Insight | July 15, 2021

Navigating the Transitions Created by Monetary, Fiscal and Responsible Investing Policies

As we move into the second half of the year, and as the global pandemic appears to be petering out, we believe there are three key theme that will likely influence markets in the months ahead: post-pandemic inflation risk, the future impact of current fiscal and monetary responses and a new set of green targets.

Post-pandemic Inflation Risk

The pandemic has created huge disruptions globally, and as a result we are now seeing higher inflation on the back of an unprecedented economic recovery in countries such as the US. But is this transitory or permanent?

We believe the surge in inflation is due to multiple factors. Pent-up demand after a lack of spending for the last 15 or so months. Supply chain disruptions where we are seeing shortages of everything from computer chips to building materials.

Supply/demand labour market inefficiencies where labour shortages could be due to a variety of factors such as a higher savings rate or that economies are transitioning to a lower-carbon model. Meanwhile, within the commodities space, the world is beginning to transition away from fossil fuels; we believe this is driving demand for other mineral as well as a likelihood of a reduction in supply, which could drive-up prices.

Since the April-May high inflation print, the debate at the Federal Reserve (Fed) seems to have shifted, and they are now debating how transitory they think these higher inflation rates are likely to be.

In turn this has moved some voting Fed members to consider increasing the short-term federal fund rate in 2023, or possibly sooner. We expect the debate around tapering, interest rates, inflation and overall economic growth to continue and cause periodic volatility in rates and potentially risky assets.

The Forward-Looking Impact of Fiscal & Monetary Responses

Fiscal and monetary responses are aimed at increasing potential output and transitioning to a lower carbon economy. How will this affect long-term financial market stability?

