October 27, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

Investors spent most of the week in “wait-and-see” mode, ready to adjust expectations and positions as headlines on domestic and geopolitical developments, growth and inflation data and banking and corporate earnings were expected to offer more clarity on the roadmap ahead for the global economy and asset prices.

In Japan, parliament elected Sanae Takaichi as the country’s first female prime minister. In her inaugural address to the legislature, Takaichi pledged to prioritize addressing the cost-of-living crisis and strengthening national defense with a goal of raising defence spending to 2% of GDP[1]. The upcoming stimulus package, estimated to exceed US$92 billion, [2] will be funded primarily through higher-than-expected tax revenues and unspent funds from previous budgets, according to the newly appointed finance minister. 1

The first inflation report since Takaichi took office underscored why tackling the cost-of-living crisis sits at the top of her policy agenda. Japan’s key inflation gauge has now remained at or above the Bank of Japan’s (BOJ’s) 2% target for three and a half years. Headline inflation accelerated to 2.9% year-over-year (YoY) in September from 2.7% in August, in line with expectations, with the uptick largely driven by higher energy costs. The core Consumer Price Index (CPI) also rose to 2.9% YoY from 2.7%.[3]

On a positive note, services inflation - a key focus for the BOJ - eased slightly, to 1.4% from 1.5%, likely reflecting the waiver of childcare fees and slower gains in dining-out costs following a pullback in rice prices. However, in terms of the cost of living, rice has still risen 49.2% YoY.[4]

The BOJ is expected to stay on hold at its next policy meeting on October 30, with the overnight interest swap market pricing in an 86% probability of a 25 basis points (bps) hike at January’s meeting. 4 Meanwhile, the Japanese yen was the underperforming global currency this week as macro investors dialed back rate expectations and questioned long-term debt sustainability for Japan.

Elsewhere in Asia, China watchers were closely monitoring headlines from the Fourth Plenum in Beijing, where top leaders are set to outline development plans for the next five years. The Gross Domestic Product (GDP) growth target is expected to be in the range of 4.5–5.0%.[5]

China’s top leaders were greeted with positive news as the Plenum began; the economy grew 4.8% YoY in Q3, bringing YTD growth to 5.2%, well ahead of the full-year 5% target. The economy now only needs annualized 4.5% YoY growth in Q4 to meet the yearly goal. 5 However, warning signs remain as growth softens from 5.2% YoY in Q2 and becomes increasingly lopsided, relying heavily on exports and industrial production from emerging sectors such as digital products, drones, New Energy Vehicles (NEVs), and robotics. Deflation also persists, with the GDP deflator remaining negative (-1.0% YoY), extending the streak to a record ten quarters. 5

In the near term, China’s growth remains underpinned by exports and manufacturing, but persistent demand weakness, deflationary pressures, and a faltering property sector, highlight the country’s structural economic challenges. Investors are therefore watching the Fourth Plenum closely. Any explicit binding inflation target would be welcome, as would a clear commitment to boosting consumption’s share of GDP or implementing further supportive measures for the property sector.

In Europe, it was a good week for the UK. While investors nervously await the government’s Autumn Budget, both the government and gilt markets received positive news from recent economic data releases. Inflation unexpectedly held steady in September after food prices fell for the first time in 16 months. Headline CPI remained at +3.8%, below the expected +4.0%, while core CPI unexpectedly fell to +3.5%, versus an expected +3.7%.[6] This prompted investors to raise the probability of a Bank of England policy cut in December to 65%, up from 40%, and helped the gilt market emerge as the week’s best performing government bond market, with the 10-year gilt yield falling 9bps. [7]

The government will also likely be relieved by upside surprises in both the Purchasing Managers’ Index (PMI) and retail sales. The composite PMI rose to 51.1 from 50.1 and retail sales grew for a fourth consecutive month, with the volume of goods sold online and in stores climbing 0.5% month-over-month (MoM) in September and 1.5% YoY. [8] The data suggests an unexpectedly strong boost to third-quarter growth, providing welcome support for the economy and budgetary considerations.

Investors in the US are still waiting for signs the government will resolve its impasse, now the second-longest shut down in history. The Senate has failed to advance its funding bill 12 times.

Although the government shutdown continues, it has not slowed the flow of headlines and public statements from President Trump. Trade negotiations with Canada have been terminated, reportedly in response to an advertisement opposing tariffs funded by the government of Ontario. However, perhaps even more notable, is the political pivot from the White House, with President Trump scheduled to meet China’s President Xi on October 30 on the sidelines of the APEC summit, while simultaneously announcing new sanctions on Russian oil companies Rosneft and Lukoil, citing Russia's lack of serious commitment to a peace process to end the war in Ukraine.

