October 13, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

There was little in the way of economic data this week with Golden Week in China, no central bank policy meetings (most are scheduled for the last week of October into the first week of November), and companies entering their blackout periods ahead of third-quarter earnings. Consequently, it was left to geopolitics to provide the entertainment, and to financial markets to offer guidance.

The first surprise of the week came from Japan, where the ruling Liberal Democratic Party (LDP) elected Sanae Takaichi as its new leader—the first woman in the party’s history to hold the position. Ideologically aligned with former Prime Minister Shinzo Abe, who was assassinated in 2022, Takaichi shares many of his nationalist and revisionist views. A darling of the right wing, she advocates for fiscal stimulus and a more hawkish diplomatic stance. Takaichi has expressed support for aggressive public spending. She has even floated the idea of renegotiating the trade and investment agreement with the US, under which Donald Trump agreed to lower tariffs on Japanese autos and other goods in exchange for US$550 billion in Japanese investment[1].

A parliamentary vote on October 15 will determine whether Takaichi becomes Japan’s first female prime minister. Her challenge has intensified, however, after the governing coalition collapsed, delivering a major blow to the LDP when Komeito—a key partner for the past 26 years—withdrew from the coalition.[2] Takaichi could still be elected prime minister by parliament without a coalition partner, but her authority would be diminished, making lawmaking more challenging. This outcome may be viewed as more bond-friendly, as her plans for aggressive fiscal spending could be limited. The likelihood of someone from another party being chosen as prime minister remains low, though not impossible.

In the near term, market volatility should be expected. This week, the Nikkei was the best-performing equity market, while the yen was the weakest G10 currency against the US dollar. Furthermore, because of the political uncertainty, a delay in the Bank of Japan’s October 30 rate-tightening decision now seems likely.

Over the medium term, a solo LDP minority government is unfortunately unsustainable—as the French government demonstrated this past week with new Prime Minister Sebastien Lecornu and his government resigning on Monday 6th, just 27 days after taking charge, making Lecornu the shortest-serving prime minister in the history of the Fifth Republic. His downfall followed failed attempts to form a stable coalition and criticism that his new cabinet resembled the previous one too closely. Partners in the centrist alliance, Les Républicains, ultimately withdrew support, leaving the government unable to pass a budget or advance President Macron’s deficit-reduction plans.[3]

The worst-case scenario of a snap election still looks unlikely, with President Macron promising to name a new prime minister by the end of the week, and his office announcing that a nomination would be made by Friday evening. Caretaker Prime Minister Lecornu also struck a cautiously optimistic tone, suggesting that a deal on the country’s budget could potentially be reached by year-end. [3]

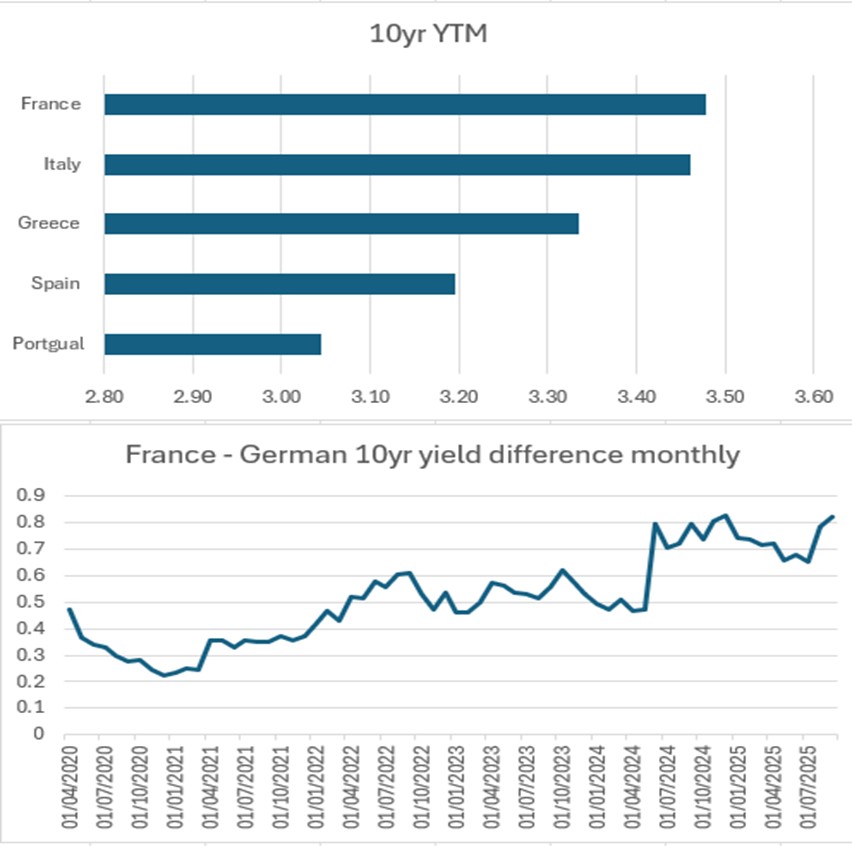

The political chaos, however, has taken a toll on the president’s image. Macron’s approval rating fell three points to 14%, the lowest level since he took office in 2017. [3] Meanwhile, France’s sovereign funding costs within the European Union have continued to worsen. During the 2011-2013 Eurozone crisis, the countries with the worst funding stress—Portugal, Italy, Greece, and Spain—were labelled with the infamous acronym “PIGS.” Today, funding costs for these countries at the 10-year point are below those of France. Meanwhile, the funding spreads to Germany for French debt are now at levels last seen during the crisis (see Chart of the Week).

