July 21, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

In our latest roundup of the key developments in financial markets and economies, we look at the implications of the threat to Federal Reserve independence.

Last week saw relatively sideways price action. US government bond yields were largely unchanged, UK Gilts underperformed, and the long end of the Japanese government bond curve outperformed.

Corporate credit markets were also flat, with European credit slightly outperforming.

Commodities traded within a narrow range, while the US dollar posted its third consecutive week of marginal gains, with the DXY index up 1.5% month-to-date.[1] Equities were mostly in the green, with US and Asian markets leading with small gains.

Deflation threat hangs over China

Last week gave investors further insight into the impact of the US administration’s tariff policy, supported by June inflation data, retail sales figures, quarterly growth numbers, and corporate earnings reports.

Elsewhere, China’s second quarter growth report took centre stage. Despite a confluence of challenges, from the lingering effects of the trade war and a deflating property market to persistent low consumer confidence and outright deflation, China’s economy held up. In the first half of 2025, output expanded 5.3% year-on-year, with second-quarter growth reaching 5.2%, beating expectations and bringing the official 5% full-year target within reach.[2]

Interesting, the main driver of growth has been exports, making up for sluggish domestic demand and possibly masking underlying economic weakness driven by deflation. If we review growth through a nominal GDP lens, reflecting both real growth and price changes, the economy expanded just 3.9%, the weakest pace outside of the pandemic era since records began in 1993.[3]

For China to achieve its 5% growth target for the full year, it must navigate several key challenges. These include weakening global trade, the waning impact of front-loaded stimulus and, most importantly, a deepening deflationary trend. Deflation is driven in part by overcapacity in critical sectors such as electric vehicles and solar panels, as well as a broad-based decline in property prices across the country.[4] Falling prices discourage consumption and investment as households and businesses delay purchases in anticipation of better deals. This cycle erodes corporate profitability, suppresses wages, and further weakens demand and economic confidence.

On the plus side, it is encouraging that Beijing’s messaging has noticeably shifted in recent weeks. President Xi Jinping and other senior officials have delivered unusually direct assessments of the “cutthroat” price competition that is weighing heavily on entire industries.[5]

On the monetary policy front, credit is expanding on a more consistent basis. In June, aggregate financing, a broad measure of credit, rose by 4.2 trillion yuan (US$585.7 billion), according to Bloomberg calculations, surpassing the median economist estimate of 3.8 trillion yuan. Meanwhile, M2 money supply, a key gauge of liquidity and spending power in the economy, grew at its fastest pace for over 12 months, rising 8.3% year-on-year and beating consensus expectations.[6]

There may be rate cuts ahead…..

In an interview with The Sunday Times, Bank of England Governor Andrew Bailey hinted at the possibility of larger interest rate cuts if the jobs market deteriorates more rapidly than the central bank currently anticipates.

“I think the path [for interest rates] is down. But we continue to use the words ‘gradual and careful’ because … some people ask me, ‘Why are you cutting when inflation is above target?’” Bailey said, setting the stage for last week’s inflation and employment data releases.[7]

The latest consumer price data confirmed Bailey’s concerns, as inflation unexpectedly accelerated in June, a reminder that the fight to control price pressures in the UK is not yet over. Headline inflation rose broadly, reaching its highest level since January 2024, with the Consumer Price Index climbing to 3.6% in June from 3.4% in May.[8] Stripping out volatile components such as airfares, package holidays, and education, a measure the Bank of England has previously referred to as ‘core’ services inflation - inflation edged up to 5.1% in June from 5.0% in May.