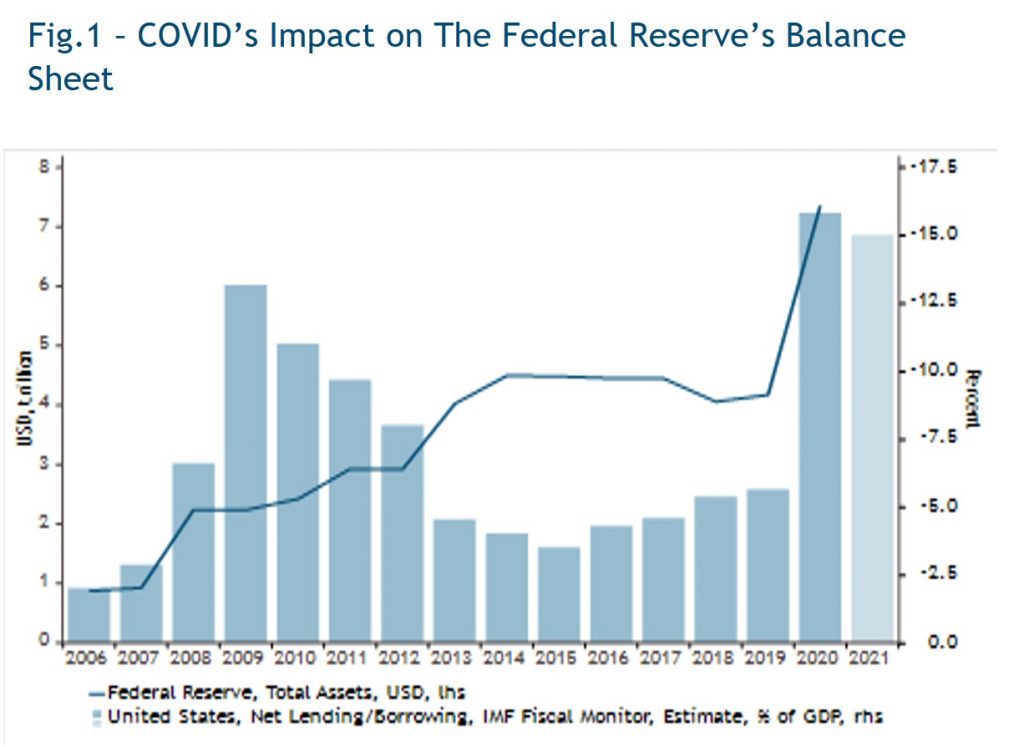

We do not expect a sudden return to austerity and a reduction in stimulus as we saw a decade ago. Instead, we believe stimulus is likely to remain elevated, in part due to increasing commitments to tackle climate change. Central banks are the primary purchasers of the extra debt being issued. As Fig. 1 highlights, COVID-19 triggered a record fiscal deficit since March 2020, while the Federal Reserve’s balance sheet has doubled in size.

We also question how much central banks can step back if governments continue to have large funding needs. We believe we are entering a new era which could lead to a potential increase in volatility.

Source: Macrobond as of end of May 2021. Forecasts are IMF Fiscal Monitor April 2021. Muzinich views and opinion, not to be construed as investment advice.

Source: Macrobond as of end of May 2021. Forecasts are IMF Fiscal Monitor April 2021. Muzinich views and opinion, not to be construed as investment advice.

A New Set of Green Targets

Meanwhile, we are also seeing changes due to the climate transition challenge to net zero. Despite the disruptions of the pandemic and lockdown measures, we only saw an 5.8% reduction in carbon emissions by the energy sector in 2020¹, which falls short of the 7% annual reduction in line with the Paris Agreement.

This is an indication of the level of the challenges we are facing if we want to adhere to net zero by 2050. We are already seeing increasing actions from governments, asset managers, corporates and society as a whole and we expect this transition is likely to move to the heart of fiscal stimulus, economic transformation and job creation going forward.

A Different Correlation Regime

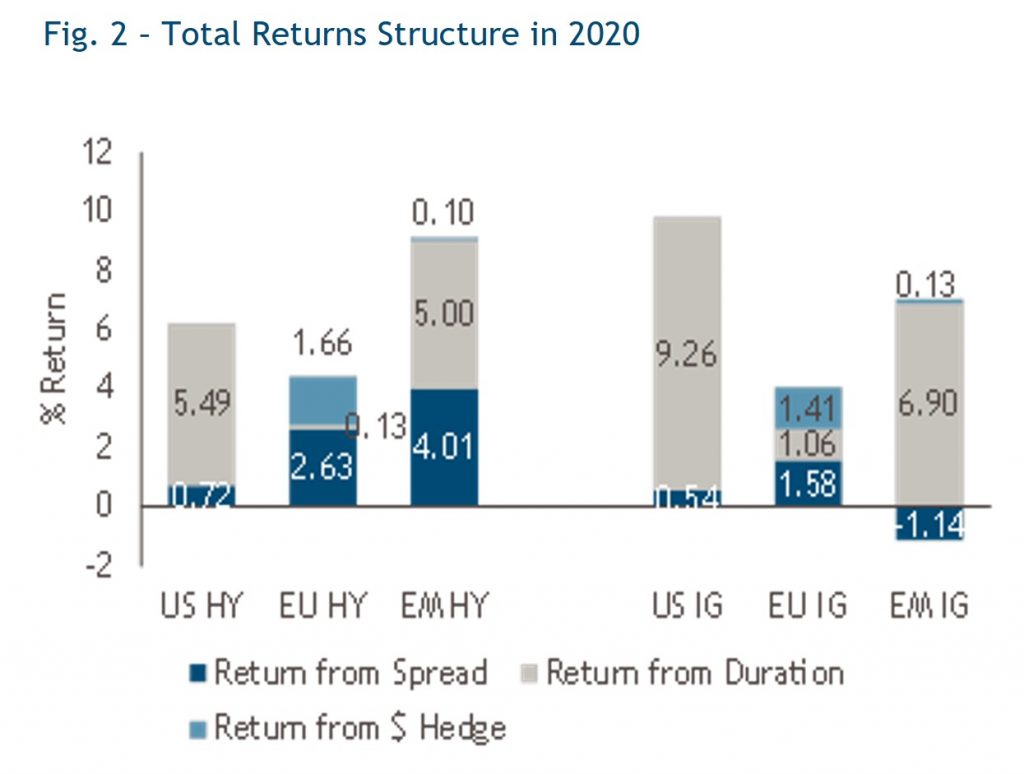

How will these transitions impact credit markets? Last year central banks provided liquidity and confidence in a period of crisis, which led to a fall in interest rates and global total returns driven primarily by rates.

