In a search for carry environment, high yield could be considered as one of the best places to be. High yield issuance has been so far easily absorbed by the market signaling the demand for yield product. In addition, the high yield asset class is less sensitive to yields rise and less inclined to investors’ exit in case of rates volatility.

So, how can investors access the potential of the high yield market but also mitigate uncertainty? A long/ short credit, actively managed, absolute return fund that seeks to generate strong risk-adjusted returns over a market cycle with a focus on mitigating downside risk could be an interesting option.

Muzinich LongShortCreditYield Fund

A liquid, high yield UCITS, targeting attractive gains with principal protection and moderate volatility, in and across the market cycle.

- Actively managed portfolio that invests mainly in US High yield and tactically in Investment Grade, Europe and Emerging Market

- Seeks to generate positive returns throughout the credit cycle, by capturing the upside and protecting on the downside

- Absolute return focus driven by bottom-up, fundamental credit research, shaped by top-down views

- History of capital preservation during volatile markets

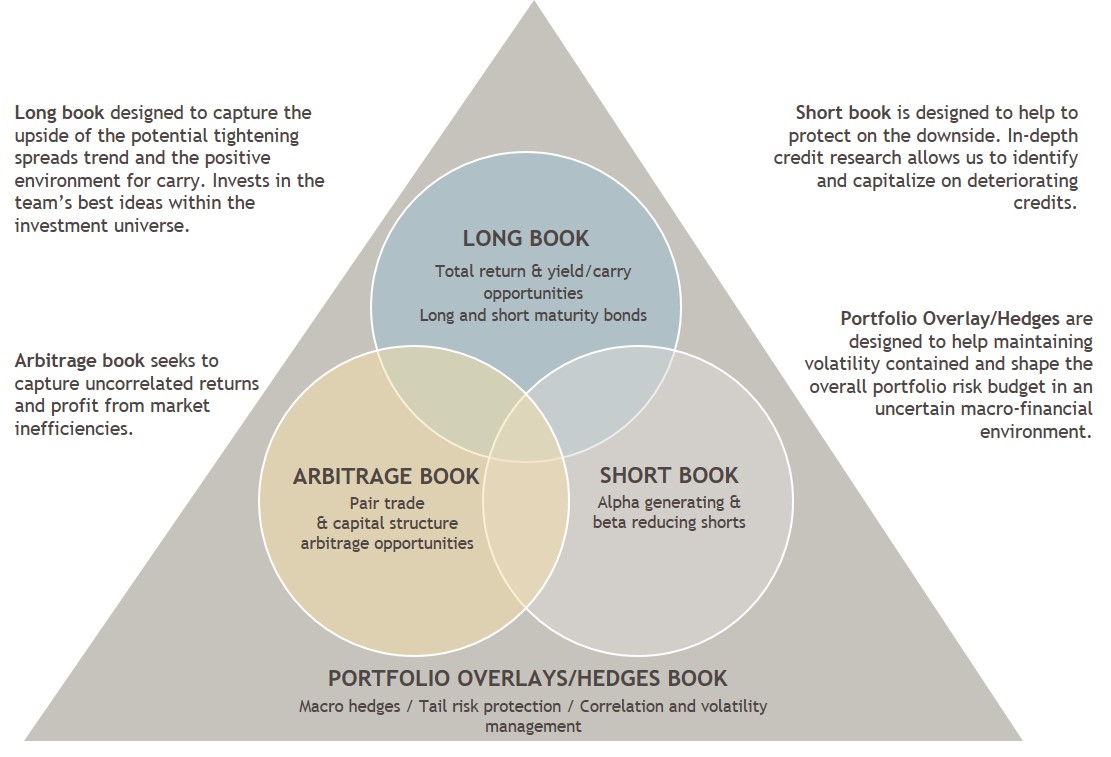

Portfolio construction based on 4-pronged approach: long, short, arbitrage, and portfolio overlays/hedges.

Long/Short Credit Why Now?

