January 29, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

In an increasingly competitive market, disciplined execution and a focus on the lower middle market remains critical to preserving capital and long-term returns, argue Kirsten Bode and Rafael Torres.

As we move through 2026, we expect European private credit – particularly in the lower middle market – to be shaped less by cyclical upside and more by structural forces, regulatory change and investor behaviour.

Our base case assumes a broadly stable macro environment rather than a sharp recovery, with risks skewed to the downside. In this context, we believe returns are likely to be driven by selectivity, underwriting discipline, diversification and the ability to navigate increasing complexity across markets and capital structures.

Capital abundance

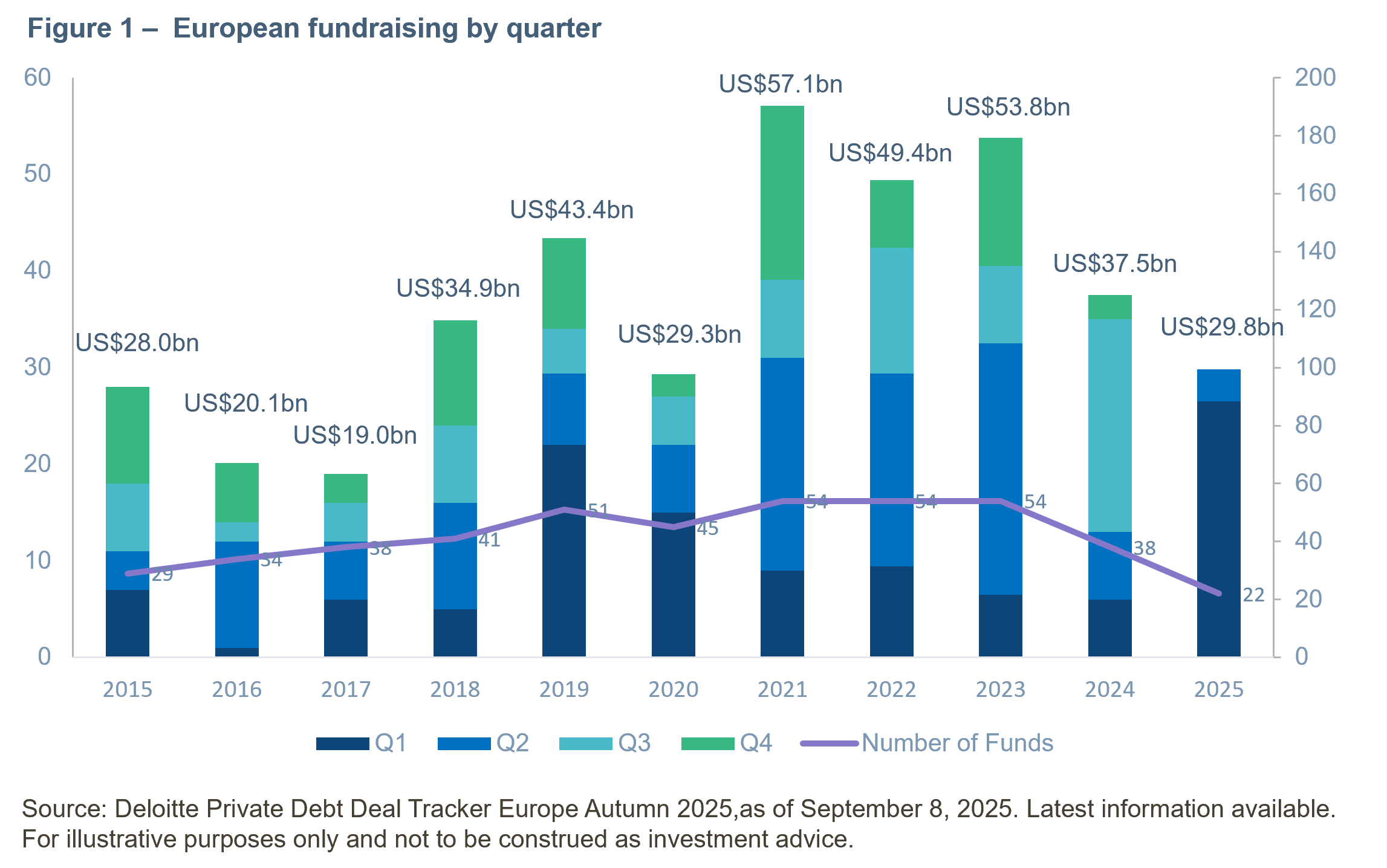

In our view, one of the defining features of the European private credit market is the continued inflow of capital. Interest from European Investors, and more recently from Canadian and Asian investors remains strong,1 while regulatory changes are making it easier for insurance companies to allocate to private markets.2 Yet this steady supply of capital is increasing competition across the asset class, particularly in larger-cap segments.

However, against this backdrop we continue to see the lower middle market as relatively insulated. Deal sizes, “on the ground” sourcing capabilities, local dynamics and execution complexity act as natural barriers to entry, allowing lenders to maintain pricing discipline and structure transactions more conservatively, even as competitive pressures intensify elsewhere.

That said, competition remains an important risk as the cycle progresses. Continued capital inflows are likely to keep pressure on pricing, leverage and documentation standards. While these pressures are less acute in the lower middle market, maintaining discipline will be critical to preserving downside protection. At the same time, the growth of semi-liquid private credit structures heightens the importance of consistent and transparent valuation practices. Perceived inconsistencies or opacity around valuations represent a risk not just to individual managers, but to confidence in the asset class more broadly.