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Source: ICE Bank of America Merrill Lynch Indices as of December 31st, 2020. Returns are in USD. C0A0 -ICE BofA ML US Corporate Index. J0A0 - ICE BofA ML US Cash Pay High Yield Index. ER00 - ICE BofA ML Euro Corporate Index. HE00 - ICE BofA ML Euro High Yield Constrained Index. EMIB - ICE BofA ML High Grade Emerging Markets Corporate Plus Index. EMHB – ICE BofA ML High Yield Emerging Markets Corporate Plus Index. Index performance is for illustrative purposes only. You cannot invest directly in the index. Reference to $ is USD. Index performance is for illustrative purposes only. You cannot invest directly in the index.

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Source: ICE Bank of America Merrill Lynch Indices as of December 31st, 2020. Returns are in USD. C0A0 -ICE BofA ML US Corporate Index. J0A0 - ICE BofA ML US Cash Pay High Yield Index. ER00 - ICE BofA ML Euro Corporate Index. HE00 - ICE BofA ML Euro High Yield Constrained Index. EMIB - ICE BofA ML High Grade Emerging Markets Corporate Plus Index. EMHB – ICE BofA ML High Yield Emerging Markets Corporate Plus Index. Index performance is for illustrative purposes only. You cannot invest directly in the index. Reference to $ is USD. Index performance is for illustrative purposes only. You cannot invest directly in the index.

