December 8, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

After the fireworks of November, December kicked off on a decidedly quieter note. Our preferred sentiment index, the VIX, continued to decline, touching 15 - a level typically associated with stable markets.

Japanese Government Bonds (JGBs) were the underperformers in the bond space this week. The 10-year yield rose to 1.939%, up 12 basis points (bps), and inching closer to the psychological threshold of 2.00%, which has not been breached since 1998. The weakness was triggered by clear signals from the Bank of Japan (BOJ) and the government that policy rates may be adjusted in December.

Governor Kazuo Ueda indicated the Bank would consider whether to raise interest rates at the upcoming meeting – a remark widely interpreted as a deliberate signal. Meanwhile, key members of Prime Minister Sanae Takaichi’s government would reportedly not intervene if the BOJ decides to proceed with a December rate hike[1]. The overnight interest rate swap market is currently pricing in a 90% probability that the BOJ will hike by 25bps on December 19th[2].

Prime Minister Takaichi has called for macro-policy coordination under Article 4 of the BOJ Act. Article 4 requires the BOJ and the government to “exchange views sufficiently” and maintain close coordination on macroeconomic policy. While this does not grant the government direct control over monetary policy, it does create a legal framework requiring the BOJ to take the government’s broader economic objectives into account.[3]

A key risk for 2026 is the potential for a policy clash between the Takaichi administration (which is likely to continue to pursue a pro-growth agenda supported by loose fiscal policy and accommodative monetary guidance) and the BOJ (which may feel an increasing sense of urgency to accelerate the normalization of monetary policy). The BOJ’s 2% year-over-year (YoY) inflation target remains difficult to achieve in 2026, and the Bank is becoming more concerned about signs of another property bubble: prices of new condominiums are now rising at their fastest pace since the early 1990s. 3

Takaichi is often described as a protégé of Shinzo Abe. During 2012–2013, Abe threatened to revise the BOJ Act and reduce the Bank’s independence to force a more expansionary policy stance. The question for 2026 is whether similar tensions could re-emerge. Could history repeat itself and is central-bank independence one of the major macro risks for the year ahead? This concern is not limited to Japan –the question of monetary policy independence has also been raised in the US with respect to the Federal Open Market Committee (FOMC). One possible release valve for this tension could be the yen. Interest-rate differentials suggest the yen could be significantly stronger (see Charts of the Week).

Elsewhere in Asia, China will once again have its fair share of doom-mongers as the economy grapples with excess capacity in key manufacturing sectors, lingering stress in the property market and fragile consumer confidence. The latest data underscore these concerns: China’s official manufacturing Purchasing Managers Index (PMI) came in slightly below expectations at 49.2, marking the eighth consecutive month below the 50-expansion threshold. Meanwhile, the non-manufacturing PMI unexpectedly fell from 50.1 to 49.5 – the first reading below 50 in nearly 3 years.[4] Although the government has not yet set an official GDP (Gross Domestic Product) target, the question arises: what level of growth would be deemed unacceptable? Our view is that growth below 4.5% could trigger a significant round of stimulus measures.

In Europe, yields ticked slightly higher as economists were surprised to see HICP (Harmonised Index of Consumer Prices) inflation accelerate to 2.2% YoY, driven by higher services prices and energy costs. However, a closer look suggests underlying inflation is set to fall below 2%. The 3-month annualized change in services inflation – a timelier indicator of where the annual reading may be heading – fell to 2.7% in November from 3.1% in October. Meanwhile, base effects are expected to ease in December, particularly for airfares, which rose an unusually high 14.8% month-over-month in December last year. We do not expect such a spike to be repeated in 2025. [5]

Is disinflation the main risk for the eurozone economy in 2026, and could Switzerland serve as a leading indicator? Swiss headline inflation again undershot expectations in November, falling to 0% YoY – a 4-year low – driven by lower energy prices as well as softer imported goods. [6]

An alternative concern for 2026 could be political stability, even though no major national elections are scheduled. Potential risks include a snap legislative vote in France, a leadership shake-up in Britain’s Labour Party and recurring friction between coalition partners in Germany – particularly over pension reforms. In Spain, Prime Minister Pedro Sánchez faces the ongoing challenge of governing without a majority. Meanwhile, the rise of far-right parties in opinion polls – currently leading in Germany, the UK, Italy and France – could further complicate the European political landscape. [7]

