February 4, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

In an environment of heightened competition and macro uncertainty, the lower middle market stands out as a structurally underserved segment in private credit, offering greater control, stronger protections and more resilient returns, argues Jens Ernberg.

We expect the US lower middle market (LMM) private debt landscape will be shaped by a combination of structural capital imbalances, evolving bank behaviour, persistent macro uncertainty and shifting investor priorities. While headline activity remains dominated by the core and upper middle markets, we believe this dynamic continues to reinforce the attractiveness of the LMM, where competition is structurally lower, and lender influence remains meaningfully higher.

Concentrated competition

The US private credit market faces several structural drivers which we believe are creating opportunities for lenders focused on the LMM.

One of the defining features is the concentration of capital among the largest managers. This is directing capital toward the core and upper middle markets and intensifying competition between traditional broadly syndicated loans and large-cap private credit, driving what increasingly looks like a race to the bottom on pricing, leverage, documentation and investor protections.1

Additionally, macro uncertainty has influenced capital velocity and net new loan issuance. Despite expectations a more pro-business administration and moderating rates would spark a wave of M&A, inconsistent policy signals around trade, immigration and taxation, combined with persistent inflation and a cautious Federal Reserve has, until recently, delayed any rebound.2 This has resulted in extended portfolio holding periods and sent private equity dry powder to historically high levels.