Upside/Downside Capture: a key focus for the fund is to capture the upside potential of the high yield market. Active daily management of four complementary strategies—with a focus on strong credit selection—has led to a more consistent return throughout the credit cycle.

- We believe absolute level of spreads in High Yield market are still at attractive long-term levels

- Dispersion in the credit markets is particularly elevated and offers numerous opportunities on both long and short positions

- Market dislocation offers numerous opportunities to incorporate positive convexity in such strategies, without increasing tail volatility

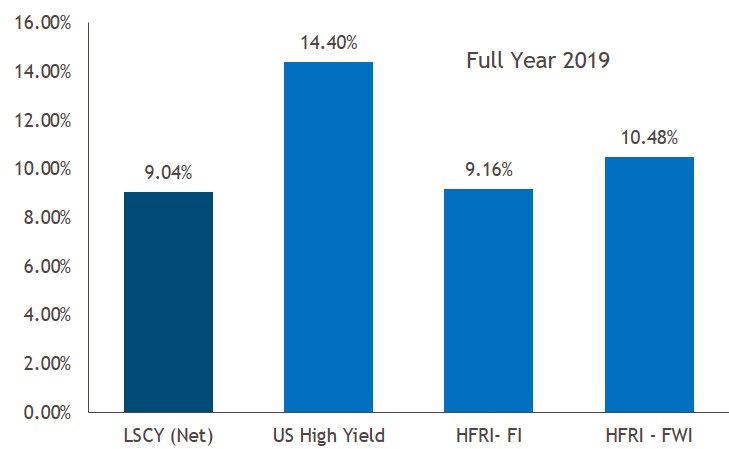

Fund Performance During Most Recent Up Market (2019) vs. the broad and credit hedge fund universes and the US High Yield market

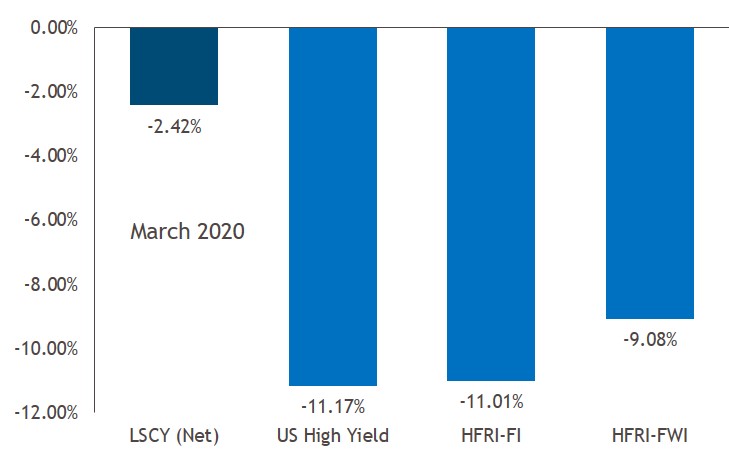

Fund Performance During Most Recent Down Market (March 2020) vs. the broad and credit hedge fund universes and the US High Yield market

Source: Muzinich and Bloomberg. Fund performance is the USD Accumulation share class net of fees. Hedge Funds are represented by the HFRI Weighted Composite Index and the HFRI Relative Value Fixed Income-Corporate Index. US High Yield represented by the ICE BofA ML U.S. Cash Pay High Yield Index (J0A0). Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