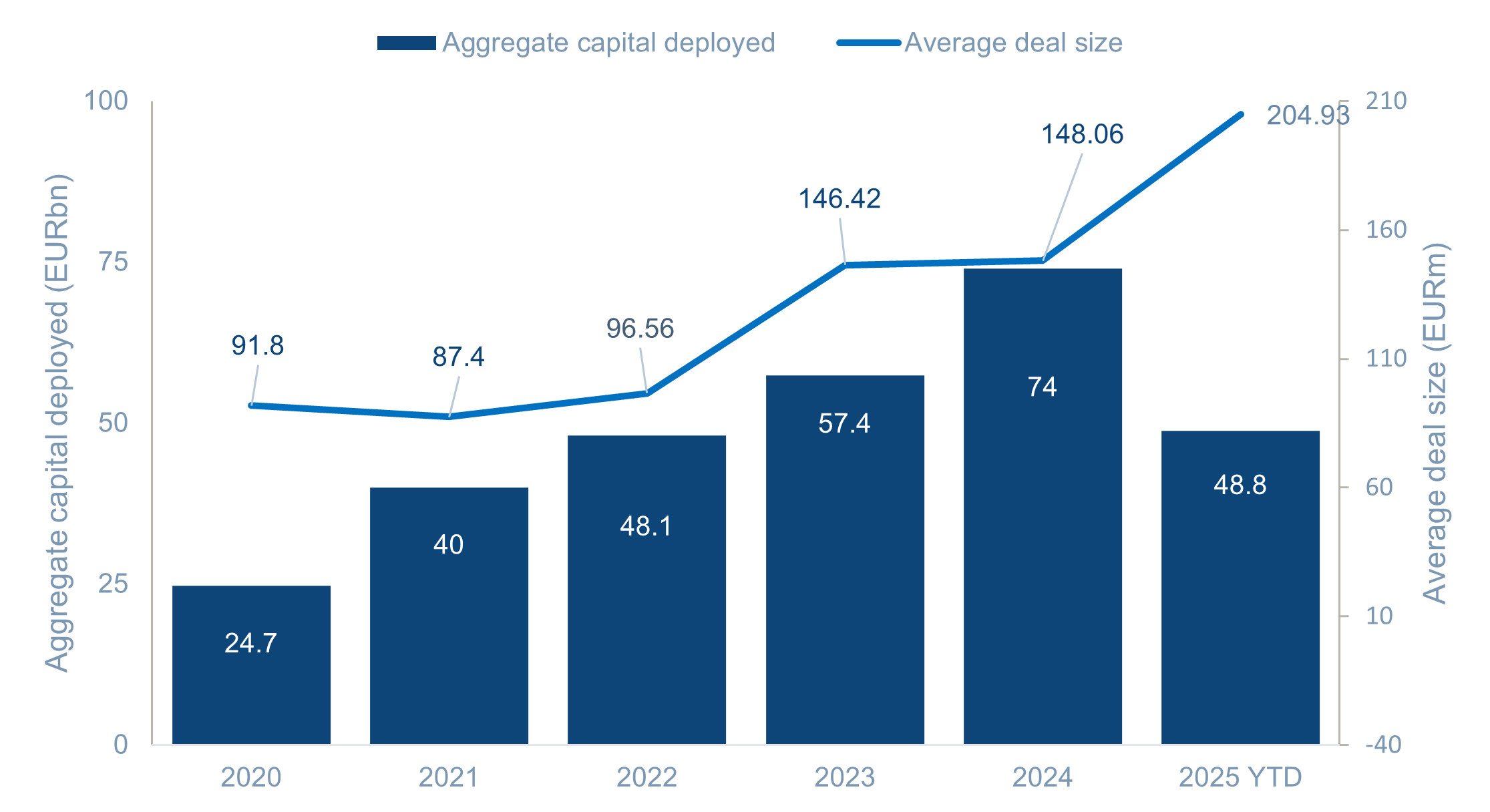

On the demand side, refinancing activity is likely to remain elevated in 2026, although not always because of acute financing gaps. Relatively tight spreads continue to support opportunistic refinancings, while M&A activity – particularly buy-and-build strategies – remains an important driver of deal flow.

Overlaying this is the ongoing overhang from several years in which private equity sponsors were unable to exit assets as originally planned. As a result, companies are being held for longer, increasingly through continuation vehicles, and in some cases are showing signs of underperformance. This is driving greater demand for more complex and bespoke capital solutions, such as Holdco payment in kinds (PIK) layered alongside senior refinancings. While these situations often sit outside traditional lending strategies, they create attractive opportunities for flexible capital where risk can be appropriately structured and priced.

Ongoing bank retrenchment

We expect European banks to continue retreating from parts of the lending market as regulatory requirements tighten further under the Basel framework. This trend is particularly visible in markets such as Scandinavia, where banks have historically been able to hold larger loan tickets.3 As capital constraints bite, we see a growing opportunity for private credit – across direct and parallel lending structures, where banks and asset managers partner in loans pari-passu – to step in and fill the gap left by shrinking bank balance sheets. We believe this dynamic remains one of the most durable sources of opportunity for the asset class.

