September 1, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

In our latest roundup of the key developments in financial markets and economies, we explore potential catalysts for market drawdowns in September – historically a poor month for financial asset prices.

August was kind to investors, with most equity markets finishing in the green. The Bloomberg World Large & Mid Cap Index rose more than 2.5%, the Shanghai Index turned out to be the standout performer, gaining nearly 8%, while several benchmarks hit record highs. India’s Sensex 30 was a notable laggard, falling more than 1% after the US decision to raise tariffs to 50%.[1]

Meanwhile, the US dollar continues to depreciate against global currencies, with the DXY down over 10% year-to-date and on course for its worst year in over a quarter of a century.[2] The Brazilian real emerged as the top performer in August, appreciating over 3% against the dollar as investors looked past political noise to focus instead on one of the highest real yields in the world. Among developed markets, both the Japanese yen and the euro strengthened more than 2% against the dollar.

Energy prices eased as OPEC+ pressed ahead with supply increases, adding 1.9 million barrels per day since April.[3] In contrast, metals extended their rally, buoyed by supply shortages, tariff headwinds and growing demand for their role as a store of wealth. Silver was the standout in August, appreciating more than 5% as it played catch-up to the strong gains previously seen in gold.[4]

Global government bond curves broadly steepened in August. The front end found support from the shift toward lower policy rates, while the long end came under pressure from fiscal expansion and, in the US, renewed questions over central bank independence. The US 2-year Treasury yield fell more than 20 basis points (bps) after Federal Reserve Chair Jerome Powell signalled at Jackson Hole that the committee is prepared to cut rates in September.[5] In contrast, German 2-year yields were unchanged. At the long end, the US 30-year yield rose just 4 bps — muted compared to peers — as fiscal concerns pushed Japanese, UK and French 30-year yields higher by 13bps, 16bps, and 24 bps, respectively.

Inflows continued into corporate credit markets, with both US and EM credit generating total returns above 1%, supported by a rally in the front end of the US Treasury curve and spread tightening. In contrast, European credit was largely flat in August.

Do you want the good news or the bad news?

The common drivers behind recent price movements include robust economic growth alongside anchored inflation and continued easing of global financial conditions — factors that have helped push equity markets to new highs, tighten corporate credit spreads and support commodity prices (excluding energy). Differentiation across markets has largely been driven by geopolitical factors, including tariffs, fiscal concerns and pressures on independent institutions or weak coalition governments.

Investor positioning remains heavily skewed toward equities and other risk-seeking assets, such as digital currencies. The consensus favours a depreciating US dollar, while gold prices are expected to continue rising. Corporate credit spreads reflect complacency, mirrored by the VIX trading below 15, signalling that investors perceive limited near-term risk,[6] while economists expect continued easing of government policy, through either rate cuts or fiscal measures. This optimism, combined with all-time highs across multiple assets classes, sets the stage for September.

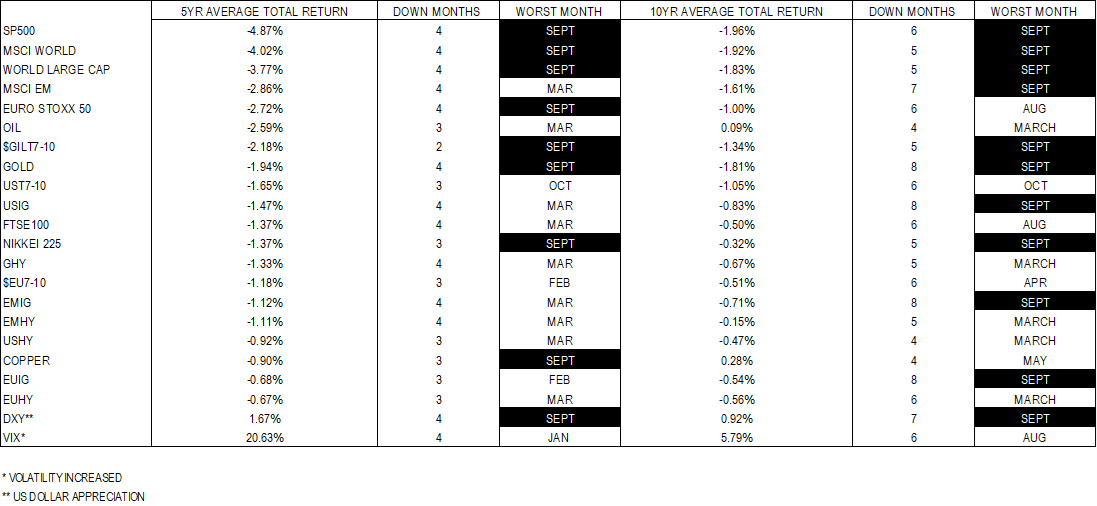

Those with weak constitutions may want to stop reading here. Historically, September has been a poor month for asset prices (See ‘Chart of the Week’). Take equities, for example; September has been the worst-performing month over the last decade, with drawdowns recorded in 4 of the past 5 years.

