September 15, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

In our latest roundup of the key developments in financial markets and economies, we look at the growing chasm between bullish markets and a deteriorating global political backdrop.

A common thread running across the world today is the deep uncertainty — some might call it chaos — emerging from global politics and current affairs. No region appears immune, with uncertainty, distrust and rising desperation evident in both advanced and emerging economies.

In Asia, Japan is without a Prime Minister after Shigeru Ishiba announced his resignation on September 7, bowing to pressure within his Liberal Democratic Party (LDP) after a historic upper house election defeat in July.[1] The LDP, having lost control of both chambers in successive, humiliating national elections, faces an existential debate over its direction. A leadership contest scheduled for October 4 will be decided by just over one million rank-and-file members, who must choose between doubling down on right-wing populism and fiscal largesse or rebranding around reform and generational change.[2]

The spotlight is likely to fall on two contenders: Sanae Takaichi, a right-wing favourite advocating for hawkish diplomacy and pro-stimulus “easy money” policies that could weaken the yen and push long-term bond yields higher, and Shinjiro Koizumi, a reformist offering a fresher image and greater reassurance for investors concerned about Japan’s towering debt. Whoever succeeds Ishiba will inherit a fragile political environment and need opposition support to govern. Most opposition parties have made demands for tax cuts that would put more pressure on Japan’s debt burden.

Meanwhile, in Indonesia, the abrupt removal of Finance Minister Sri Mulyani Indrawati, without any explanation for her dismissal, surprised many investors.[3] Widely respected, Indrawati kept Indonesia’s deficit below the 3% legal cap and helped secure investment-grade sovereign credit ratings during nearly 14 years in office under three presidents. Her exit is expected to give President Prabowo greater freedom to pursue populist policies, fuelling concerns over fiscal discipline. She has been replaced by Purbaya Yudhi Sadewa, head of the Deposit Insurance Corporation since 2020, who pledged to keep Indonesia financially healthy.[4]

Stability vs. hostility

While India and China are seen as anchors of political stability, they remain at the epicentre of an increasingly hostile global trade and geopolitical environment. The Trump administration has been pressing G7 partners to impose higher tariffs on both countries for buying Russian oil and supporting Moscow economically, raising the issue at a meeting earlier this month between US and EU sanctions officials in Washington.[5]

Meanwhile, Mexico’s 2026 budget proposal, submitted to the Chamber of Deputies last week by President Claudia Sheinbaum, includes tariffs of 10 to 50 per cent on 1,371 product categories from Asia.[6]

In Europe, France has its fifth prime minister in just two years. Sebastien Lecornu took office amid protests by nearly 200,000 people against proposed budget cuts seen as a prelude to nationwide strikes on September 18.[7] Former defence minister Lecornu faces the herculean task of pushing through fiscal reforms to rein in France’s outsized deficit, while the country remains under a caretaker government until a budget deal is agreed.

The travails of the UK government continue, with two senior exits already this month. Deputy Prime Minister Angela Raynor resigned after breaching the ministerial code,[8] while ambassador to the US, Peter Mandelson, was sacked after reports linking him to Jeffrey Epstein.[9] In response, Prime Minister Keir Starmer sought to contain the fallout by ordering a wide-ranging government reshuffle.[10]

Elsewhere, protests erupted in Istanbul after a court-appointed trustee attempted to seize the local headquarters of the Republican People’s Party (CHP). Riot police escorted Gursel Tekin, a former CHP lawmaker, into the building to assume control — an unprecedented move bypassing party members. The action reflects mounting judicial pressure on the CHP, which has faced multiple cases since last year’s local election victories. The latest setback is a precursor to a September 15 case that could invalidate the 2023 national congress and remove CHP chairman Ozgur Ozel.[11]

No respect

Worryingly, we are seeing evidence of a brazen disregard for sovereign borders, with an Israeli strike targeting Hamas officials in the Qatari capital, Doha,[12] and Russian drones shot down after breaching NATO airspace in Poland.[13]

In the Americas, Argentina was jolted by the resounding defeat of President Javier Milei’s La Libertad Avanza in the Buenos Aires provincial elections. Voters signalled growing doubts over his reform agenda, while a corruption scandal further eroded support — a stinging setback that serves as a warning ahead of October’s national midterms.[14]

In Brazil, the Supreme Court sentenced former president Jair Bolsonaro to 27 years in prison for coup plotting, concluding a landmark trial that split the nation and drew sharp criticism from Washington. Judges voted 4–1 to convict him of attempting to overturn Luiz Inácio Lula da Silva’s 2022 election victory.[15] Bolsonaro’s team is now seeking congressional support for an amnesty bill, but the ruling appears to end his hopes of running for office again. Attention is turning to São Paulo Governor Tarcísio de Freitas, seen as a technocratic alternative to Bolsonaro’s combative right-wing politics and Lula’s leftist agenda.