In the US, yields ticked slightly higher over the week amid a heavy calendar of economic data, highlighting the resilience of the economy with signs of easing price pressures. Black Friday sales climbed 4.1%, according to Mastercard, [8] surpassing last year’s growth and suggesting US consumers are returning to spending following the recent government shutdown. Meanwhile, a report from Challenger, Gray & Christmas showed fewer announced layoffs than expected, indicating stability may be returning to the labour market.[9] The Institute for Supply Management (ISM) services index also came in stronger than anticipated, expanding to 52.6 – its highest level of expansion since February. Perhaps most notably, the prices-paid component fell to a 7-month low of 65.4, easing concerns about tariff-driven inflation. [10]

Is the main risk to the US economy in 2026 a re-acceleration? A combination of loose financial conditions, deregulation and spending from the “US Big Beautiful Bill” seem to be driving faster growth. The Federal Reserve Bank of Atlanta’s GDPNow model currently estimates real GDP growth for Q3 2025 at 3.5% YoY. [11] At the same time, one key takeaway from November is how markets reacted to the prospect the FOMC might slow or pause its policy-rate normalization.

In corporate credit markets, carry was king, with high yield outperforming and emerging markets taking the top spot. As is often the case, the main concern for credit investors is that a surge in supply could overwhelm returns. Will hyperscaler issuances distort investment grade indexes, or will growing government indebtedness and fiscal indiscipline crowd out corporates and steepen yield curves? Meanwhile, falling interest rate differentials between the US and Asia could bring the Asia-dollar supply back to the market, while the declining relative attractiveness of US Treasury yields could reverse capital flows away from the US.

The US dollar was slightly weaker across the board this week, depreciating by more than 1% against the Australian dollar. A resurgence of US exceptionalism – accompanied by renewed dollar strength and tighter global financial conditions – would likely be welcomed by market bears. Commodity prices remained range bound, with the big question for 2026 being how low will oil fall? Predicting oil prices is often described as a “dark art,” but some trends are clear: oil prices have declined through 2025, and the market is already in surplus, estimated at 1.6 mb/d in the second half of 2025. 12 If Russian supply remains flat in 2026, and non-OPEC ex-Russia supply grows faster than expected, or alternatively global growth slows significantly, it is likely that oil prices will fall below $50.[12]

