February 10, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

How will Venezuela’s political reset impact oil markets, regional power dynamics and US foreign policy priorities, asks Warren Hyland.

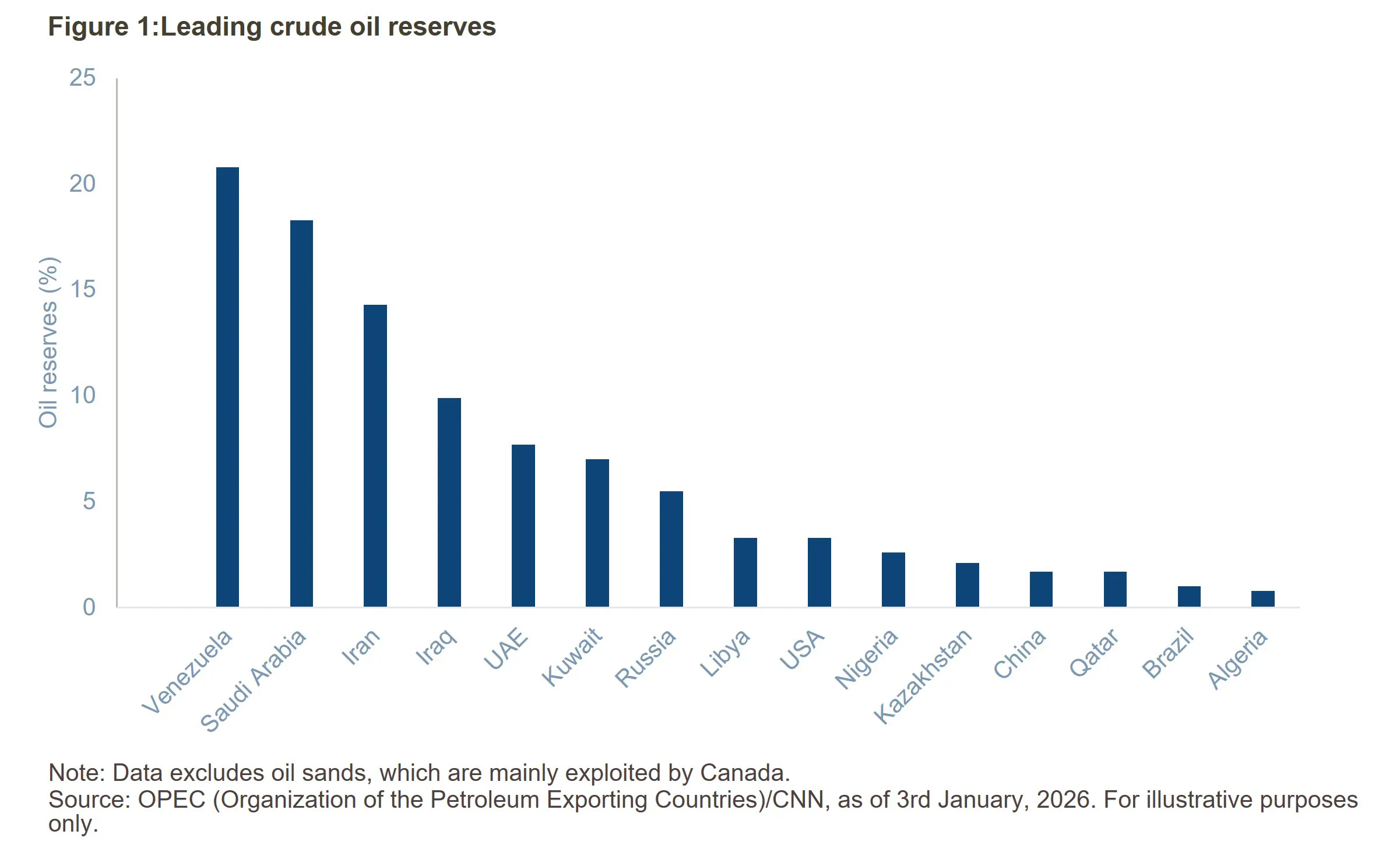

The US’s recent intervention in Venezuela and the removal of President Nicolás Maduro after 13 years in power generated a surge of headlines, as markets and policymakers assessed the implications of a profound political shift. Given Venezuela sits atop the world’s largest proven oil reserves,1 the global repercussions of these developments are likely to be transmitted primarily through the oil market and broader geopolitical dynamics.