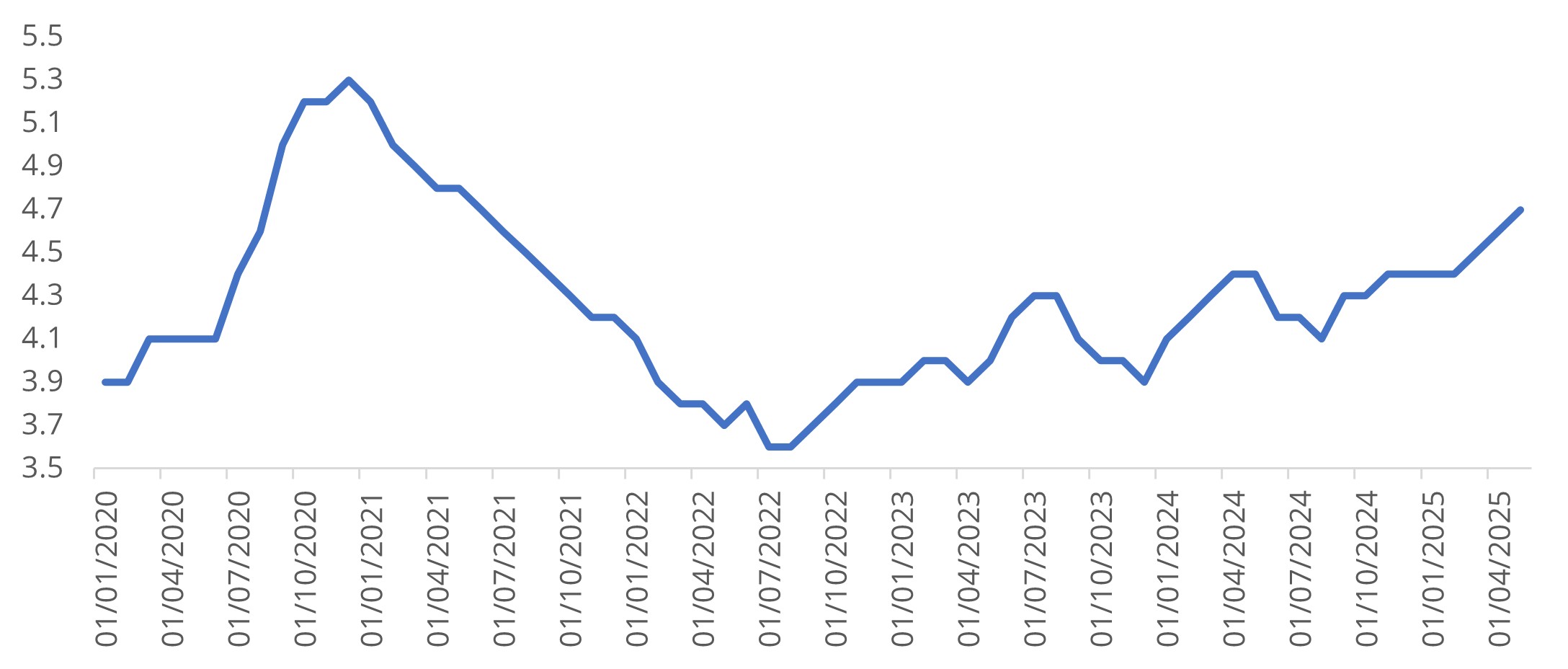

There was also little good news from employment data, which reinforced perceptions of a weakening British labour market. The unemployment rate increased to 4.7% in the three months through May, compared with 4.6% in the previous period, to reach the highest level in four years (See ‘Chart of the Week’).[9] Separately, tax data showed the number of employees on payrolls dropped by over 41,000 in June, worse than the decline of 35,000 expected by economists.[10]

These inflation and employment reports have added further weight to criticism of the Labour government's tax increases. Critics argue that higher labour costs - driven by increased National Insurance contributions and minimum wage requirements - are being passed on to consumers through price hikes and job cuts, rather than being absorbed by businesses via reduced profit margins.

While China's lack of urgency to policy stimulus may have pushed its economy into a deflationary environment, UK government policies appear to have driven the economy toward stagflation. This leaves the Bank of England facing a difficult balancing act.

The OIS market is now pricing a 90% probability of a 25-basis points rate cut in August, now the only fully priced policy easing for 2025.[11]

Under the spotlight

In the US, the administration’s tariff and immigration policies came under the spotlight again. The Federal Reserve’s June Beige Book depicted a backdrop of broad economic stability across the 12 Districts. Prices rose at a modest pace, driven by tariff-related input costs and rising insurance premiums. Economic activity edged up slightly, reflecting a modest improvement over the previous report. Meanwhile, labour markets remained tight but stable.[12]

June’s consumer and producer price reports came in softer than expected. Core consumer inflation rose less than forecast for the fifth consecutive month, even as businesses increasingly passed tariff-related costs on to consumers. A drop in vehicle prices helped cap broader inflation, although tariff-exposed goods like toys and appliances recorded their fastest price increases in years. Monthly core CPI rose 0.23%, up from 0.13% in May, while year-on-year core CPI edged up to 2.9% from 2.8%.[13]

Despite this modest uptick in prices, the US consumer remained resilient - retail sales rose 0.6% in June, well above expectations, with gains in 10 of 13 categories. However, since the figures are not adjusted for inflation, the increase may reflect higher prices rather than stronger sales volumes.[14]

While policy missteps may be contributing to the economic malaise in China and the UK, as of the end of June, the US economy appears to be effectively absorbing the administration's aggressive policy measures, as highlighted by the Beige Book. Improving financial conditions, coupled with loose fiscal policy, are supporting both consumption and investment. Meanwhile, the independence and long track record of the Federal Reserve in keeping inflation anchored are helping to contain price expectations.