Another government that is not open for business is the US federal government, which remains shut down with little political movement. The latest Senate vote on the House-passed continuing resolution that would reopen the government concluded at 52-42, falling short of the 60-vote threshold for passage—marking the fifth time such an effort has failed. [4]

More than 250,000 US federal workers have already missed paychecks as the government shutdown enters its second week, with another 2 million at risk. The Pentagon’s next military payday on October 15, coinciding with the release of key CPI data, could become both a political and market tipping point. Meanwhile, air travel is emerging as the most visible strain, with flight delays caused by air-traffic-control staffing shortages reported at airports across the country.[5]

Meanwhile, OPEC+ countries have decided to increase their production quotas in November by 137,000 barrels per day, reflecting what some view as an optimistic outlook based on expectations of stable global economic growth and favorable market conditions, including currently low oil inventories. [6] Others, however, take a more cautious view. Analysts at Macquarie Group Ltd., a bank with a large commodities business, now expect the oil market to head into an immense surplus in early 2026—a surplus they describe as “cartoonish” in scale.[7]

To end on a positive political note, Israel and Hamas seem to have reached an agreement on Gaza. This marks the first phase of President Trump’s peace plan, which was swiftly approved by Israel’s cabinet. Under the deal, Hamas is expected to return all Israeli hostages, while Israel will withdraw to the initial positions outlined in Trump’s 20-point framework, release 2,000 Palestinian prisoners, and allow humanitarian aid to flow into the Gaza Strip.[8]

The deal has been cautiously welcomed by both Israelis and Palestinians, although significant obstacles remain to its long-term implementation—even before negotiations begin on the remaining elements of the 20-point framework. Still, one can hope for the “strong, durable, and everlasting peace” in the Middle East that President Trump expects. Perhaps he will renew his public campaign for the Nobel Peace Prize in 2026.

In the meantime, this year’s Nobel Peace Prize has been awarded to Venezuelan opposition leader María Corina Machado, in recognition of her tireless efforts to promote democratic rights for the people of Venezuela and her struggle to achieve a peaceful and just transition from dictatorship to democracy[9].

As for making sense of all the geopolitics, government bond markets bull flattened. With inflation proving sticky and quantitative easing now in reverse, the most likely explanation for the curve movement is growing investor concern that economic growth will weaken, alongside a rising bid for safe-haven duration as political uncertainty intensifies. Corporate credit markets told a similar story— spreads widened, and investment-grade debt outperformed high yield, reflecting increasing caution about the economic outlook.

In currency markets, the US dollar rallied broadly against global currencies, likely reflecting a rise in investor risk aversion. Meanwhile, commodity markets continued to move in the path of least resistance. Oil prices fell sharply, with WTI dropping below $60 amid signs of oversupply and the possible unwinding of the Middle East risk premium. In contrast, metal prices continued to climb — industrial metals are being supported by supply shocks, while precious metals benefited from strong safe-haven demand. Gold briefly breached $4,000, and copper touched $11,000 intra week.

Equity markets largely took the week’s news in stride, with investors looking ahead to what is expected to be a strong third-quarter earnings season. However, sentiment turned later in the week after President Donald Trump said he saw “no reason” to meet Chinese President Xi Jinping and threatened a “massive increase” in tariffs on Chinese goods, citing Beijing’s recent “hostile” export controls on rare-earth minerals. “I was to meet President Xi in two weeks, at APEC in South Korea, but now there seems to be no reason to do so,” Trump posted on social media Friday[10].

Should we add a potential renewed trade war back to the growing list of geopolitical risks, or is this just the standard Trump tactic we have come to expect, aimed at striking a better deal?

Chart of the Week: France - The cost of political uncertainty

Source: Bloomberg, as of October 3, 2025. For illustrative purposes only.

Source: Bloomberg, as of October 3, 2025. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] The Guardian, ‘Sanae Takaichi: the new leader of Japan’s Liberal Democratic party who cites Thatcher as an influence, October 4, 2025

[2] Bloomberg, ‘Japan’s Decades-Old Ruling Coalition Collapses, Jolting Markets,’ October 10, 2025

[3] Bloomberg, ‘Macron Seeks to End French Chaos With New Premier by Friday,’ October 9, 2025

[4] Deutsche Bank Research, ‘Early Morning Reid, Macro Strategy,’ October 7, 2025

[5] Bloomberg, ‘US Government Shutdown Triggers Ripples of Pain: Economics Daily,’ October 10, 2025

[6] Interfax Ltd News Agency, ‘Eight OPEC+ countries decide to increase November output quotas by 137,000 b/d due to low oil reserves, October 6, 2025

[7] Bloomberg, ‘Financing the Oil Tsunami of 2026 Won’t Be Cheap: Javier Blas,’ October 5, 2025

[8] Bloomberg, ‘A Deal in Gaza—But Will It Hold?,’ October 10, 202

[9] BBC News, ‘Venezuelan opposition leader Maria Corina Machado wins Nobel Peace Prize,’ October 10, 2025

[10] Bloomberg, ‘Trump Sees ‘No Reason’ to Meet Xi, Threatens New Tariffs,’ October 10, 2025

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of October 10, 2025, and may change without notice. All data figures are from Bloomberg, as of October 10, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.