Yet Venezuela’s vast resource endowment has long failed to translate into sustained production growth. Decades of underinvestment, deteriorating infrastructure, and the technical challenges associated with extracting and refining predominantly heavy and extra-heavy crude have left oil output near historic lows. These structural weaknesses were exacerbated by political decisions, including the nationalisation of the oil industry and the resulting loss of foreign capital and technical expertise under successive Chávez and Maduro administrations. International sanctions further compounded financial and operational constraints, deepening the sector’s decline.

As a result, Venezuela’s current crude production remains a fraction of its potential, underscoring the reality that resource wealth alone is insufficient to guarantee production strength. Against this backdrop, expectations political change could rapidly unlock higher oil output – and exert meaningful downward pressure on prices – should be tempered by the scale of the country’s long-standing structural and investment challenges.

Who gains from Venezuela’s oil revival?

A political transition in Venezuela could enable a gradual recovery in oil production, creating near-term downside pressure on oil prices of approximately US$2-3 per barrel. However, the dominant oil-price drivers are likely to remain the global supply overhang stemming from OPEC+ output and resilient US shale production, alongside geopolitical risks associated with Iran.

Venezuela’s oil output could increase by 200–300 thousand barrels per day (bpd) by 2026 and potentially reach 2mn bpd by the end of the decade (up from c.1mn bpd currently),2 assuming a smooth political transition and sanctions relief. Nevertheless, a return to historical peak production levels would require substantial investment - estimated at around US$110 billion in exploration and production capital expenditure - roughly twice the amount invested globally by US oil majors in 2024.3

US Gulf Coast (USGC) complex refiners stand to benefit from increased Venezuelan crude supply, given their ability to process heavy sour grades into high-value refined products. This may also come at the expense of Canadian oil producers, the current regional dominant supplier of heavy sour.

Geopolitical realignment

The US military operation in Venezuela signals a more assertive American foreign policy, aimed at reasserting US influence in the Western Hemisphere, (further recent examples of sovereign intervention include Panama4 and Argentina5), controlling migration flows and combating drug trafficking. This approach – also referred to as the “Donroe Doctrine”6 – asserts a unilateral US right to prevent rival powers from gaining control of strategically vital assets in the region.

Venezuela’s political transition would also serve as a test case for US-China competition, given China’s extensive economic exposure to Venezuela and its status as the country’s closest geopolitical partner in Latin America,7 alongside a broader weakening of Russia’s global influence.

In addition, the administration has signalled its intention to maintain long-term oversight of Venezuelan oil sales, positioning the US as the central authority in coordinating and approving future exports. This would significantly expand US influence over global oil markets, given the US and Venezuela account for roughly 24% of global reserves. If considered alongside Iran’s known reserves, US leverage could extend to close to 40% of global oil reserves - though it is important to note these figures are theoretical, as the vast majority of these resources remain undeveloped and in the ground. Nevertheless, the scale of such potential influence is likely to be viewed with concern by China and other major energy-importing nations.

US intervention could establish a precedent whereby governments aligned with Washington in Latin America receive increased political and economic support, while those viewed as adversaries face heightened pressure. As a result, regional powers such as Brazil and Mexico may become more cautious in engaging with alternative geopolitical partners to avoid provoking tensions with the US.

Colombia, given its deep economic and political ties with Venezuela,8 is expected to be a key beneficiary of Venezuela’s political transition. Venezuela was previously a major destination for Colombian non-oil exports, accounting for nearly one-third of the total.9 The recent normalization of bilateral relations has already more than doubled Colombian exports to Venezuela, and a sustained Venezuelan economic recovery could further boost Colombian exports by an estimated US$2–3 billion over the next two years.10 This would translate into an approximate 0.5% increase in Colombia’s GDP.

At the same time, the US’s commitment to Asia could come under scrutiny. Increased US engagement in Latin America may exacerbate geopolitical tensions in the Asia-Pacific region, potentially driving higher defence spending in countries such as Japan, South Korean and Taiwan. Concerns over US strategic bandwidth and long-term commitment to Asia could intensify if Washington becomes increasingly entangled in Latin America.

