Insight | January 25, 2022

European Private Debt – A Bright Outlook

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

Does a strong recovery in deal flow and the prospect of protection from rising interest rates reinforce the investment case for private debt? Co-Heads of Pan Europe Private Debt Kirsten Bode and Rafael Torres discuss.

A Hedge Against Rate Rises and Greater Public Markets Volatility

- Private debt aims to provide higher returns than those available in public debt markets.

- By investing almost exclusively in floating rate instruments, it may protect against the prospect of higher inflation and higher interest rates.

- Private debt seeks to take advantage of providing refuge against the increasing volatility of public markets.

Ongoing bank disintermediation and tighter regulations have resulted in private lenders becoming a fixed part of the lending landscape – a trend we believe is only likely to continue with the introduction of Basel III this month.

With the growth of the asset class has come an increased number of players in the market, yet the lower middle market (companies with €5M-€25M EBITDA) appears to be underserved from a lending perspective.

We believe this segment offers a vast opportunity set (over 100,000 companies in Europe) for lenders with the ability to do the due diligence and work in partnership with these smaller companies on their growth journey.

Strong Recovery in Deal Flow

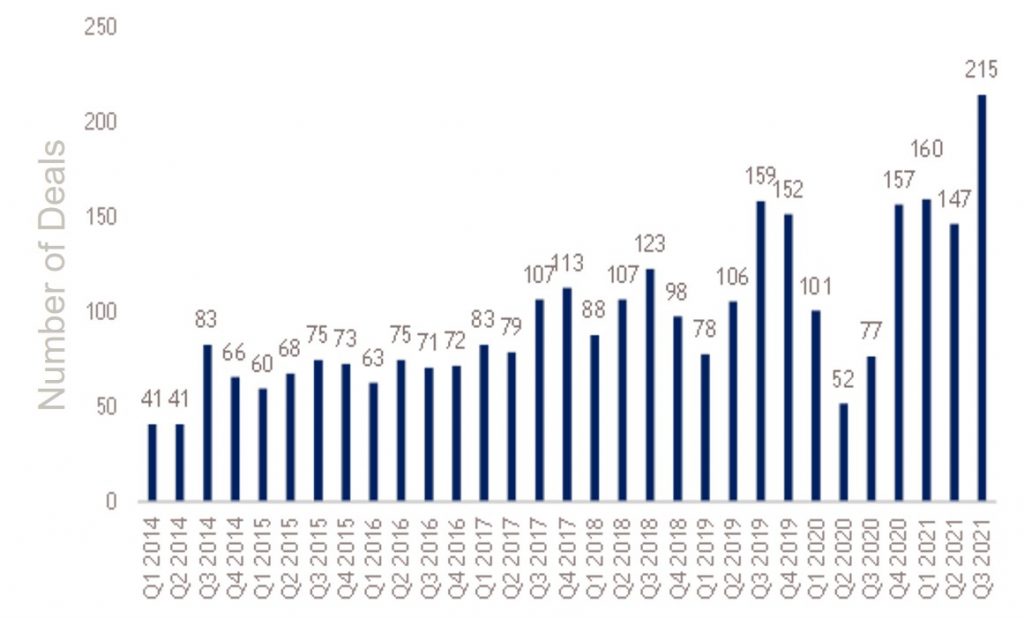

Like all asset classes, the global pandemic had an impact on the private lending market. However, as Fig 1 highlights, this trend has reversed dramatically, and we saw a notable rebound in lending in 2021 as companies began to recover from the economic impact of societal lockdowns.

Q3 2021 produced a record number of deals and the total number of deals for the year to end October has already surpassed 2019’s total.1 Therefore, in our view the asset class is likely to continue to recover strongly from the impact of pandemic.

Fig. 1 – Lending Deals Increasing Post Covid

Source: Deloitte Alternative Lender Deal Tracker Q3 2021, as of 9th December 2021. Latest information available used. For illustrative purposes only.

Source: Deloitte Alternative Lender Deal Tracker Q3 2021, as of 9th December 2021. Latest information available used. For illustrative purposes only.

Indeed, the alternative lending market has managed to adapt, and we have seen a flight-to-quality shift by lenders towards more Covid-19 resistant sectors such as healthcare, technology and pharmaceuticals.

This theme has been reflected in our own deal activity, in line with our strict focus on capital preservation. However, we have also sought out interesting opportunities in relatively niche sectors, such as petfood providers, which we believe have strong fundamentals and a very steady underlying growth trend.