Commodities have not fared much better; over the last five years, oil has averaged a return of -2.59% in September, while gold has declined in 8 of the last 10 Septembers. Government bonds have failed to live up to their perception as safe havens, with UK gilts particularly weak, and investment-grade and high-yield credit have also underperformed. Investment-grade bonds have experienced drawdowns in 8 of the last 10 Septembers. Historically, the only positions to have profited have been long US dollars and long volatility — directly opposite to current investor positioning and thinking.

Black swan catalysts

Over the past five years, there have been two main catalysts for broad-based September drawdowns. In 2020 and 2021, markets were rattled by COVID-19 fears, while in 2022 and 2023, declines were fuelled by unanchored inflation and subsequent aggressive monetary policy tightening.

As for potential catalysts this September, the most obvious is US tariffs. July pricing reports suggested companies were absorbing tariff costs through margin compression or inventory drawdowns,[7] but August reports will provide a clearer picture of actual price pass-through. Any upside surprise — potentially signalling unanchored inflation expectations — could prompt the Fed to reconsider its planned rate cut. The other central bank with the potential to move markets is the Bank of Japan. While policy rates are not expected to be adjusted until Q1 next year, rising inflation pressures are fuelling a growing chorus of voices urging the central bank to demonstrate its resolve in anchoring prices.[8]

As for other potential causes of a September selloff, government tension and interference cannot be overlooked. In Europe, political instability looms large, with the possibility of government collapses in both France and the Netherlands.[9] Meanwhile, delays and uncertainties in the Ukraine peace process are testing international patience and could trigger severe sanctions against Russia.[10]

The US administration continues to advance its ‘Make America Great Again’ agenda at the expense of global stability, while seeking to increase its influence over Fed policy.[11] Could September see bond vigilantes force government bond yield-curves to bear-steepen or threats to Fed independence become a catalyst for a US dollar crisis? Given current elevated risk asset valuations, buyer fatigue and quarter-end rebalancing have the potential to disrupt markets and should not be underestimated, while the ongoing reappraisal of artificial intelligence’s potential continues to make headlines.[12]

Yet perhaps the biggest surprise - or “black swan” - for September 2025 is that capital markets keep grinding higher, reinforcing the old adage that “the trend is your friend.” For investors, however, we would suggest they hold on tight: September has the potential to be a rollercoaster month.

Chart of the Week: September seasonality

Past performance is not a reliable indicator of current or future results.

Source: Bloomberg, as of August 29, 2025. For illustrative purposes only.

References

[1] The White House, ‘President Donald J. Trump Addresses Threats to the United States by the Government of the Russian Federation,’ August 6, 2025

[2] Bloomberg, DXY Index, as of August 29, 2025

[3] OPEC+, ‘Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman reaffirm commitment to market stability,’ August 3, 2025

[4] Metals Daily, Precious metals prices, as of August 29, 2025

[5] Federal Reserve, ‘Speech by Chair Powell on the economic outlook and framework review,’ August 22, 2025

[6] CBOE, 'Chicago Board Options Exchange Volatility Index,' as of August 29, 2025

[7] US Bureau of Labor Statistics, ‘PPI for final demand advances 0.9% in July; services rise 1.1%, goods increase 0.7%,’ August 14, 2025

[8] Reuters, ‘BOJ to raise interest rates again in Q4, possibly in October, say economists,’ August 21, 2025

[9] Politico, ‘Likely French government collapse raises stakes of planned national shutdown,’ August 28, 2025

[10] Bloomberg, ‘EU’s Top Diplomat Touts Secondary Sanctions Against Russia,’ August 29, 2025

[11] Bloomberg, ‘Trump’s Fed Grab Shakes the Foundation of Global Finance,’ August 29, 2025

[12] The Week, ‘The AI bubble and a potential stock market crash,’ August 29, 2025

--------

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of September 1, 2025, and may change without notice. All data figures are from Bloomberg, as of August 29, 2025, unless otherwise stated.

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-08-30-16842