In the US, the shocking shooting of conservative influencer Charlie Kirk grabbed headlines,[16] while the administration pressed ahead with efforts to reshape the Federal Reserve and defend its trade policies. President Donald Trump asked a federal appeals court to pause a lower court decision blocking his attempt to oust Fed Governor Lisa Cook, signalling his push to fast-track the case to the Supreme Court.[17]

Meanwhile, Treasury Secretary Scott Bessent admitted the US may need to refund tens of billions in tariffs if the Supreme Court rules against the administration.[18] Two lower courts have already found that Trump exceeded his authority by using the 1977 International Emergency Economic Powers Act to impose sweeping tariffs on nearly every country. The Supreme Court has agreed to hear the case in November and the stakes are enormous: the US has collected US$158 billion in tariffs so far this year. Bessent warned if a ruling is delayed until June 2026, up to US$1 trillion could be at risk, creating severe budget and market disruption.

And yet the rally continues

Amid the chaos, investors may have been pleasantly surprised to see the risk-on rally continue. Month-to-date, government bond yield curves have bull-flattened, with the 30-year US Treasury down 25 basis points (bps), and both UK and French long bonds leading returns in Europe, falling 15bps and 12bps, respectively. In Turkey, the central bank cut policy rates more than expected to 40.5%, while its Finance Ministry sold US$2 billion of 10-year dollar bonds, attracting bids more than three times the offering.[19]

Credit spreads tightened across corporate markets, with US investment grade and EM high yield outperforming in total return terms. Demand continues to outpace net supply — EM hard currency and US high-yield inflows have reached roughly 0.9% and 0.62% of assets under management month-to-date.[20]

The US dollar has weakened broadly against major currencies, with the Japanese yen the exception. This likely reflects risk-on sentiment, highlighted by its main equity market, the Nikkei 225, rising nearly 5% and the Bloomberg World Large & Mid Cap Index rising over 2%.

For those of a rational mind, perhaps the only asset class that made total sense in such uncertain times was commodities, with gold and silver prices increasing over 5%.

Warning signs there for all to see

In outlining the triggers for a bear market, political uncertainty can have an instant impact if it is unexpected, often resulting in an event-driven selloff. Fortunately for market bulls, political developments have been well flagged and can largely be grouped into two categories: fiscal largesse and political parties prioritizing their own interests over the country or the global economy.

The longer-term effects of political uncertainty often play out through economic policy, market liquidity, profitability and growth — but for now, these variables remain supportive. Global financial conditions continue to ease, with the least line of resistance for central banks to cut rates despite political noise — as seen last week in Turkey — while fiscal support is firmly in place.