Fed-Trump tensions escalate

However, tensions between President Trump and Fed Chairman Jerome Powell escalated further last week. A White House official told CNBC that Trump was moving toward dismissing Powell, while a report in The New York Times indicated the president had even drafted a letter outlining Powell’s removal.[15] Although Trump denied that Powell’s dismissal was imminent, he notably stopped short of ruling it out.[16]

Removing Federal Reserve Chair Jerome Powell would represent a significant policy misstep, in our view. An independent central bank is a cornerstone of national sovereignty and sound governance. Undermining this could have immediate and severe consequences, including a sharp depreciation of the US dollar and inflation expectations would become unanchored. Stripping the Federal Reserve of its autonomy could lead to a politically influenced successor who would be obliged to cut interest rates at the president’s discretion, severely damaging policy credibility.

Credit rating agencies would likely respond with swift downgrades, while investors could demand significantly higher risk premiums, leading to a steepening of the government bond yield curve, increasing increase the cost of government borrowing and worsening the country’s fiscal position. Meanwhile, both consumption and investment would likely contract, as international capital flees, and domestic sentiment deteriorates.

In recent years, Turkish President Erdoğan has pursued a heavily interventionist approach to monetary policy. In July 2019, he dismissed Central Bank Governor Murat Çetinkaya, who had served since April 2016, due to policy disagreements. Over the following five years, the Turkish lira depreciated by more than 400%. In a bid to stabilize capital outflows and attract foreign investment, the Central Bank eventually raised the one-week repo interest rate to 50%. President Erdoğan narrowly secured re-election in a runoff in May 2023, winning only 52.2% of the votes in a second-round runoff. A key message of his campaign was a return to orthodox monetary policy and to restore central bank independence.[17]

Chart of the Week: UK unemployment hits 4-year high (per cent)

Source: Office for National Statistics, UK Unemployment Index, July 17, 2025. For illustrative purposes only.

References

[1] Bloomberg, DXY Index, as of July 18, 2025. The DXY index measures the value of the dollar against a basket of six major currencies.

[2] National Statistics Bureau of China, Q2 GDP, July 14, 2025

[3] Bloomberg, ‘China GDP beat masks fragile demand,’ July 15, 2025

[4] Reuters, ‘China home prices fall at fastest pace in 8 months, stimulus calls rise,’ July 15, 2025

[5] Bloomberg, ‘Xi’s Price-War Campaign Creates a Buzz in China’s Stock Market,’ July 13, 2025

[6] Bloomberg, ‘Credit pickup adds to signs of steadier economy,’ July 14, 2025

[7] The Sunday Times, ‘Andrew Bailey mulls dangers as he marks 40 years at the Bank,’ July 13, 2025

[8] Office for National Statistics, ‘CPI – June 2025,’ July 16, 2025

[9] Office for National Statistics, ‘Labour market overview, UK: July 2025,’ July 17, 2025

[10] Office for National Statistics, ‘Earnings and employment from Pay As You Earn,’ July 17, 2025

[11] Bloomberg, World Interest Rate Probabilities,’ as of July 18, 2025

[12] Federal Reserve, ‘Beige Book - July 2025,’ July 17, 2025

[13] US Bureau of Labor Statistics, ‘CPI June 2025,’ July 16, 2025

[14] US Census Bureau, ‘Advance Monthly Sales for Retail and Food Services,’ July 17, 2025

[15] New York Times, ‘Trump Has Penned Letter To Fire Fed Chair Jerome Powell,’ July 17, 2025

[16] Bloomberg, ‘Trump Denies Plan to Ax Powell After Floating Idea to Lawmakers,’ July 18, 2025

[17] CEPR, ‘Silence is golden: How public criticism of central banks can backfire for leaders,’ April 18, 2024

Past performance is not a reliable indicator of current or future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of July 21, 2025, and may change without notice. All data figures are from Bloomberg, as of July 18, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co.”, “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-07-18-16600