Insight | June 21, 2021

Aviation Finance: A Positive Outlook in a Post-COVID World

As the end of the global pandemic nears, we believe an interesting opportunity in aviation finance has arisen which could appeal to investors looking for attractive, stable returns uncorrelated to other asset classes

Aviation finance is an alternative asset class that focuses on the provision of capital to finance the purchase or lease of an aircraft. It is the asset class that has driven globalisation by connecting the world over the last 50 years. The industry is dominated by notable brands such as Cathay, British Airways, American Airlines, Virgin Atlantic, Boeing, Airbus, EasyJet and Ryanair – many of which have become household names.

Historically, aircraft financing has been a stable, income-generating asset class providing investors with potentially attractive returns on a risk-adjusted basis. It aims to provide downside protection for investors with its dual security of credit and assets. There are also sub-asset classes within aircraft finance that can provide very different risk/return profiles for investors. For example, in our view, the yield on senior secured aircraft investment in private markets appears attractive on a relative value basis to comparable investment grade bonds (although pricing has tightened after the global vaccine roll out and in anticipation of the global economic recovery).

Potential Opportunities within Aviation Investing

In a post-COVID world, we believe traditional sources of aircraft finance have limited availability. Capital markets appear only open to the largest names (typically the top 3-4 US airlines, and some investment grade lessors). The asset backed securities (ABS) market is starting to reopen for new issuance, but on a very selective basis. Banks, meanwhile, are only open for their core clients, or where there is local/regional motivation to provide support. Many banks are managing their existing exposures and supporting airlines and leasing companies through interest deferrals. This leaves a financing gap in the market that we believe can be filled by private lenders.

There are several ways of investing in aviation finance; via sale and leasebacks with top-tier airlines to enable them to generate liquidity and thus provide future increased fleet flexibility, debt financing for airlines and lessors with exposure to high-quality credits, and distressed assets in the secondary market including aircraft backed debt via the aircraft asset backed securities (ABS) market or other private channels.

Airlines and Lessors

Airlines are looking for liquidity due to the global air travel restrictions introduced in response to the COVID-19 pandemic. The 25 largest airlines that were able to access local banks/capital markets have drawn all accessible liquidity and national champion airlines have also already taken the offer of government support. ¹ We believe the remaining airlines are also looking to their existing funding sources for support, (i.e., rent deferrals and interest holidays).

Lessors meanwhile have had no support from governments and are squeezed between accepting rent deferrals from airlines and maintaining debt obligations to lenders. Those with liquidity and no investments in the last 2-3 years are able to invest and support airlines. Most are focused on managing exposures and seeking support from debt providers.

In our view, in this segment investors should focus on good credit fundamentals, historic profitability and strong liquidity and capitalisation (for instance, borrowers that were previously investment grade). These are usually airlines with dominant market positions, or those with explicit or implied government support. The focus should be on investments in core assets within an airline’s fleet, with an emphasis on aircraft types and vintages that are not likely to be at risk for retirement over the next few years. Older aircraft (refer to figure 2 below) have been slower to return to service or have been discontinued, meaning they are disproportionately affected in terms of current value. We focus on younger aircraft which we believe will see a quicker return to service, with a less negative impact on price. These are also the most fuel-efficient and are cost-effective for the industry.

Distressed Aircraft Backed Debt

Distressed aircraft backed debt includes opportunities in the aircraft ABS market or acquiring existing bank and lessor portfolios in private markets. In the case of aircraft ABS, this is when A-Tranche debt (the most senior ranking) is trading at a distressed level, which can imply a double-digit yield to maturity. ²

In the case of private markets, several banks and lessors have pulled back from aviation due to the pandemic and are looking to downsize or sell their aviation book. While we have started to see new players like Apollo, Blackstone and KKR enter this sector to take advantage of this dislocation, there is still an imbalance between demand and supply of capital.