Impact on global growth

Over the near-term, we believe the direct impact of Venezuelan developments on global GDP is limited, as Venezuela accounts for approximately 0.1% of global output.11 However, lower oil prices would provide an income boost to oil-importing economies, while heightened geopolitical risk could weigh on investment and consumer confidence. On balance, in a scenario involving sanctions relief and a modest recovery in oil production, the net impact on global GDP is likely to be slightly positive.

More broadly, the larger impact may be felt through shifting linkages surrounding the US dollar as the global order evolves – best likened to the slow movement of tectonic plates. The emerging landscape points toward a system of national or regional capitalism, in which sovereign states prioritize self-sufficiency and strategic alliances over globalization, raising the possibility of an erosion – or even an end – of Pax Americana, under which US dominance has long been a defining feature of the international system. This dynamic has historically afforded the US access to cheap and abundant external financing; by the end of 2024, the US net international investment position stood at a deficit of US$26.2 trillion.12

Impact on credit markets

Geopolitical risk premia would be expected to rise as events in Venezuela unfold, given ongoing uncertainty around the near-term political outlook. However, the adjustment in risk premia is ultimately driven by the projected shock to the global growth and inflation outlook. As this shock is expected to be small - and at the margin slightly positive – it is unsurprising that credit markets exhibited only a limited initial reaction.

Still, thematically, there could be a bias toward investing in sovereigns or regions where strategic or favourable relationships with the US administration exist. In Latin America, this includes Argentina and Panama, as well as the more pragmatic engagement with Mexico.

Elsewhere, strong ties are evident with Saudi Arabia and Israel in the Middle East, and with Hungary and Poland in Eastern Europe. In Asia, positive relationships are shaped by strategic competition with China for Taiwan and the Philippines and by long-standing defence alliances with Japan and South Korea.

Regarding the US linkage, since taking office, the current administration has overseen a depreciation of over 10% in the US Dollar Index (DXY),13 allowing local currencies to purchase more US dollars per unit. This has two notable effects: it lowers the cost of funding in USD, as less local currency is required to service principal and coupon payments, effectively easing monetary conditions and supporting increased exposure to emerging market high-yield credit and domestic revenue-driven sectors such as telecommunications and utilities. At the same time, a weaker dollar boosts purchasing power, enabling local buyers to acquire more goods per unit of USD, benefiting commodity-related sectors like metals and non-perishable goods.

As for the unknowns, it remains to be seen whether the US’s privilege of unconditional, cheap international funding will persist as global geopolitical dynamics continue to shift. To position conservatively around this theme, we recommend reducing exposure to the long end of the bond curve (10-year-plus maturities) or overweighting a relative curve steepener versus benchmarks.

Small economy, big consequences

Venezuela’s political reset is an important inflection point, but its global impact is likely to be gradual rather than disruptive. Despite vast oil reserves, years of underinvestment, institutional decay and sanctions mean any recovery in output will be slow and capital-intensive, limiting Venezuela’s ability to act as a near-term swing producer. Its return to oil markets should therefore be viewed as marginal, not transformative.

The bigger implications lie in geopolitics. The US intervention signals a renewed assertiveness in the Western Hemisphere, reshaping regional alignments and sharpening great-power competition, even as it raises questions about strategic trade-offs elsewhere. For the global economy, Venezuela’s small size constrains the direct growth impact, but modest downside pressure on oil prices could provide a limited boost to importers, offset by higher geopolitical risk.

Taken together, Venezuela’s political transition is perhaps best viewed as something that marginally eases energy markets, reshapes regional geopolitics and modestly tilts the balance of risks for global growth to the upside.

EM look back – January

Fixed income

- Global government bond curves underperformed at the long end, led by a sharp steepening in Japan; European government bonds outperformed US Treasuries across the curve.

- Corporate credit outperformed within fixed income, with emerging-market high yield the strongest-performing segment.

- In investment grade, BBBs delivered the strongest returns, while in high yield, single-B exposure drove performance as distressed debt recovered.

- Cyclical sectors outperformed, notably homebuilders and autos, while quasi-sovereigns and financials lagged.