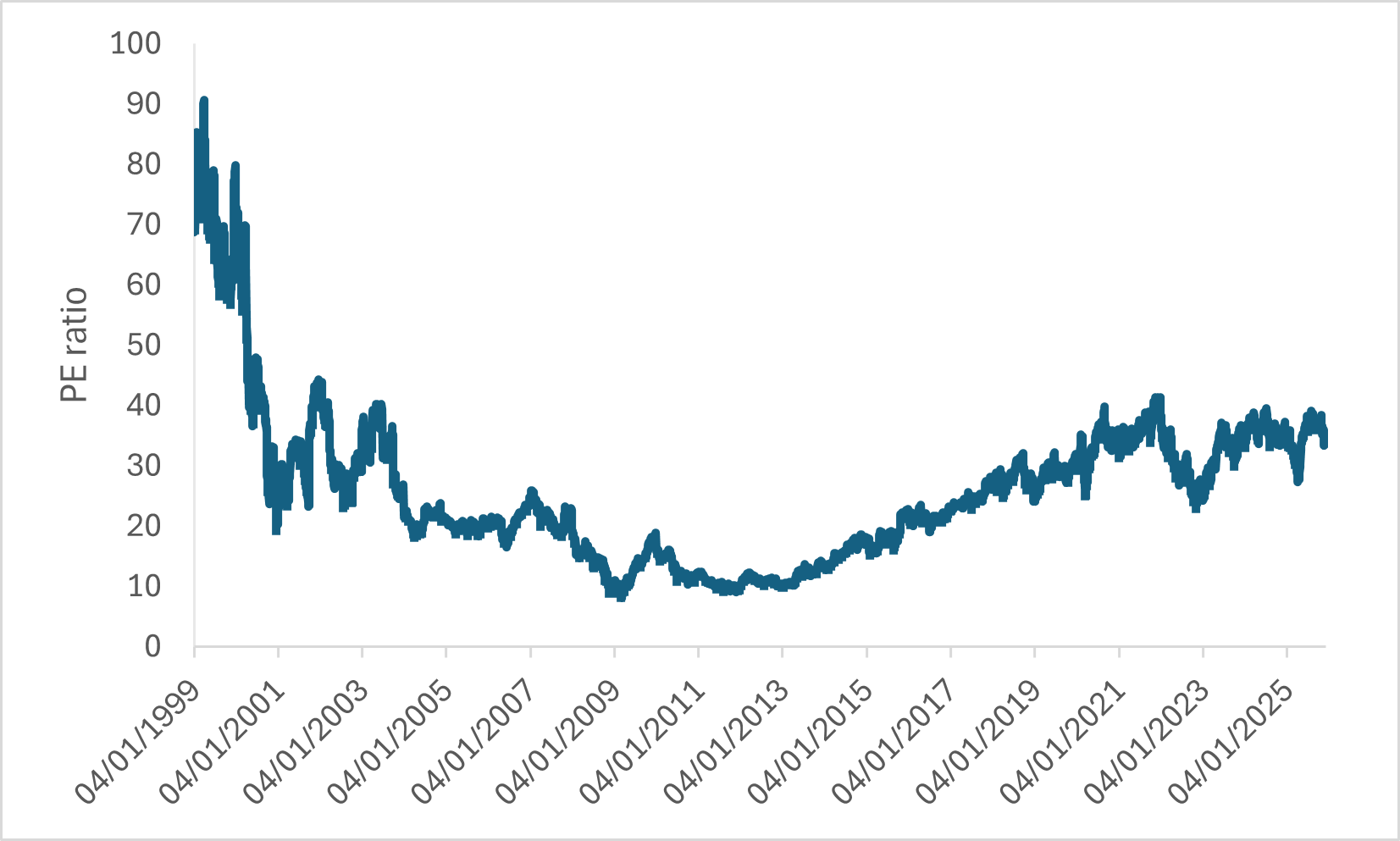

Finally, equities delivered a solid week, with markets closing broadly higher and major indices approaching all-time highs. The question on everyone’s lips is whether we are witnessing an AI-driven bubble – and if it could burst in 2026. One of the key preconditions for identifying a bubble is a significant detachment of prices from fundamentals, with P/E ratios often used as a benchmark. Microsoft may serve as our “canary in the coal mine”: it was a poster child of the late-1990s tech bubble and is now a core member of the Magnificent Seven. Its current P/E ratio sits around 34; briefly in 1999 it touched 90 (see Chart 2 of the Week).

Chart 1 of the Week: US vs. JP 10yr yield levels suggest the Yen should be closer to 130 than 150

Source: Bloomberg, as of 5th December 2025. For illustrative purposes only.

Source: Bloomberg, as of 5th December 2025. For illustrative purposes only.

Chart 2 of the Week: Microsoft P/E reached 90 during Dotcom Bubble

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] Bloomberg, ‘Key Japan Officials Would Go Along With a BOJ December Rate Hike,’ December 4, 2025

[2] Bloomberg, as of December 5, 2025

[3] Bloomberg, ‘JAPAN INSIGHT: Dovish BOJ + Takaichi Heat = K-Shaped Economy,’ December 5, 2025

[4] Bloomberg, ‘CHINA REACT: PMI Hinted at Another Consumption Down-Drift,’ November 30, 2025

[5] Bloomberg, ‘EURO-AREA REACT: Inflation Rise May Pass, ECB Wariness Too,’ December 2, 2025

[6] Bloomberg, ‘Swiss Inflation Unexpectedly Slows to Zero in SNB Setback,’ December 3, 2025

[7] Bloomberg, ‘EUROPE INSIGHT: Merz Stuck, Starmer Out? Political Risks in 2026,’ December 5, 2025

[8] Mastercard Spending Pulse “U.S. Black Friday retail sales up +4.1% year over year as holiday momentum builds,’ November 29, 2025

[9] Bloomberg, ‘US Layoff Plans Ease, But Still Most for November Since 2022,’ December 4, 2025

[10] Bloomberg, ‘US REACT: Tariff-Driven Uncertainty Slows Service Prices Paid,’ December 3, 2025

[11] GDPNow—Federal Reserve Bank of Atlanta, December 5, 2025

[12] Goldman Sachs, as of 17th November 2025. Oil prices through 2035: down in 2026 on last supply wave, up later.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of December 5, 2025, and may change without notice. All data figures are from Bloomberg, as of December 5, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.