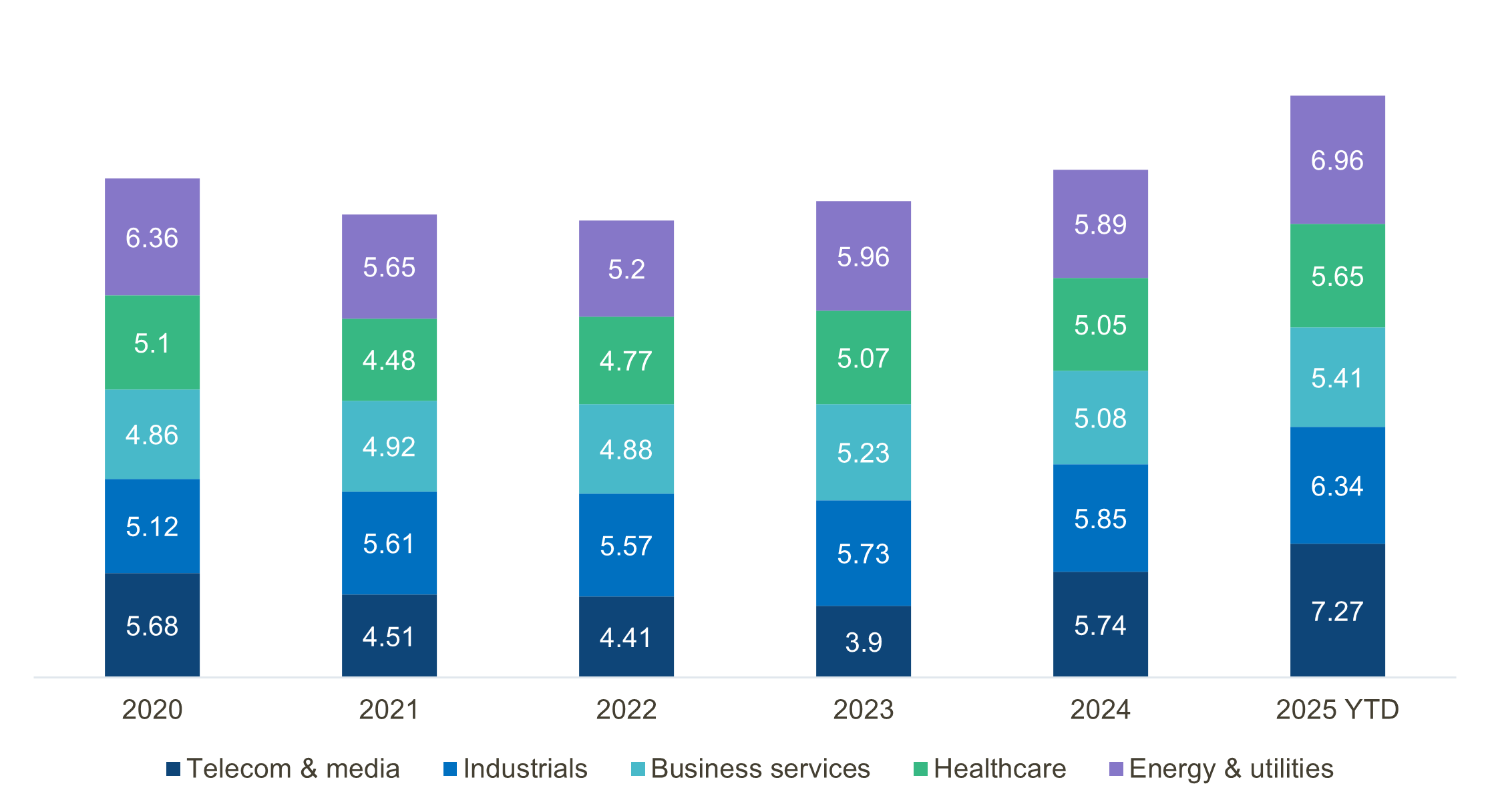

Figure 1: Private equity, venture capital buyout average holding period (years)

Source: S&P Global, Preqin Pro as of 12th December, 2025. For illustrative purposes only.

Source: S&P Global, Preqin Pro as of 12th December, 2025. For illustrative purposes only.

Finally, the vast majority of the private debt capital raised is directed at sponsor-backed lending. The appeal of that market for well-capitalised private credit managers is rooted in the efficiency of PE-backed deal flow – characterised by institutional diligence, more concentrated sourcing, and greater certainty of execution – which allows for accelerated and scaled deployment. So, while leveraged buyout activity is showing signs of recovery, an abundance of capital chasing fewer opportunities is expected to continue to put pressure on spreads and weaken investor protections. Again however, this is a theme that in our view is having a greater impact on larger and more standardised M&A and LBO transactions.

Far from the madding crowd

Against this backdrop, we believe the US lower middle market remains a structurally attractive segment of private credit. Relative to the more crowded core and upper middle, the LMM offers higher relative spreads, more conservative leverage, stronger covenant packages and greater lender influence over transaction structure. Longer diligence timelines, smaller deal sizes and higher execution complexity act as natural barriers to entry, helping insulate the segment from the most aggressive competitive pressures.