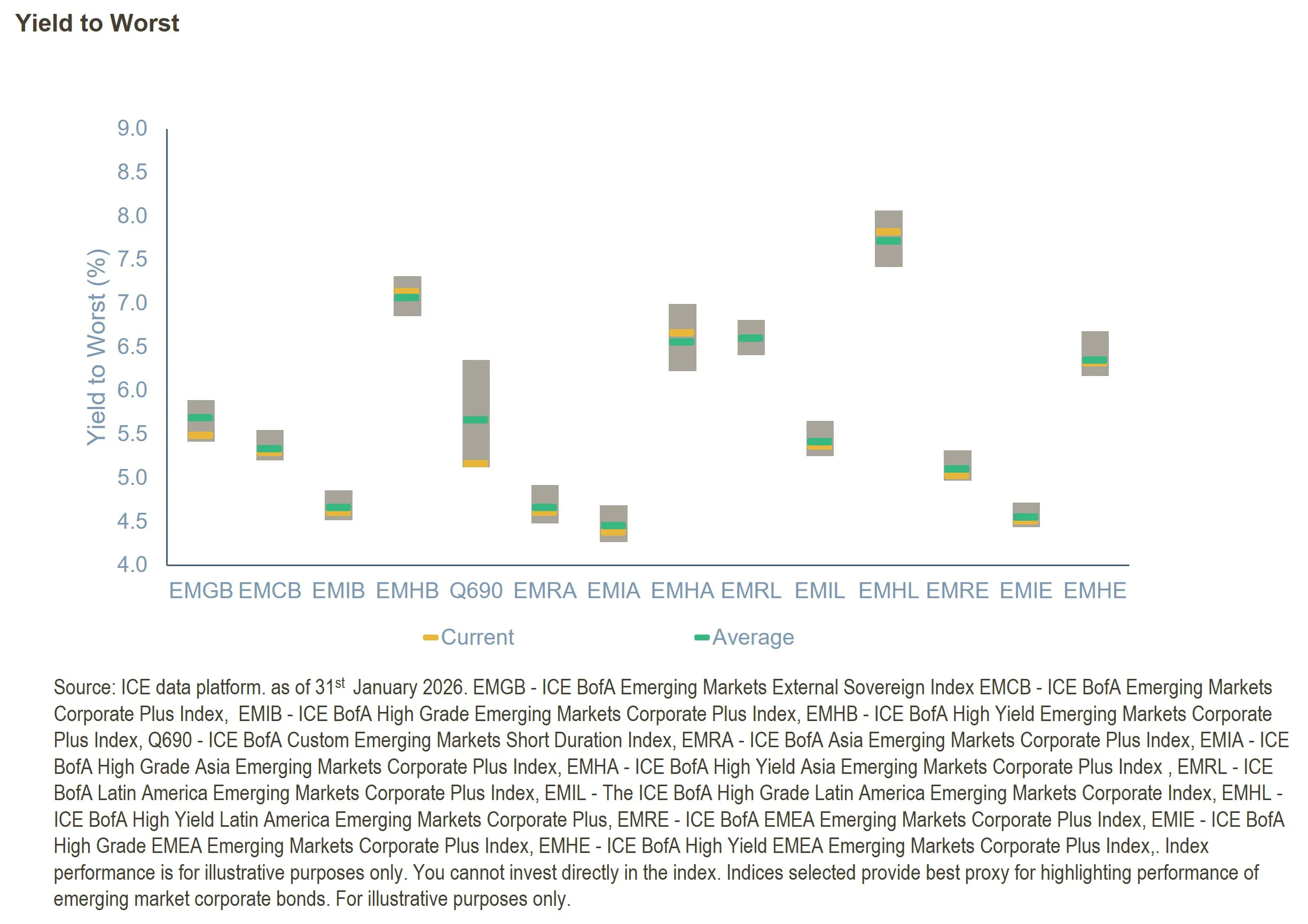

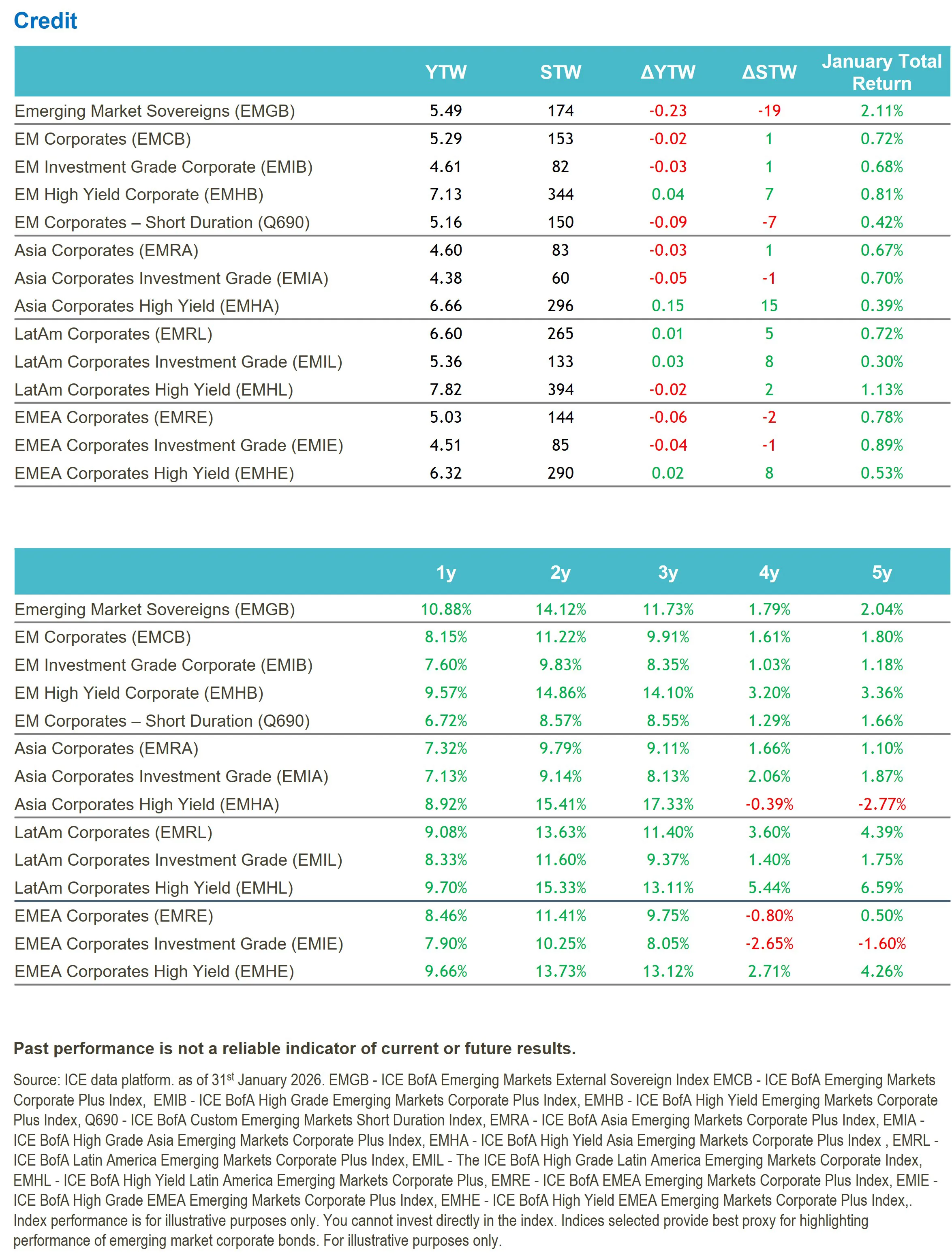

EM credit

- EM corporate credit outperformed sovereigns, led by Asia high yield while in Eastern Europe, investment grade was the best performing region.

- Strong inflows supported elevated supply, with January EM corporate issuance hitting a record US$83bn, resulting in net positive supply of US$51bn.

- Including sovereigns, total EM hard-currency issuance reached US$153bn, also a record.

- By region, Middle East and Africa was the main issuance driver, with Saudi Arabia accounting for roughly half of regional supply; Saudi quasi-sovereigns are increasingly replacing energy dividends with bond funding.

- No defaults occurred in January; the distressed universe fell to 6.4%, its lowest level since 2017.

Credit conditions improved across regions: LatAm benefiting from the technology media and telecommunications sector, Emerging Europe from utilities, and Asia which was supported by bond tenders and exchanges.

Monetary policy

- Israel’s central bank cut rates by 25bps to 4%, citing lower inflation and a strong shekel.