Opportunities from regional diversification

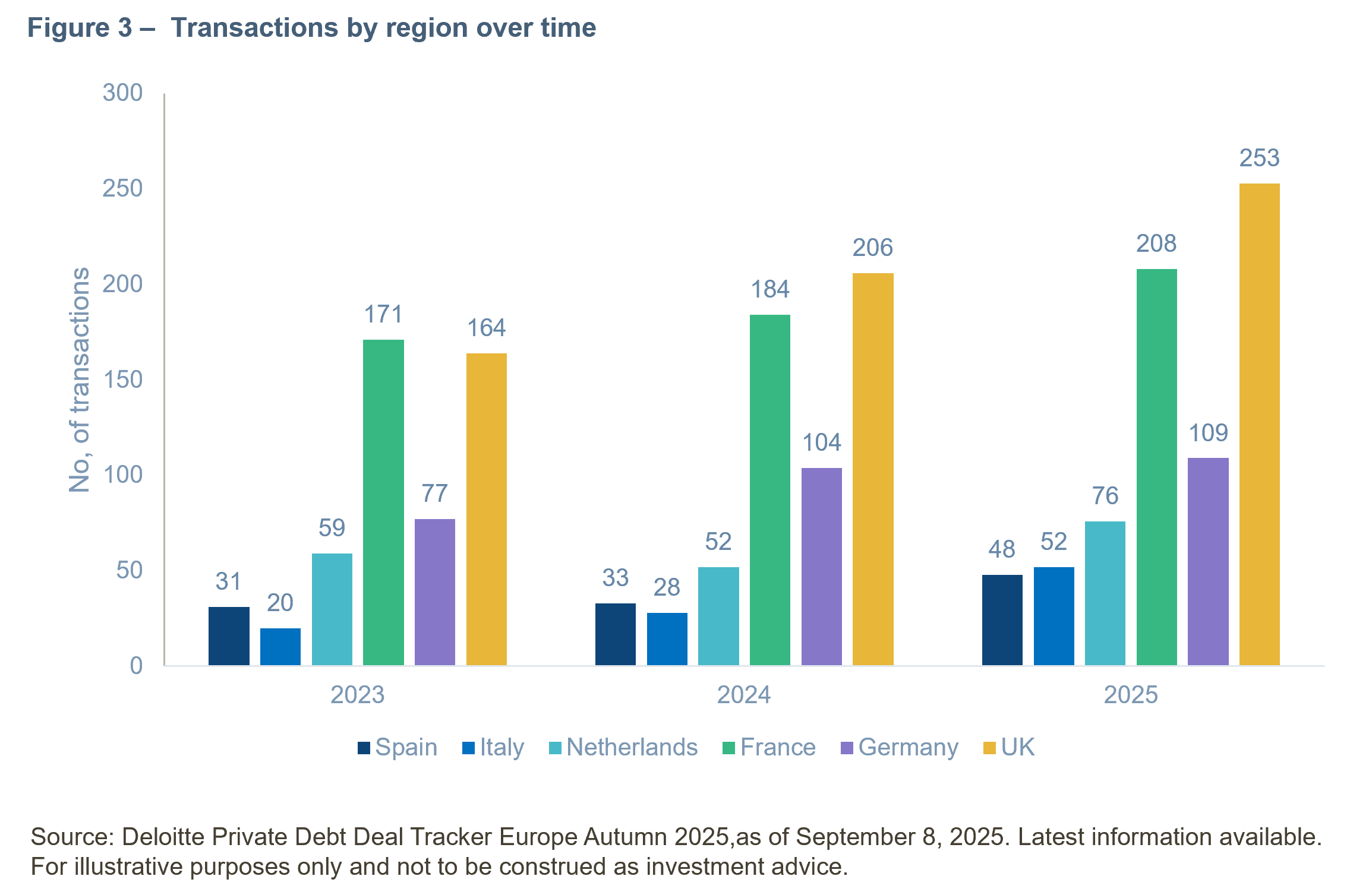

Geographically, we expect differences across European markets to persist. Transaction trends (Figure 3) suggest Southern European countries such as Italy and Spain are increasingly able to offer opportunities, while Northern European countries such as the UK and Germany face more structural challenges, including weaker industrial demand and country-specific issues that are unlikely to be resolved quickly.

In this environment, a pan-European approach remains a key advantage, allowing us to allocate capital selectively across jurisdictions rather than being tied to a single domestic market.