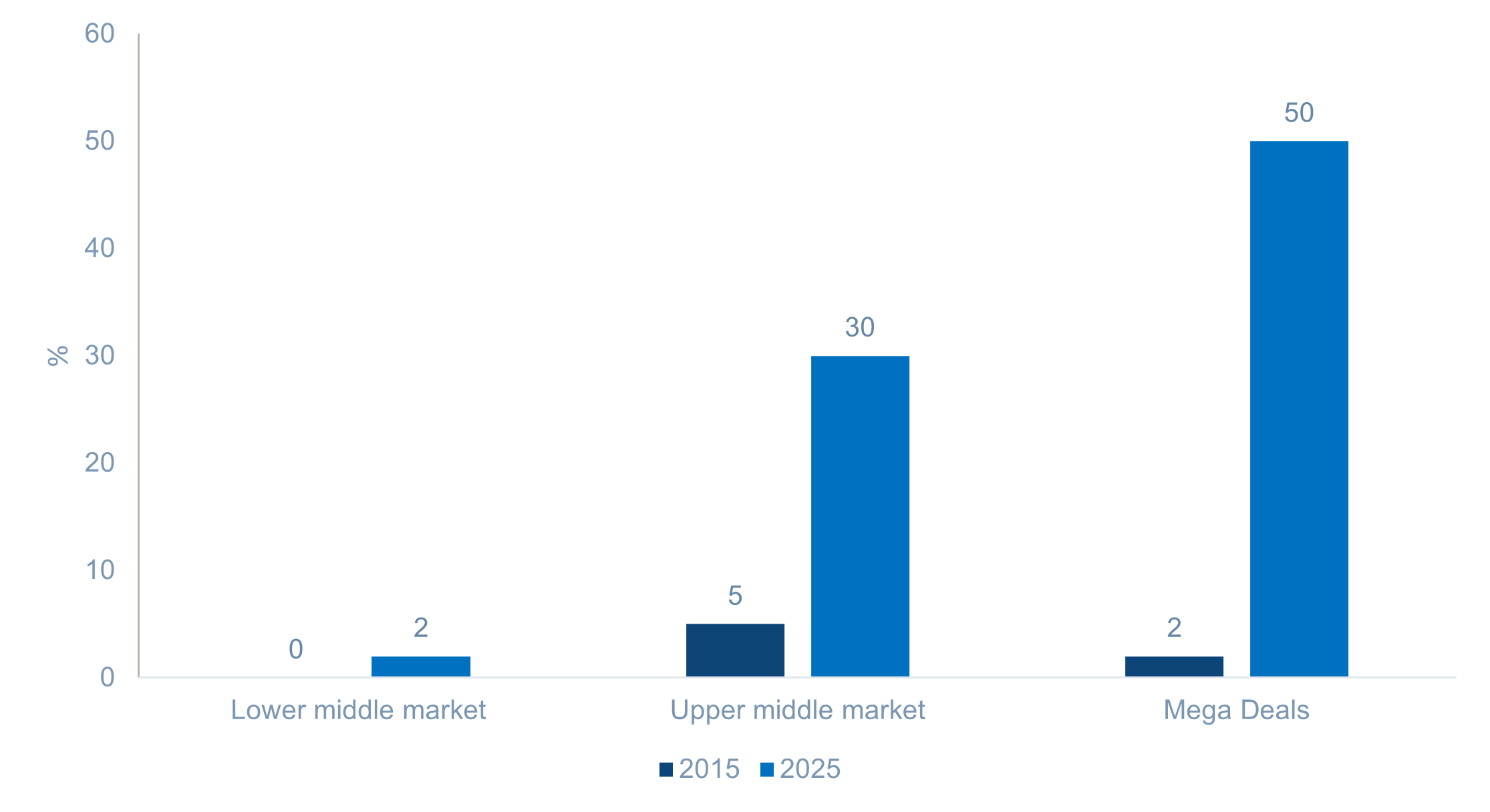

Figure 2: Lower middle market remains insulated from covenant lite deals

Source: Chronograph, as of 30th September 2025. “How direct lending competition is impacting private credit deal terms”. For illustrative purposes only.

Source: Chronograph, as of 30th September 2025. “How direct lending competition is impacting private credit deal terms”. For illustrative purposes only.