- Turkey’s central bank slowed the pace of easing, cutting its one week repo rate to 37% from 38% which was less than expected.

- Brazil’s central bank held rates at 15%, signalling potential cuts ahead but maintaining a tight policy stance.

- Colombia surprised markets with a 100bp rate hike to 10.25%, driven by inflation pressures following a sharp minimum wage increase.

Past performance is not a reliable indicator of current or future results.

Muzinich views and opinions are for illustrative purposes only and not to be construed as investment advice. There can be no guarantee the above objectives will be achieved.

Country-specific news

- Czech Republic: GDP growth accelerated to 2.5% in 2025, driven by rising household consumption.

- Hungary: Pre-election fiscal stimulus announced, including wage hikes and pension measures.

- Poland: Returning to the Samurai bond market to fund rising borrowing needs.

- Romania: Fitch warned progress on deficit reduction is needed to stabilise the credit outlook.

- Ukraine: US-Russia diplomatic talks signalled progress toward peace discussions.

- Argentina: Government ruled out global bond issuance while alternative funding remains available.

- Mexico: Rejected US tariff threats linked to oil shipments to Cuba on humanitarian grounds.

- Panama: Courts blocked foreign acquisitions to keep canal control local, limiting Chinese involvement.

- Peru: Government dismissed impeachment motions against the president.

- Japan called a snap election, boosting equities but weakening the yen and JGBs.

- Major trade deals announced (US – Taiwan, EU – India); Canada and UK sought closer China ties.

- Indonesia faced market volatility after MSCI warned of possible frontier reclassification.

- China reportedly relaxed its “three red lines” property policy, seen as symbolic but supportive.

- Strong AI-related demand boosted Asian tech sentiment; Micron announced a US$24bn expansion in Singapore.

All sources are Bloomberg unless otherwise stated.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of February 2026 and may change without notice.

References

1. Oil Price, as of 19th January 2026. “Venezuela’s oil reset has finally begun.”

2. Rigzone, as of 8th January 2025. “Could Venezuela production get back to 3MM barrels per day?”

3. Al Jazeera, as of 5th January 2026. “Trumps bid to commandeer Venezuela’s oil sector faces hurdles, experts say.”

4. Le Monde, as of 11th April 2025. “Panama deal allows US to deploy troops to canal, but no permanent bases.”

5. BBC News, as of 31st December 2025. “The US bet big with Argentina bailout – is it paying off?”

6. New York Times, as of 17th November 2025. The ‘Donroe Doctine’: Trump’s bid to control the Western Hemisphere.

7. US-China Economic & Security Review Commission, as of 13th January 2026. China-Venezuela factsheet “A short primer on the relationship.”

8. Merco Press, as of 29th January 2025. Bordering Colombian and Venezuelan districts to deepen ties.

9. BBVA Research, as of July 2012. Economic Watch – Colombia.

10. Barclays, as of 5th January 2026. Venezuela after Maduro; Implications from the political and oil sector reset.

11. World Bank, as of 31st December 2024. Venezuela’s GDP c. US$119.8bn/US$123,000bn of Global GDP = 0.1% of world GDP. Most recent available data used.

12. US Bureau of Economic Analysis (BEA), as of 31st December 2024. Most recent data available data used.

13. U.S Dollar Index, as of 2nd February 2026.

--------

Index descriptions

EMGB - ICE BofA Emerging Markets External Sovereign Index tracks the performance of US dollar and euro denominated emerging markets sovereign debt publicly issued in the major domestic and eurobond markets. Qualifying securities must have risk exposure to countries other than members of the FX-G10, all Western European countries and territories of the US and Western European countries.

EMCB - ICE BofA Emerging Markets Corporate Plus Index tracks the performance of the US dollar and euro denominated emerging markets non-sovereign debt publicly issued in the major domestic and eurobond markets. Qualifying issuers must have risk exposure to countries other than members of the FX G10, all Western European countries, and territories of the US and Western European countries.

EMIB - ICE BofA High Grade Emerging Markets Corporate Plus Index is a subset of the ICE BofA ML Emerging Markets Corporate Plus Index (EMCB) including all securities rated AAA through BBB3, inclusive.