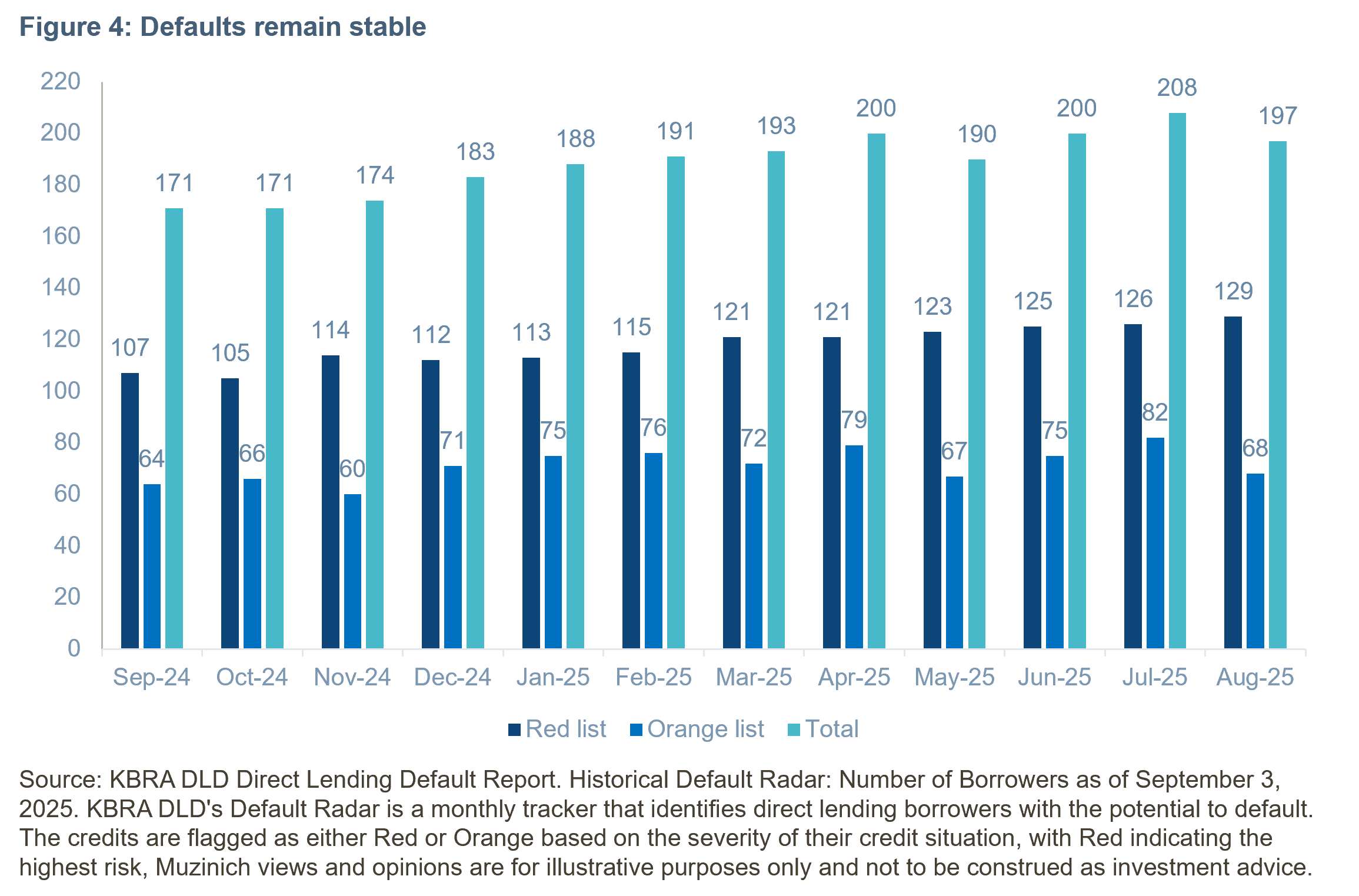

From a credit perspective, we do not currently see evidence of a material increase in defaults. While market commentary continues to focus on the risk of rising credit stress, default indicators remain broadly stable (Fig. 4). Overall, absent a significant macro shock, such as a severe AI-driven downturn or a sharp recession, we do not expect a step change in credit performance. However, as portfolios grow and mature the absolute number of restructurings and headline credit events is also likely to increase. This places greater emphasis on active portfolio monitoring, restructuring expertise and a deep understanding of the underlying businesses we finance.

Our sector positioning remains intentionally conservative. We continue to favour healthcare, software and business services, where recurring revenues, defensive characteristics and limited consumer exposure support more resilient cash flows. While areas such as defence benefit from strong thematic tailwinds, uncertainty around normalised profitability makes risk-adjusted underwriting more challenging, reinforcing our focus on sectors where downside risk is more predictable.

Discipline over yield

We believe investor priorities will increasingly reflect a preference for safety over yield, with a focus on senior secured exposure, diversification across geographies and strategies and capital preservation.

Against this backdrop, the European private credit opportunity set remains compelling. However, success will depend less on market beta and more on disciplined execution, geographic flexibility and the ability to manage complexity across portfolios as the market continues to evolve.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of January 2026 and may change without notice.

References

1. Private Debt Investors, as of 26th August 2025. BCI says Europe exposure key for private debt diversification.

2. Reinsurance News, as of 18th June 2025. European insurers to increase private credit allocations, according to Moody’s.

3. Nordea, as of 23rd September 2021. Basel IV: Unintended consequences of levelling the playing field.

------

Important information

Muzinich and/or Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. Muzinich views and opinions. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

This discussion material contains forward-looking statements, which give current expectations of future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2026-01-15-17661