 12, 2025

[17] CoinMarketCap, Bitcoin price, August 14, 2025

[18] FactSet, ‘Earnings Insight,’ August 8, 2025

[19] NFIB, ‘Main Street Business Owners Report Improving Conditions,’ August 12, 2025

Past performance is not a reliable indicator of current or future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of August 18, 2025, and may change without notice. All data figures are from Bloomberg, as of August 15, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-08-16-16779