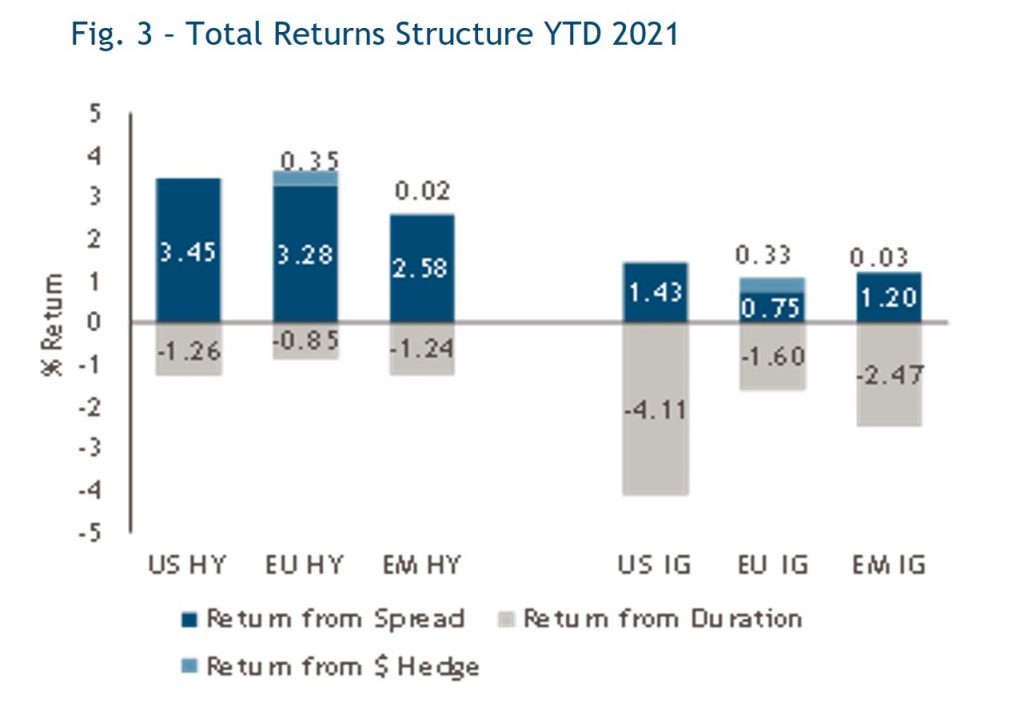

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Source: ICE Bank of America Merrill Lynch Indices as of May 31st, 2021. Returns are in USD. C0A0 -ICE BofA ML US Corporate Index. J0A0 - ICE BofA ML US Cash Pay High Yield Index. ER00 - ICE BofA ML Euro Corporate Index. HE00 - ICE BofA ML Euro High Yield Constrained Index. EMIB - ICE BofA ML High Grade Emerging Markets Corporate Plus Index. EMHB – ICE BofA ML High Yield Emerging Markets Corporate Plus Index. Index performance is for illustrative purposes only. You cannot invest directly in the index. Reference to $ is USD.

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Source: ICE Bank of America Merrill Lynch Indices as of May 31st, 2021. Returns are in USD. C0A0 -ICE BofA ML US Corporate Index. J0A0 - ICE BofA ML US Cash Pay High Yield Index. ER00 - ICE BofA ML Euro Corporate Index. HE00 - ICE BofA ML Euro High Yield Constrained Index. EMIB - ICE BofA ML High Grade Emerging Markets Corporate Plus Index. EMHB – ICE BofA ML High Yield Emerging Markets Corporate Plus Index. Index performance is for illustrative purposes only. You cannot invest directly in the index. Reference to $ is USD.

This year, as we see the global economic recovery gain momentum and we move from a period of deep recession to high growth, return drivers have changed. This is good for credit but not for rates.

We are now in an environment of rising interest rates, influenced by central bank policy, and rising inflation expectations. In this environment we are therefore focusing on credit markets with more spread and shorter duration (i.e., rates) exposure, such as US and emerging market high yield.

In addition, in terms of asset class exposure in our multi-asset credit portfolios, we believe emerging market corporate credit appears attractive. While the emerging market economies are slightly behind the global economic recovery, we are seeing them return to growth and repair themselves post pandemic.