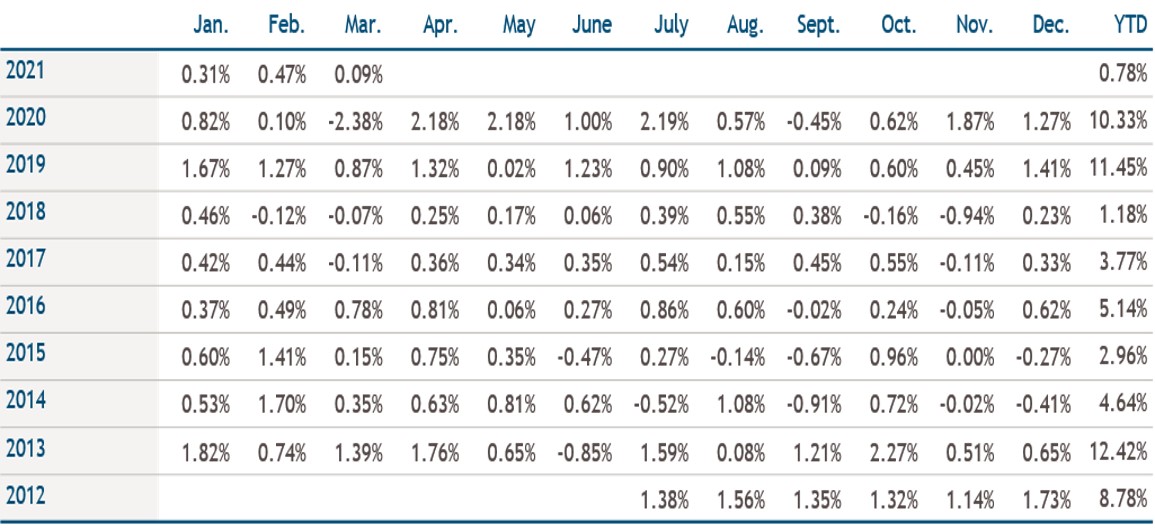

Low Volatility & Consistent Track Record: since inception, the fund has delivered attractive returns with low volatility for a high Sharpe ratio while participating in the upside of the US high yield market. The table below shows gross performance and how the fund has provided positive returns even in difficult market environments such us the ‘Taper Tantrum’ in 2013, energy crisis in 2015, or COVID-19 selloff in 2020.

The Fund’s annualized volatility since inception is 2.36%

Fig.1 Monthly Gross Returns Since Inception

Source: Muzinich. Data as of March 31st, 2021. Muzinich returns are gross for the Muzinich LongShortCreditYield USD Accumulation Class since inception July 6th, 2012. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Gross performance does not account for the effect of fees and charges, which would reduce the values shown.

Source: Muzinich. Data as of March 31st, 2021. Muzinich returns are gross for the Muzinich LongShortCreditYield USD Accumulation Class since inception July 6th, 2012. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Gross performance does not account for the effect of fees and charges, which would reduce the values shown.

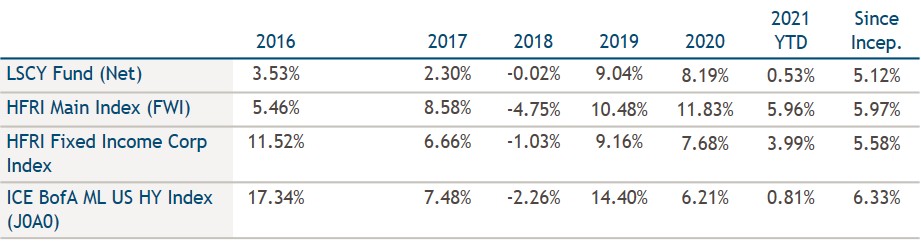

Calendar Year Returns (%)

Source: Muzinich, HFRI and Bloomberg. Data as of March 31st, 2021. Muzinich returns are net returns of the Muzinich LongShortCreditYield USD Accumulation Class since inception July 6th, 2012. The indices shown are the HFRI Hedge Fund Composite Fund Weighted Index (HFRIFWI), the HFRI Fixed Income Relative Value Corporate Index (HFRIFIHY) and the ICE BofA ML U.S. HY Cash Pay Index (J0A0). Returns greater than one year are annualized. Past performance is not indicative of future results and should not be the sole factor of consideration when making an investment decision. Net Performance provided is net of all fees and expenses.