Market Dislocation Creates Attractive Entry Point

When the pandemic hit the Western world in February 2020, we saw a dramatic fall in air-traffic demand. However, in our view, the repercussions of COVID-19 on aviation finance have created a once- in-a-lifetime opportunity, especially for new entrants looking to invest for the longer-term and players who have been underweight the sector. Recently, the oldest aviation lessor General Electric, sold its aviation leasing platform at 0.7 times NAV.³ As a comparison, transactions pre-pandemic were typically done between 1.25-1.5 times NAV, according to our estimates.

As air traffic demand is expected to improve and mirror the gradual growth in global GDP over the next few months, we believe that the long-term fundamentals of the industry continue to look attractive. Our positive outlook for the sector is underpinned by some of the following key themes.

Air Travel Demand is Recovering

Since early March 2021, air travel demand has shown signs of global recovery, led by North America and the Asia-Pacific region (dominated by domestic markets in China and India, with India again recovering from a recent dip in April-May due to a new virus variant). Europe continues to lag due to relatively high government enforced restrictions and because geographically there are no large domestic markets to stimulate demand.

It is the slower European recovery which is dominating the news flow. The vaccine roll out has picked up pace in several countries and is the clear ‘light at the end of the tunnel’ for the return of air travel. The uneven global vaccine roll out centred on the ‘wealthier’ nations also correlates to the larger air travel markets, suggesting the potential for a strong near-term recovery in passenger demand as vaccinated consumers are also the demographic with strong pent-up demand and a propensity to travel.

Fig.1 Regional Recovery of Air travel

Source: BofA Commercial Aerospace Tracker, as of June 15th, 2021.

Source: BofA Commercial Aerospace Tracker, as of June 15th, 2021.

The largest aviation markets are the most important to assess when analyzing the recovery. While historically North America was the largest market for air travel, in 2020 it was overtaken by China. ⁴ We have seen that China is now back to pre-COVID-19 levels of activity and aircraft usage and local airline flight numbers are recovering in the biggest domestic markets in Asia.

Meanwhile the US is close to 80% activity versus 2019, with some of the low-cost carriers currently providing more daily flights than in 2019.⁵

The continued global recovery, but especially the ‘domestic’ European markets and inter-continental travel, will rely on the reopening of borders which is primarily linked to the vaccine roll out. In our view, a successful European roll out would likely bolster further air travel demand globally.

Aircraft Types – Most Technologically Advanced, Young Aircraft Types Are Performing

Aircraft are very different when it comes to technology and useful life, with certain types of aircraft more affected by the pandemic than others. Fig. 2 gives a snapshot of the different Boeing and Airbus aircraft in circulation today.

Fig. 2 Aircraft in Global Circulation

Source: Muzinich views and opinions as of March 2021

Source: Muzinich views and opinions as of March 2021

The pandemic has affected certain aircraft types and vintages more than others. For example, older vintages and older technology types (those in red font) have been slower to return to service and are being retired or stored by airlines. As a result, these types of aircraft have been disproportionately impacted in terms of current value.

Conversely, the youngest, latest technology types which are fuel efficient (green font) and are expected to be used well into the next decade have mostly returned to service and their values are therefore less affected.

The impact on aircraft values should be a consideration for investors. Industry appraisers have generally determined that certain aircraft types have been more affected than others as a result of the pandemic, which is intuitive when we consider the usefulness of the underlying assets.

Furthermore, the supply of aircraft available to finance has been controlled as airlines have retired older fleets and the Original Equipment Manufacturers (OEMs) have reduced production rates on new types, which has supported the values of the newest technology and latest delivery aircraft types.

Airline Risk – A Clear Emergence of Winners and Losers

The airline sector has been hit hard by COVID-19, and the pandemic has created a divergence in airline credit quality. We believe a selection of airline groups will emerge as winners from the crisis due to their systemic market positions, strong government or shareholder support and access to various capital sources due to their historic credit quality.