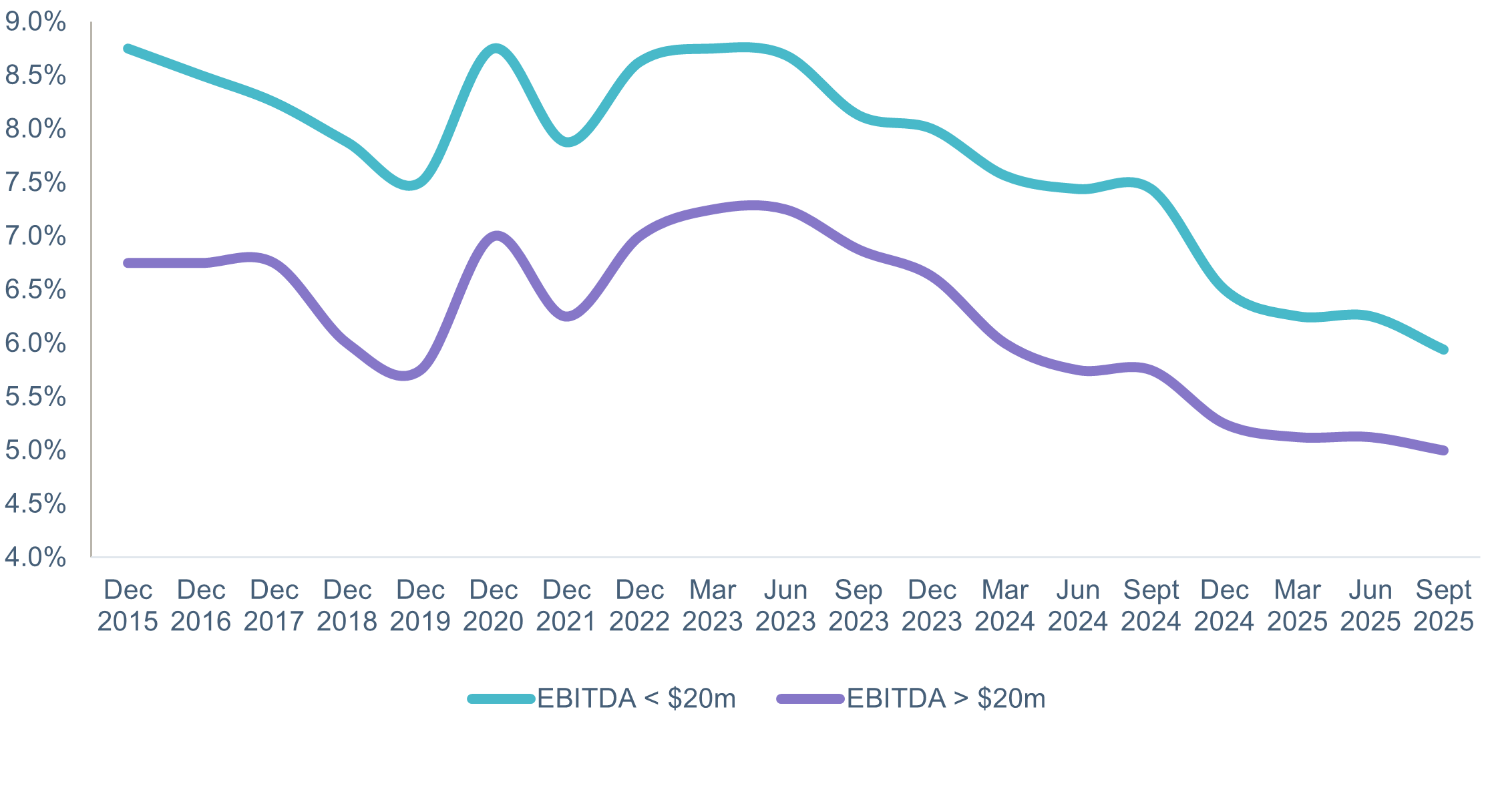

Figure 3: Better spread and lower leverage in the lower middle market

Historic spreads Source: SPP’s Middle Market Leverage Cash Flow Market At A Glance – September 30, 2025. For illustrative purposes only.

Source: SPP’s Middle Market Leverage Cash Flow Market At A Glance – September 30, 2025. For illustrative purposes only.