EMHB - ICE BofA High Yield Emerging Markets Corporate Plus Index is a subset of the ICE BofA ML Emerging Markets Corporate Plus Index (EMCB) including all securities rated BB1 or lower.

Q690 - ICE BofA Custom Emerging Markets Short Duration Index tracks the performance of short-term US dollar and euro denominated emerging markets non-sovereign debt publicly issued in the major domestic and eurobond markets.

EMRA - ICE BofA Asia Emerging Markets Corporate Plus Index is the subset of the ICE BofAML Emerging Markets Corporate Plus Index, which includes only securities issued by countries associated with the region of Asia, excluding Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan.

EMHA – The ICE BofA High Yield Asia Emerging Markets Corporate Plus Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BB1 and lower with a country of risk within the Asia region.

EMIA - The ICE BofA High Grade Asia Emerging Markets Corporate Plus Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BBB3 and higher with a country of risk within the Asia region.

EMRL - ICE BofA Latin America Emerging Markets Corporate Plus Index is a subset of The ICE BofA Emerging Markets Corporate Plus Index including all securities issued by countries associated with the geographical region of Latin America.

EMIL - The ICE BofA High Grade Latin America Emerging Markets Corporate Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BBB3 and higher with a country of risk within the Latin America region.

EMHL - ICE BofA High Yield Latin America Emerging Markets Corporate Plus is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated sub-investment grade based on the average of Moody's, S&P and Fitch, and with a country of risk associated with the geographical region of Latin America.

EMRE - ICE BofA EMEA Emerging Markets Corporate Plus Index is a subset of The ICE BofA Emerging Markets Corporate Plus Index including all securities issued by countries associated with the geographical region of Europe, the Middle East and Africa including Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan.

EMIE - ICE BofA High Grade EMEA Emerging Markets Corporate Plus Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BBB3 and higher with a country of risk within the Europe, Middle East and Africa regions.

EMHE - ICE BofA High Yield EMEA Emerging Markets Corporate Plus Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BBB3 and higher with a country of risk within the Europe, Middle East and Africa regions.

The MSCI EM Index is a free-float weighted equity index that captures large and mid cap representation across emerging market countries. The index covers approximately 85% of the free float-adjusted market capitalisation in each country.

LDMP - ICE BofA Local Debt Markets Plus Index is designed to track the performance of emerging markets sovereign debt publicly issued and denominated in the issuer's own currency.

J0A0 - The ICE BofA ML US Cash Pay High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt, currently in a coupon paying period that is publicly issued in the US domestic market.

C0A0 - The ICE BofA ML US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.

HE00 - The ICE BofA ML Euro High Yield Index tracks the performance of EUR dominated below investment grade corporate debt publicly issued in the euro domestic or eurobond markets.

ER00 – The ICE BofA ML Euro Corporate Index tracks the performance of EUR denominated investment grade corporate debt publicly issued in the eurobond or Euro member domestic markets.

ICE BofA High Yield Emerging Markets Corporate Plus India Issuers Index (EINH) - is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities with India as the country of risk that are rated sub-investment grade based on average of Moody's, S&P and Fitch

ADOL -The ICE BofA Asian Dollar Index tracks the performance of U.S. dollar denominated sovereign, quasi-government, corporate, securitized and collateralized debt publicly issued in the U.S. domestic and eurobond markets by Asian issuers.

ADHY - ICE BofA Asian Dollar High Yield Index tracks the performance of sub-investment grade U.S. dollar denominated sovereign, quasi-government, corporate, securitized and collateralized debt publicly issued in the U.S. domestic and eurobond markets by Asian issuers.

ADIG - ICE BofA Asian Dollar Investment Grade Index tracks the performance of investment grade U.S. dollar denominated sovereign, quasi-government, corporate, securitized and collateralized debt publicly issued in the U.S. domestic and eurobond markets by Asian issuers. Qualifying securities have a country of risk classified as an Emerging Markets country that is part of the Asia/Pacific Region.

CEMBI Broad Div. Index - The JP Morgan CEMBI Broad Diversified Index (CEMBIB Div) is a benchmark that tracks the performance of US dollar-denominated, fixed and floating-rate debt instruments issued by emerging market corporate entities.