Source: Muzinich, HFRI and Bloomberg. Data as of March 31st, 2021. Muzinich returns are net returns of the Muzinich LongShortCreditYield USD Accumulation Class since inception July 6th, 2012. The indices shown are the HFRI Hedge Fund Composite Fund Weighted Index (HFRIFWI), the HFRI Fixed Income Relative Value Corporate Index (HFRIFIHY) and the ICE BofA ML U.S. HY Cash Pay Index (J0A0). Returns greater than one year are annualized. Past performance is not indicative of future results and should not be the sole factor of consideration when making an investment decision. Net Performance provided is net of all fees and expenses.

Related Documents

Fund Factsheet & Literature

Webinar Replay

Q&A

FOR PROFESSIONAL CLIENTS/QUALIFIED AND ACCREDITED INVESTORS ONLY – NOT FOR RETAIL USE OR DISTRIBUTION – CONFIDENTIAL

The Fund is a sub-fund of Muzinich Funds, a unit trust organised under the laws of Ireland and authorised by the Central Bank of Ireland as UCITS for the purposes of the UCITS Regulations. The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Where references are made to portfolio guidelines or features, these may be subject to change over time and prevailing market conditions.

This discussion material contains forward-looking statements, which give current expectations of the Fund’s future activities and current or future performance. Return and portfolio characteristic targets may not be met and are for illustrative purposes. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties even though the assumptions underlying the forward-looking statements contained herein are believed to be reasonable. In light of the significant uncertainties herein the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any duty or obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

The prices of fixed income securities fluctuate in response to perceptions of the issuer’s creditworthiness and also tend to vary inversely with market interest rates. The value of such securities is likely to decline in times of rising interest rates. Conversely, when rates fall, the value of these investments is likely to rise. Typically, the longer the time to maturity the greater are such variations. A Fund investing in fixed income securities will be subject to credit risk (i.e., the risk that an issuer of securities will be unable or unwilling to pay principal and interest when due, or that the value of a security will suffer because investors believe the issuer is less able or willing to pay).

This presentation references certain proposed internal targets and guidelines relating to the Fund. There is no assurance that the targets will be achieved, or guidelines met. In addition, the targets and guidelines are subject to change from time to time at the discretion of the Investment Manager without notice.

Any research in this presentation has been procured and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgement and are subject to change without notice. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

Please note that investment is subject to documentation, including but not limited to the Prospectus and Key Investor Information Document (KIID) which contain a comprehensive disclosure of applicable risks. Investors in the UK should also access the Muzinich Supplemental Information Document (‘SID’). Each of these documents are available in English at www.Muzinich.com, together with the Fund’s annual and semi-annual reports. KIIDs are available by share class in each language required in the countries in which the share classes are registered. A complete listing of these KIIDs and the KIIDs themselves are also available at www.Muzinich.com.Investors should confer with their independent financial, legal or tax advisors.

Singapore – The Fund is a restricted scheme under the Sixth Schedule to the Securities and Futures (Offers of Investments) (Collective Investment Schemes) Regulations of Singapore. No offer of the units in the fund for subscriptions or purchase (or invitation to subscribe for or purchase the units) may be made, and no document or other material relating to the offer of units may be circulated or distributed, whether directly or indirectly, to any person in Singapore other than to: (i) “institutional investors” pursuant to Section 304 of the Securities and Futures Act of Singapore (the “Act”), (ii) “relevant persons” pursuant to Section 305(1) of the Act, (iii) persons who meet the requirements of an offer made pursuant to Section 305(2) of the Act, or (iv) pursuant to, and in accordance with the conditions of, other applicable provisions of the Act. The offer, holding and subsequent transfer of units are subject to restrictions and conditions under the Act.

Issued outside the European Union by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.

Issued in the European Union by Muzinich & Co. (Dublin) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland No. 625717. Registered address: 16 Fitzwilliam Street Upper, Dublin 2, D02Y221, Ireland. Muzinich & Co. Limited and Muzinich & Co. (Dublin) Limited are subsidiaries of Muzinich & Co., Inc. Muzinich & Co., Inc. is a registered investment adviser with the US Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a registered investment adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2021-05-24-6501