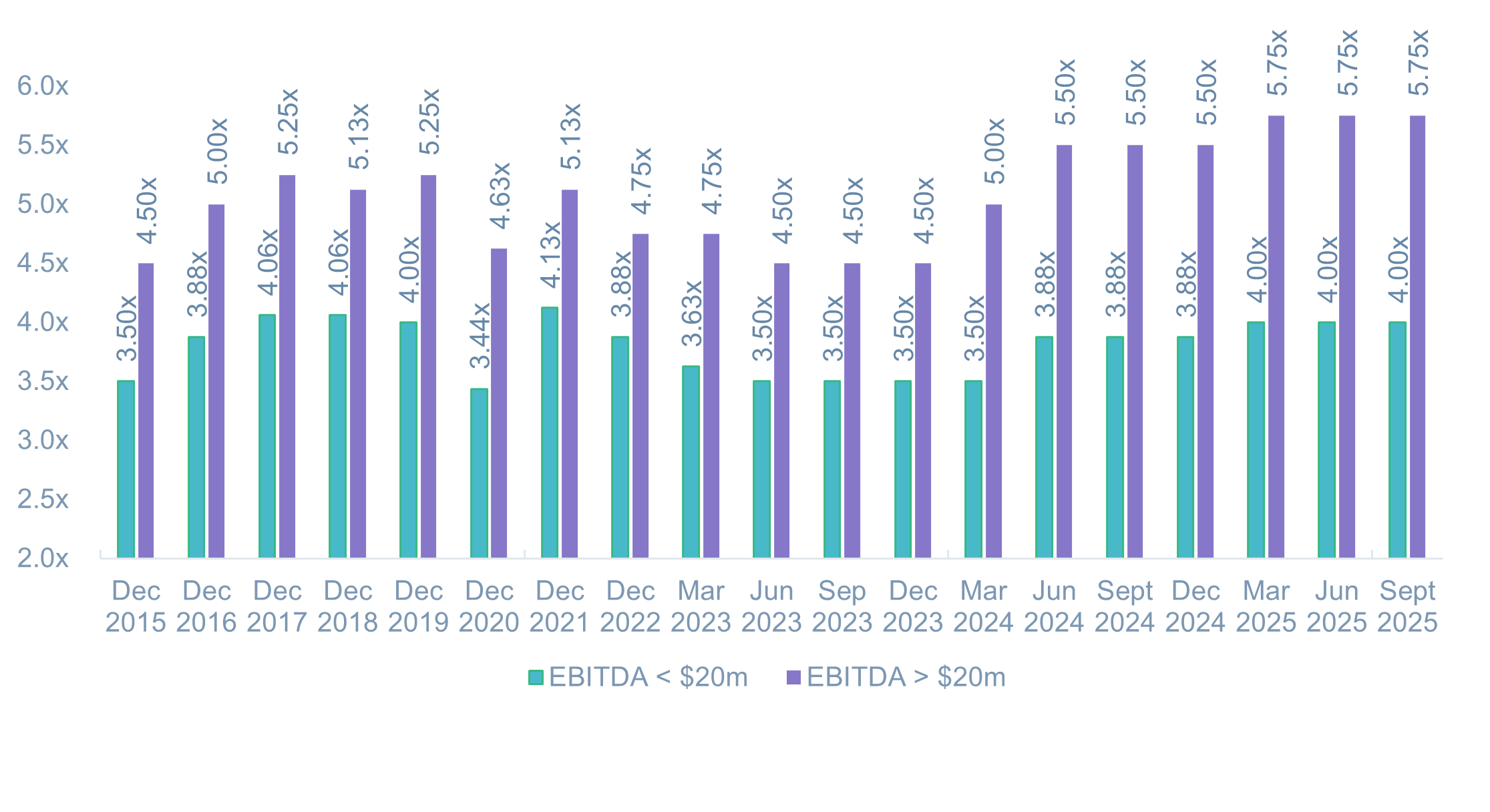

Unitranche leverage

Source: NAICS Association as of December 3, 2024. Most recent data available used. For illustrative purposes only.

Source: NAICS Association as of December 3, 2024. Most recent data available used. For illustrative purposes only.

The breadth and diversity of the LMM further enhance its appeal. While there are well-known regional concentrations of activity (e.g., manufacturing in the Midwest and Southeast, energy in Texas and Oklahoma, technology in California, etc.), targeting underserved geographies may offer more attractive risk-adjusted opportunities. Lower competition in these markets can translate into better pricing, tighter structures and stronger lender protections.

We believe investor priorities heading into 2026 also support this positioning, with increased emphasis on income consistency, capital preservation, diversification and active liquidity management. These objectives align well with a disciplined LMM approach, where conservative leverage, stronger documentation and earlier intervention through covenants can support more resilient outcomes.

That said, risks remain. Market-wide spreads have compressed to cyclical lows,3 investor protections have weakened,4 and macro indicators point to slowing growth and persistent inflationary pressures.5 Spreads appear more likely to widen than compress further from here, either through economic deterioration or as a recovery in M&A increases issuance and eases competitive pressure. While defaults are likely to remain contained absent a recession, extended holding periods and the use of amend-and-extend solutions could lead to higher restructuring activity over time.

In this context, the LMM’s simpler capital structures, stronger covenants and more conservative leverage should support better recovery outcomes relative to larger, more aggressively structured segments.