JESG CEMBI Broad Div. Index - The JP Morgan ESG CEMBI Broad Diversified Custom Maturity Index tracks liquid, US Dollar denominated emerging market fixed and floating-rate debt instruments issued by corporates.

EM3B – ICE BofA BB Emerging Markets Corporate Plus Index is a subset of the ICE BofA Emerging Markets Corporate Plus Index including ass securities rated BB1 through BB3, inclusive.

EMCS – ICE BofA Emerging Markets Corporate Plus Consumer Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities of Consumer Cyclical and Consumer Non-Cyclical issuers.

EMEN – ICE BofA Emerging Market Corporate Plus Energy Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities of Energy issuers.

EMRB – ICE BofA Emerging Market Corporate plus Real Estate, Building & Hotels Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities of Real Easte, Building & Construction, or Hotels.

EMCG – ICE BofA Emerging Markets Corporate Plus Capital Goods Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities of Capital Goods Issuers.

EMSD – ICE BofA Emerging Markets Diversified Corporate Index tracks the performance of USD dollar denominated emerging markets corporate senior and secured debt publicly issued in the US domestic and eurobond markets.

EMTM – ICE BofA Emerging Markets Corporate Plus Media & Telecommunications Index is a subset of ICE BofA Emerging Markets Corporate Plus index including all securities of media and telecommunications issuers.

EM2B – ICE BofA BBB Emerging Markets Corporate Plus Index is a subset of the ICE BofA Emerging Market Corporate Plus index including all securities rated BBB1 through BBB3, inclusive.

EMUT – the ICE BofA Emerging Markets Corporate Plus Utility Index is a subset of the ICE BofA Emerging Markets Corporate Plus Index including all securities of Utility issuers.

EMPB – ICE BofA Public Sector Issuers Emerging Markets Corporate Plus Index is a subset of The BofA Emerging Markets Corporate Plus Index including all quasi-government securities as well as debt of corporate issuers deemed to be government owned or controlled.

ACIG – ICE BofA Asian Dollar Investment Grade Corporate Index tracks the performance of investment grade US dollar denominated securities issued by Asian corporate issuers in the US domestic and eurobonds market. Qualyfying securities have a country of risk associated with Bangladesh, Bhutan, Cambodia, China, John Kong, India, Indonesia, Laos, Macau, Malaysia, Mongolia, Myanmar, Nepal, Pakistan, Papua New Guinea, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Thailand and Vietnam.

EMAB – Ice BofA Automotive & Basic Industry Emerging Markets Corporate Plus Index is a subset of the ICE BofA Emerging Markets Corporate Plus Index.

EMHE - The ICE BofA High Yield EMEA Emerging Markets Corporate Plus Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BBB3 and higher with a country of risk within the Europe, Middle East and Africa regions.

EMNS – The ICE BofA Non-Financial Emerging Markets Corporate Plus Index is a subset of the ICE BofA Emerging Markets Corporate Plus Index excluding all financial securities as well as debt of corporate issuers designated as government owned or controlled by ICE BofA emerging markets credit research.

EM1B – the ICE BofA AAA-A Emerging Markets Corporate Plus Index is a subset of the ICE BofA Emerging Market Corporate Plus Index including all securities rated AAA through A3, inclusive.

EMFN – EM Corporate Plus Financial is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities of financial issuers.

EMIE - The ICE BofA High Grade EMEA Emerging Markets Corporate Plus Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities rated BBB3 and higher with a country of risk within the Europe, Middle East and Africa regions.

EM4B – ICE BofA B & Lower Emerging Markets Corporate Plus Index is a subset of the ICE BofA Emerging Markets Corporate Plus Index.

EMRT – ICE BofA Emerging Markets Corporate Plus Transportation Index is a subset of ICE BofA Emerging Markets Corporate Plus Index including all securities of Transportation issuers other than airlines or railroads.

GSFCI - The Goldman Sachs Financial Conditions Index is a measure that assesses the overall financial conditions in the economy, taking into account various factors such as interest rates, credit spreads, and equity prices.

You cannot invest directly in an index, which also does not take into account trading commissions or costs. Additionally, indices do not include reinvestment of dividends, and the volatility of indices may be materially different over time.

Important information

Muzinich and/or Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. Muzinich views and opinions. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

This discussion material contains forward-looking statements, which give current expectations of future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2026-02-04-17834