Airlines have received global government support who, to date, have invested US$174 billion across various forms of funding.⁶ However, this funding has been limited to select jurisdictions and therefore to certain airline groups. For example, the US government provided their airline sector US$25bn, Germany €9bn solely to Lufthansa and the French and Dutch governments €13bn just to Air France/KLM.⁷

In our view what can be determined is that this US$174bn of funding has gone to airlines which are systemic and will likely come out of this crisis in a good position.

What about the rest? Currently, there are more than 500 airlines globally, 38 of which we believe are currently creditworthy and in a good position to emerge from this pandemic relative to their peers.⁸ The rest are looking to their shareholders or current funders for support to weather the recovery and we will have to wait and review them as and when the situation becomes clearer.

Aircraft Finance Market – Reduced Competition

We note there is currently a significant reduction in competition for deals across both the financing and leasing space. The traditional bank loan and aircraft lessor markets are largely closed, meaning the institutional capital market is the only active market open for investment grade debt issuance and mainly limited to North American airlines and leasing companies.

On the leasing front the market has dramatically shifted from having a high number of players with significant capital to deploy pre-pandemic to a reduced number of active players today.

There are more than 150 leasing companies. Pre-pandemic, we estimate there were over 75 lessors active in bidding on new sale and leaseback deals with airlines, as well as acquiring portfolios from other lessors in the secondary market. Today, we estimate this has reduced to 10-12 institutions. The others are managing their existing portfolio exposure on one side and managing liabilities on the other. We do not believe these parties will return to similar levels of activity during 2021 and 2022.

Fig. 3. Summary of Aircraft Leasing Community

Source: Cirium Fleets as of March 8th, 2021 and Muzinich views and opinions.

Source: Cirium Fleets as of March 8th, 2021 and Muzinich views and opinions.

As Fig. 3 highlights, the 18 lessors we believe are looking to trade assets can provide a strong origination channel for investors over the next 24 months. We believe these companies will be required to trade to manage their balance sheets and de-lever.

The 10 lessors with available capital have common features. They are either large lessors backed by Asian banks (and therefore low and available cost of funding) or lessors backed by institutions who have not invested heavily over the last 3-4 years and have available liquidity to deploy.

These 10 lessors also want to invest in similar deals to private investors (newer technology, stronger credits) but the total number in competition is significantly reduced from a year ago, and we believe the deal supply as outlined is sufficient. As a result of this reduction in competition, the prices at which transactions are being executed have become what we believe to be relatively attractive.

Private Markets are Lagging Recovery in Public Markets

Investors have a finite number of entry points to get exposure to aviation. In our view, private markets can offer compelling value when compared to public markets which have already recovered to pre-COVID-19 levels. Leasing companies and airline share prices, whilst not recovering as strongly as the wider market (using the S&P 500 Index as a reference), have recovered almost all their losses and in some cases even exceeded values of a year ago, which in our view indicates that a recovery of the sector is priced in.

Fig. 4 Performance of S&P 500 vs. S&P 500 Airlines and Listed Lessors

Source: Bloomberg from January 1st, 2020 to March 17th, 2021. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Aercap, Air Lease and BOC Air are the only three listed lessors. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Source: Bloomberg from January 1st, 2020 to March 17th, 2021. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. Aercap, Air Lease and BOC Air are the only three listed lessors. Index performance is for illustrative purposes only. You cannot invest directly in the index.

It is a similar story for public bond issuance in 2021 so far, with many leasing companies and airlines achieving what we believe to be ‘pre-COVID-19’ coupons.