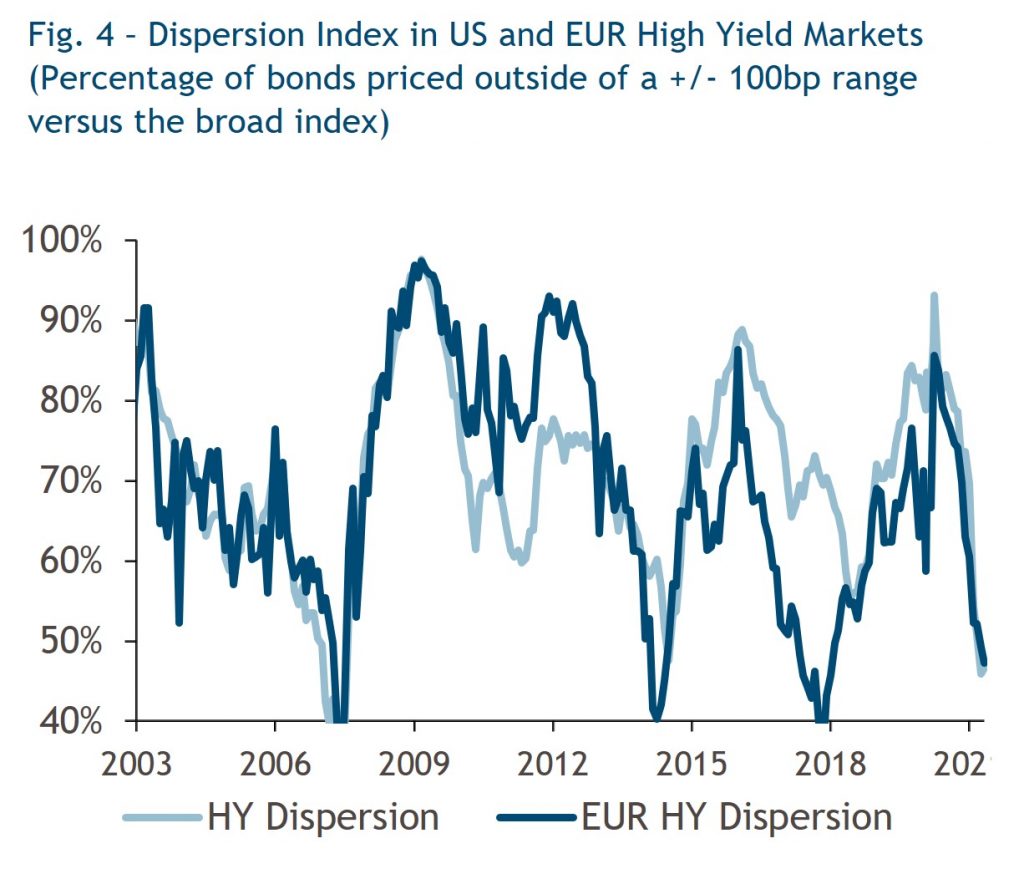

Tight Valuations Come with Low Dispersion

Valuations are tight however as the global economic recovery has long been anticipated and priced into credit. We therefore see very little dispersion in asset classes such as US and European high yield, as well as on a sector basis. Everything is compressed by quality and duration. Nevertheless, we believe this environment appears favourable for active management. We need to pay attention to fundamental credit analysis and ensure we move out of sectors and issues we believe are overvalued.

Source: ICE Bank of America Merrill Lynch Indices as of May 25th, 2021. J0A0 - ICE BofA ML US Cash Pay High Yield Index. HE00 - ICE BofA ML Euro High Yield Constrained Index.

Source: ICE Bank of America Merrill Lynch Indices as of May 25th, 2021. J0A0 - ICE BofA ML US Cash Pay High Yield Index. HE00 - ICE BofA ML Euro High Yield Constrained Index.

These views have shaped the output of our Asset Allocation Group where we have a positive view on fundamentals, which are improving very quickly due to the global economic recovery.

Technicals are also supportive; even though we are seeing a very active primary market, this is being well absorbed and is not impacting secondary market pricing. On the downside, we have a negative view on valuations because we believe nearly all the positive news is already reflected in current prices.

In our multi-asset credit strategies, we are looking to take less interest rate risk, i.e., we are increasing our exposure to shorter duration instruments such as high yield and loans.

In the investment grade segment, we prefer BBB rated bonds where we believe we can add value through bottom-up credit analysis.

From an industry perspective, we favour industries in economic recovery mode with a good outlook, such as financials, which we believe will benefit as rates move higher and yield curves steepen. We also see opportunities in some cyclical sectors and in emerging market corporates.

In addition, we are aware of the possibility of the transition to a sustainable economy being a further inflationary trigger. Overall, we could see increased demand in some industries and therefore inflationary pressure, but we could also witness deflation in other sectors as demand wains.

These will take some time to play out however, and we are still in the very early stages. But this is where active management can apply to ensure investors are positioned appropriately to weather these changes.

1.Source: Global Energy Review: CO2 Emissions in 2020 as of March 2nd, 2021.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of June 2021 and may change without notice.

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co. Limited and its affiliates. This document has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. This document and the views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity; they are for information purposes only. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained in this document constitutes forward-looking statements; due to various risks and uncertainties, actual events may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained in this document may be relied upon as a guarantee, promise, assurance or a representation as to the future. All information contained herein is believed to be accurate as of the date(s) indicated, is not complete, and is subject to change at any time. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC. Issued in the European Union by Muzinich & Co. (Dublin) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland No. 625717. Registered address: 16 Fitzwilliam Street Upper, Dublin 2, D02Y221, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2021-07-05-6692