Nevertheless, sector positioning remains important. Healthcare, software, IT and business services continue to offer durable demand and cash-flow resilience, complemented by long-term themes such as infrastructure renewal, power generation and transmission, AI-driven data centre growth, ageing demographics and housing supply constraints. In addition, we believe the PE-led consolidation of fragmented trade industries – including roofing, electrical and plumbing – remain a consistent source of lending opportunity. A powerful secular driver of demand has also emerged from succession-related transactions, as baby boomer business owners retire.6

A tale of two lenders

Meanwhile, the role of banks continues to evolve in response to a rapidly shifting regulatory environment.7 Rather than a uniform retreat from lending, we are seeing a structural adjustment in how banks deploy balance sheet and manage risk-weighted asset. Within this we see two broad themes emerging.

First, banks are increasingly lending to lenders rather than directly to operating companies. Fund finance has become a core use of bank balance sheets, allowing institutions to deploy capital at scale against diversified portfolios while benefiting from strong collateral and relatively attractive risk-adjusted returns. This shift reflects both regulatory efficiency and strategic positioning, as banks seek exposure to private markets without assuming single-name corporate risk.

Second, banks are pivoting toward an originate-and-share model with the objective of reducing risk-weighted-asset exposure on their balance sheet while preserving the direct borrower relationship.8 In practice, this allows banks to remain central to transaction origination and structuring, retain ancillary fee income and transaction banking revenues and participate economically in lending activity without fully warehousing credit risk. In contrast to the traditional originate-and-hold model, this approach prioritises capital efficiency and balance-sheet velocity over loan retention.

Within this evolving landscape, we see a meaningful and growing opportunity in parallel lending, where banks and private credit managers lend alongside one another on a pari passu basis. This structure represents a natural extension of banks’ regulatory adaptation rather than a replacement of bank capital. For commercial banks, parallel lending enables continued support of clients while optimising capital usage, diversifying credit exposure and retaining 100% of capital-light ancillary revenues. For private credit managers, it provides access to proprietary origination channels, the ability to scale diversification efficiently and the opportunity to deploy capital into well-structured transactions with strong downside protection.

We view this model as a genuinely collaborative and innovative solution that aligns incentives across participants. As regulatory constraints continue to shape bank behaviour, we believe such partnerships will play an increasingly important role in bridging the gap between bank balance sheets and borrower demand, while reinforcing private credit’s position as a complementary – rather than substitutive – source of capital.

Sense and sustainability

We continue to view the US as a particularly attractive market for private credit. Its greater scale and maturity, single currency and legal framework, creditor-friendly bankruptcy regime and more diversified economy underpin a deeper and more consistent opportunity set. While European markets can offer higher spreads and more conservative structures in select situations, we believe the structural advantages of the US remain compelling.

Looking ahead, the principal risks remain macro driven. A recession would challenge even well-structured portfolios, while rising leverage in parts of the direct lending market increases vulnerability, particularly if bank-provided financing were to retrench. In this environment, disciplined underwriting, conservative structuring and a focus on structurally underserved segments are critical to navigating the cycle.

Overall, we believe the US lower middle market continues to offer an attractive combination of yield, structural protection and resilience, particularly for investors willing to prioritise selectivity and operate where competition is lower and underwriting standards remain intact.

References

1. Chronograph, as of 30th September 2025. How direct lending competition is impacting private credit deal terms.

2. ABF Journal, as of 12th October 2025. Middle market debt weekly: Fed policy divide and tariff turbulence shape middle market financing landscape.

3. SPP’s Middle Market Leverage Cash Flow Market At A Glance – September 30, 2025,

4. Chronograph, as of 30th September 2025. How direct lending competition is impacting private credit deal terms

5. S&P Global, as of 24th November 2025. Economic outlook US: Q1 2026: steady as she goes but on a narrow path

6. Opus Connect, as of 8th September 2025. America’s US$10 trillion handoff: How baby boomers are fuelling middle-market M&A in 2025.

7. Federal Reserve, as of 3rd November 2025. Senior Loan Office Opinion Survey on Bank Lending Practices.

8. McKinsey & Company, as of 18th August 2025. Risk transfer: A growing strategic imperative for banks.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of January 2026 and may change without notice.

--------

Important information

Muzinich and/or Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. Muzinich views and opinions. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

This discussion material contains forward-looking statements, which give current expectations of future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.