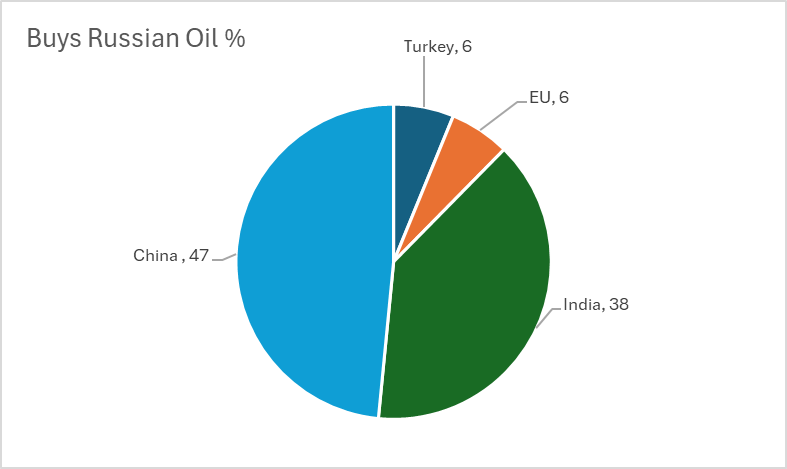

Oil prices rebounded, rising more than 8% for the week, reflecting shifting supply dynamics. Given that much of global oil commerce relies on banking, trading and insurance services based in the US, there are concerns that buyers may struggle to purchase Russian oil going forward. Russia exports roughly 7.3 million barrels per day, or 7% of global crude and refined products, with India and China currently the largest buyers, taking nearly 3.6 million barrels per day (see Chart of the Week). Indian refiners have already announced they expect to halt almost all purchases of Russian crude, while Chinese state-owned companies, including Sinopec, have cancelled some seaborne Russian shipments following the announcement of the sanctions.[9]

Finally, the release of some noteworthy economic data for the US economy - the delayed consumer inflation report. Headline CPI rose 0.31%, while core CPI increased 0.23%, both slightly below forecasts. Inflation eased across both goods and services. According to Bloomberg, the tariff pass-through rate stood at 0.26% in September - roughly unchanged from the previous three months - indicating that for every US$1 increase in tariff costs, firms passed on about 26 cents to consumers. Investors are now pricing in a 99% probability that the Federal Open Market Committee will loosen policy by 25bps at each of its last two meetings of 2025[10].

Although the public sector remains closed, the private sector is not; Q3 earnings season is in full flow, with 25.1% of the S&P 500’s market cap having reported. Earnings are beating estimates by 7.7% in aggregate so far, with 84% of companies topping projections. Earnings per share (EPS) is on pace for 10.2%.[11]

Overall, it was a positive week for investors. Geopolitical developments moved in a favorable direction, with global authorities increasing pressure on Russia to end the conflict in Ukraine, while the announced meeting between President Xi and President Trump reduced concerns over a potential escalation in trade tensions between the world’s two largest economies. Equities were the main beneficiaries, rallying across global markets, with Asia leading the gains – supported by both the improved geopolitical outlook and Japan’s new minister’s pro-growth policy stance.

Meanwhile. the economic data was encouraging for fixed income markets as investors took comfort in signs that global inflation pressures continue to ease, and that tariff pass-through remains limited, giving central banks greater confidence to support growth and employment by gradually rolling back restrictive policy measures.

Chart of the Week: Which countries buy what % of Russian oil?

Source: Bloomberg, as of October 24, 2025. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] Bloomberg, ‘Yen Underperforms G-10 Peers as Investors Weigh Takaichi Speech,’ October 24, 2025

[2] Reuters, ‘Japan’s Prime Minister Sanae Takaichi plans an economic stimulus likely to top $92 billion, focusing on inflation, growth industries, and national security,’ October 22, 2025

[3] Bloomberg, ‘Japan’s Faster Inflation Highlights Need for Takaichi Response,’ October 23, 2025

[4] Bloomberg, ‘Hotter CPI Inflation Shows BOJ’s Rate Dilemma,’ October 23, 2025

[5] UBS China Economic Perspectives, ‘Q3 growth slowed with divergence; more softness ahead,’ October 20, 2025

[6] Bloomberg, ‘CPI Miss Won’t Sway BOE Into 2025 Cuts Just Yet,’ October 22, 2025

[7] Bloomberg, as of October 24, 2025

[8] Bloomberg, ‘UK Retail Sales Rise Again in Unexpected Boost for Economy,’ October 24, 2025

[9] Bloomberg, ‘Understanding the Latest US Sanctions on Russian Oil: QuickTake,’ October 24, 2025

[10] Bloomberg, ‘CPI Seals Deal for Half Point of Fed Cuts This Year,’ October 24, 2025

[11] UBS US Equity Strategy, 3Q25 Earnings Brief: October 24,’ October 24, 2025

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of October 24, 2025, and may change without notice. All data figures are from Bloomberg, as of October 24, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.