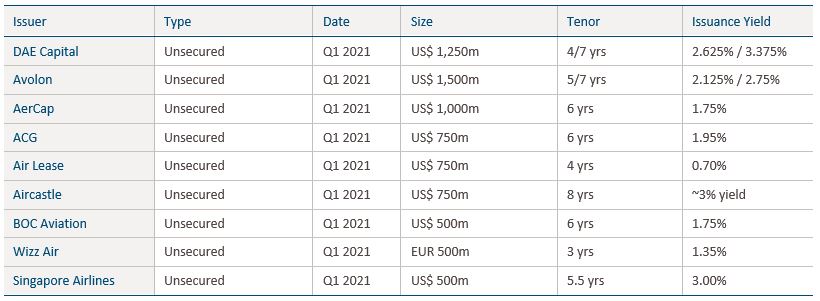

Fig. 5 Coupons Available from Lessors and Airlines

Source: Bloomberg data as of March 2021. Inclusive of all new Issue from lessors and airlines Q1 2021. Not to be construed as investment advice or an invitation to engage in any investment activity.

Source: Bloomberg data as of March 2021. Inclusive of all new Issue from lessors and airlines Q1 2021. Not to be construed as investment advice or an invitation to engage in any investment activity.

Public markets are only accessible to a select number of airlines and leasing companies, who are mainly North America based. Therefore, this is not a true reflection of the global aviation market. However, it does provide a reflection of current positive investor sentiment, in our view.

Because of limited capital supply, private markets are still significantly lagging public markets. This can be seen in limited bank lending and reduced lessor activity.

An example of this can be seen in the recent acquisition announcement by AerCap of the GECAS aircraft portfolio, composed of over 1000 aircraft at 0.70x net book value, or approximately US$31bn.⁹ GECAS was a ‘non-core’ part of the General Electric (GE) business and, whilst this was a motivation for GE to sell, we believe the price point is interesting. The Purchase Price indicates there is potential value by acquiring underlying assets and leases from lessors and airlines as it was approximately a 10% discount to the carrying value of the assets in GE’s books.

A Chance to Participate in the Global Recovery

As we emerge from global lockdowns and vaccination programmes kick in, air travel is once again likely to pick up. We have already witnessed a recovery in some markets and others are likely to follow over time. Yet the industry will continue to need financing to recover. Many traditional sources of aviation funding are now unavailable post-COVID with banks and capital markets restricted to working with a limited number of carriers or not at all. Meanwhile competition in the private finance community has significantly reduced and is likely to remain the case for the next couple of years. As a result, we believe the next 12-24 months provides investors a distinctive entry point into aircraft investing with a high degree of confidence and margin of safety to those investments. Risks remain however, and it is important for investors to focus on the highest quality assets least likely to retire, i.e., younger aircraft carriers, airlines with targeted government support and in certain jurisdictions. In our view, aviation finance offers investors opportunities with a dual security package comprising strong credit and assets with the latest technology, which we believe can generate robust, stable and uncorrelated returns to mainstream asset classes and other alternative investments.

1.Internal Muzinich review of 2020-2021 airline support packages

2.Distressed level defined when A Tranche Debt is trading at 90% of book value or lower

3.Source: Aercap Company announcements, BofA Research as of March 11th, 2021

4.Source: CAPA, April 2020. China becomes the largest Aviation Market in the world

5.Source: BofA Commercial Aerospace Tracker, as of April, 13th, 2021

6.IATA Economics, March 2021

7.IBID

8.Cirium Fleets as of March 8th, 2021

9.Source: Aercap Company announcements, BofA Research as of March 11th, 2021

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. This document has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice or as an offer to buy or sell or invitation to engage in any investment activity. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance results do not guarantee current or future performance. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document and are subject to change. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained in this document constitutes forward-looking statements; due to various risks and uncertainties, actual events may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained in this document may be relied upon as a guarantee, promise, assurance or a representation as to the future. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk. Issued in the European Union by Muzinich & Co. (Dublin) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland No. 625717. Registered address: 16 Fitzwilliam Street Upper, Dublin 2, D02Y221, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.

Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission. Muzinich & Co., Inc.’s being a registered investment adviser with the Securities Exchange Commission (SEC) in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.