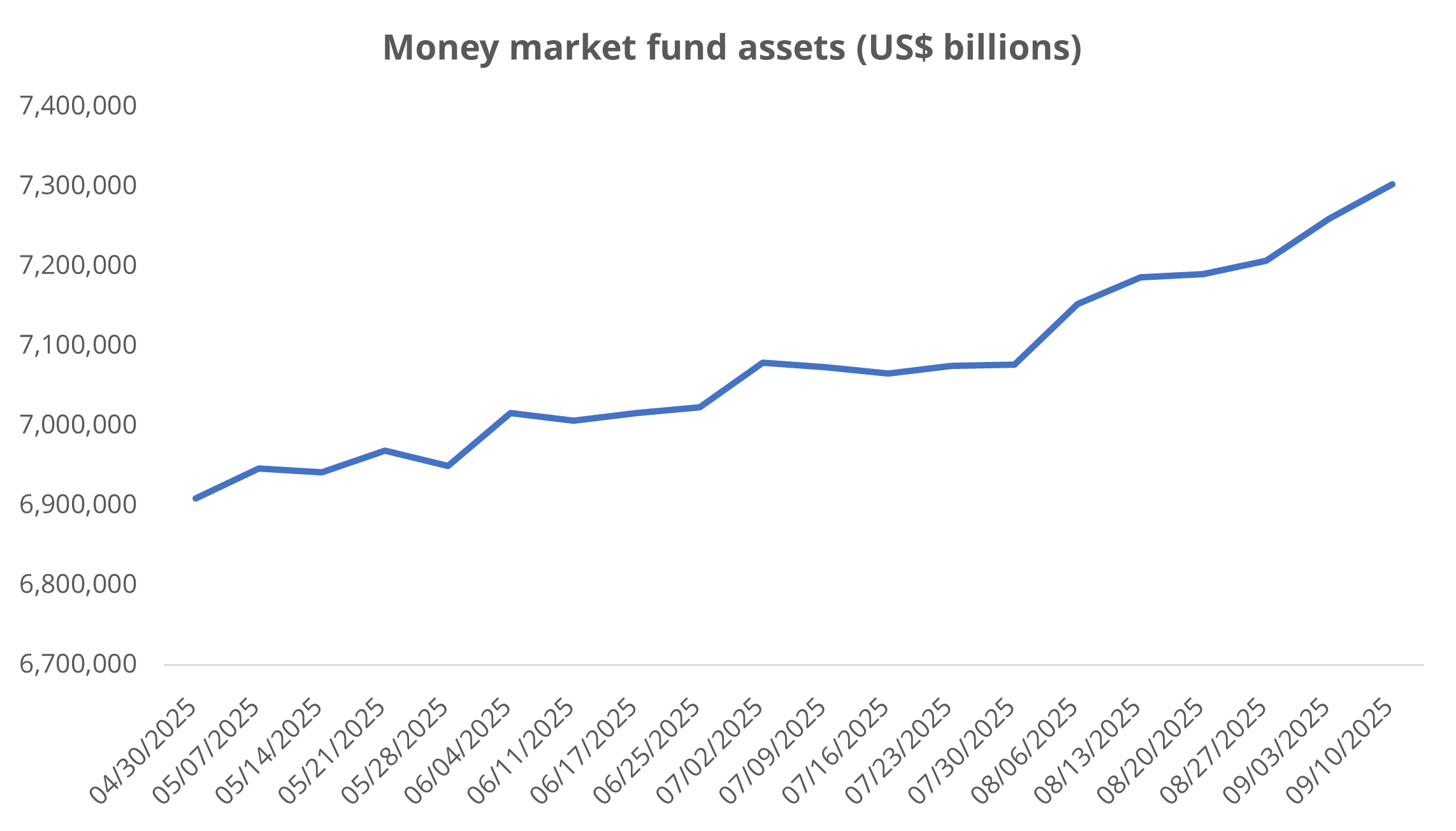

Global liquidity is abundant, with money market fund assets hitting a record high of US$7.3 trillion, perhaps evidence of investors waiting to buy on the dip (see ‘Chart of the Week’). Unsurprisingly, investors’ portfolios are in profit, supported by rate cuts, tight credit spreads, and the fact equity markets, digital currencies and precious metals have all hit new highs in recent months.

Corporate balance sheets and earnings remain solid, with projections moving higher. Using the S&P 500 as a benchmark, Q3 2025 earnings growth is now estimated at 7.5%, up from 7.2% at the start of the quarter. Estimated earnings for the index stand at US$590.4 billion, 0.3% above the earlier forecast of USS$588.7 billion.[21]

And ultimately, growth remains resilient, with most forecasts expecting an acceleration in Q4 as policy loosening takes effect, tariff risks ease and investment in artificial intelligence and related technologies continues to expand.[22]

Bull markets are climbing a wall of worry, but the cracks are always visible. In every cycle, the warning signs aren’t usually hidden, they’re ignored. The question is for how much longer.

Chart of the Week: Waiting to buy on the dip?

Source: Investment Company Institute. Money market fund assets, as of September 10, 2025. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References

[1] Prime Minister’s Office of Japan, ‘Press Conference by Prime Minister ISHIBA Shigeru,’ September 7, 2025

[2] Bloomberg, ‘Japan’s ruling party faces choice of wooing right or rebranding,’ September 9, 2025

[3] Reuters, ‘Exclusive: Respected Indonesian finance minister got an hour's notice of sacking, sources say,’ September 9, 2025

[4] Bloomberg, ‘Indonesia’s New Finance Chief May Recast Predecessor’s Budget,’ September 11, 2025

[5] Financial Times, ‘Donald Trump tells EU to hit China and India with 100% tariffs to pressure Vladimir Putin,’ September 9, 2025

[6] Mexico Business News, ‘Mexico’s 2026 Budget Aims at Deficit Cuts, Infrastructure,’ September 11, 2025

[7] France24, ‘Can Macron’s quiet power broker Sébastien Lecornu navigate France’s fractured politics as PM?’ September 10, 2025

[8] UK Government, ‘Letter from the Independent Adviser on Ministerial Standards & exchange of letters between the Prime Minister and Angela Rayner MP,’ September 5, 2025

[9] BBC, ‘Being US ambassador 'privilege of my life', Mandelson says, after being sacked over Epstein emails,’ September 11, 2025

[10] Institute for Government, ‘Seven things we learned from Keir Starmer’s first reshuffle,’ September 11, 2025

[11] Reuters, ‘Turkish court could oust opposition leader in deepening political crisis,’ September 12, 2025

[12] BBC, ‘US joins UN Security Council condemnation of Israeli strikes on Qatar,’ September 12, 2025

[13] NATO, ‘Statement by NATO Secretary General Mark Rutte on the violation of Polish airspace by Russian drones,’ September 10, 2025

[14] The Economist, ‘What Javier Milei's first defeat means for his future,’ September 11, 2025

[15] CNN, ‘Brazil’s former President Jair Bolsonaro convicted of plotting coup,’ September 11, 2025

[16] NBC News, ‘Suspect in Charlie Kirk's killing is identified by officials as Tyler Robinson,’ September 12, 2025

[17] Bloomberg, ‘Trump Bid to Ax Cook Before Fed Meets Hinges on Weekend Filings,’ September 11, 2025

[18] The Washington Times, ‘Treasury chief Bessent: U.S. would have to refund up to $1 trillion if it loses tariff case in June,’ September 9, 2025

[19] Bloomberg, ‘Investors snap up Turkey Eurobonds despite political unrest,’ September 10, 2025

[20] Standard Chartered, ‘EM flow dynamics,’ September 12, 2025

[21] Factset, Earnings Insight, September 5, 2025

[22] BNP Paribas, ‘Markets 360,’ September 12, 2025

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of September 15, 2025, and may change without notice. All data figures are from Bloomberg, as of September 9, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-09-12-16942