Increased Market Share

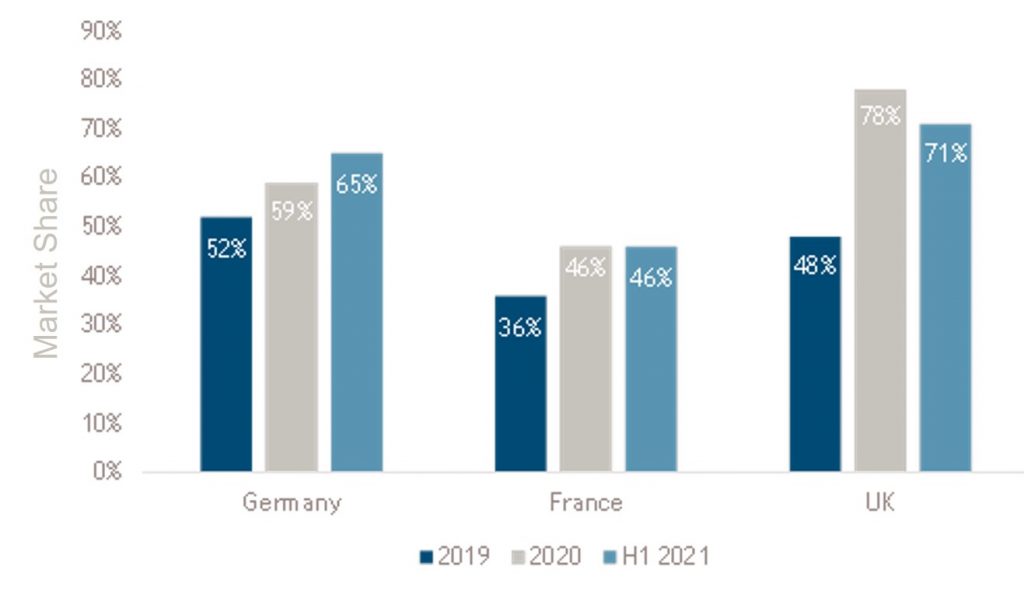

The alternative lending market has also managed to increase its market share as banks’ ability to lend was impacted by, amongst other reasons, their focus on processing government liquidity schemes during the pandemic (Fig. 2).

Fig. 2 European Direct Lending Share of Debt Funds (Senior/Unitranche vs. Banks)

Source: GCA Altium MidCapMonitor H1 2021, as of August 13th, 2021. Most recent data used. For illustrative purposes only.

Source: GCA Altium MidCapMonitor H1 2021, as of August 13th, 2021. Most recent data used. For illustrative purposes only.

Furthermore, the number of sponsored unitranche transactions continued to be strong in Q2 2021 (Fig. 3), with 95 unitranche transactions closing during the period. This marks a 121% increase versus Q2 2020, which was the first quarter to be impacted by Covid-19 (43 transactions).

The trend towards add-on acquisitions funded by debt funds also continued in Q2. This was driven by sponsors looking to create additional value through buy-and-build transactions and by strong debt fund appetite for such concepts (whereas banks have limited capacity for bolt-on acquisitions due to regulatory constraints). This data can help allay investor concerns around the ability of private lenders to deploy capital.

Fig. 3 - Sponsored Unitranche Hit New Highs

Source: GCA Altium MidCapMonitor Q2 2021, August 13th, 2021. European Unitranche Financings, (1) No. of deals per quarter. Latest data available. For illustrative purposes only.

Source: GCA Altium MidCapMonitor Q2 2021, August 13th, 2021. European Unitranche Financings, (1) No. of deals per quarter. Latest data available. For illustrative purposes only.

Looking ahead, we believe this strong deal flow trend is only likely to continue, given the improving economic backdrop and lower risks associated with the Covid-19 Omicron variant. In our own portfolios, we will continue to focus on companies within sectors that have managed to avoid the worst of the Covid fallout, or have suffered but have what we believe to be strong underlying fundamentals.

A Partnership Approach Offers Long-Term Benefits

As direct lenders, we work closely with our portfolio companies, and seek out companies interested in growth and expansion. We view ourselves as partners to their business and can customise our lending solutions to fit the specific needs of each borrower. We are also able to integrate ESG considerations, such as disclosures on regulatory compliance or governance, into the terms of the loan agreement. Such resilient relationships with our portfolio companies have already resulted in several repeat transactions, which is beneficial to us as lenders, the borrowers and ultimately our investors.

In addition, with company balance sheets being a mixture of conventional banking solutions and more short-term liquidity mechanics, we believe they will need to refinance to put their debt into a more long-term structure, and direct lenders may be the solution.

1. Muzinich & Co. views and opinions as of January 2022, and subject to change without notice.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of January 2022 and may change without notice.

----------------------------------------------------------------------------------------------------------------------------------

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Alternative investments can be speculative and are not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing and able to bear the high economic risks associated with such an investment. Investors should carefully review and consider potential risks before investing. Certain of these risks include: (a) Loss of all or a substantial portion of the investment;(b) Lack of liquidity in that there may be no secondary market for interests in the Fund and none is expected to develop in advance of an IPO; (c) Volatility of returns; (d) Restrictions on transferring interests; and (e) Potential lack of diversification and resulting higher risk due to concentration within one of more sectors, industries, countries or regions.

This material and the views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity; they are for information purposes only. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk

This discussion material contains forward-looking statements, which give current expectations of the Fund’s future activities and future performance. Further, no person undertakes any duty or obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Muzinich makes no representation or warranty (express or implied) with respect to the information contained herein (including, without limitations, information obtained from third parties) and expressly disclaims any and all liability based on or relating to the information contained in, or errors omissions from, these materials; or based on or relating to the recipient’s use (or the use by any of its affiliates or representatives or any other person) of these materials; or based on any other written or oral communications transmitted to the recipient or any of its affiliates or representatives in the course or its evaluation of Muzinich.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-01-119-7802