Insight | February 8, 2022

Emerging Markets Update - Inflation

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

Will developed market central banks follow their emerging market counterparts in combatting inflationary pressures?

Central banks continued to dominate capital markets and last week it was the turn of the European Central Bank (ECB) to communicate its hawkish stance, where there was “unanimous concern” from the governing council over inflation.1

ECB watchers brought forward the ending of the asset purchase programme to June and the rate lift-off to the fourth quarter of the year. 2 Not to be outdone, the Bank of England (BOE) raised rates 25bps with 4 out of the 9-member committee wanting to hike 50bps. 3

Understandability, European assets underperformed their US counterparts,4 with the exception being the Euro currency which appreciated 2.8% vs. the US dollar and pushed emerging market (EM) assets to become the best performers year to date.5

In EM, the Brazilian central bank monetary policy committee (Copom) hiked interest rates 150bps to 10% and communicated a reduced pace of hikes going forward, with consensus forecasters setting the terminal rate at 12% to be reached by the end of June 2022. 6 Meanwhile Vladimir Putin attempted to dial down political tensions before jetting off to the Winter Olympics, and Russia CDS closed 30bps tighter on the week. 7

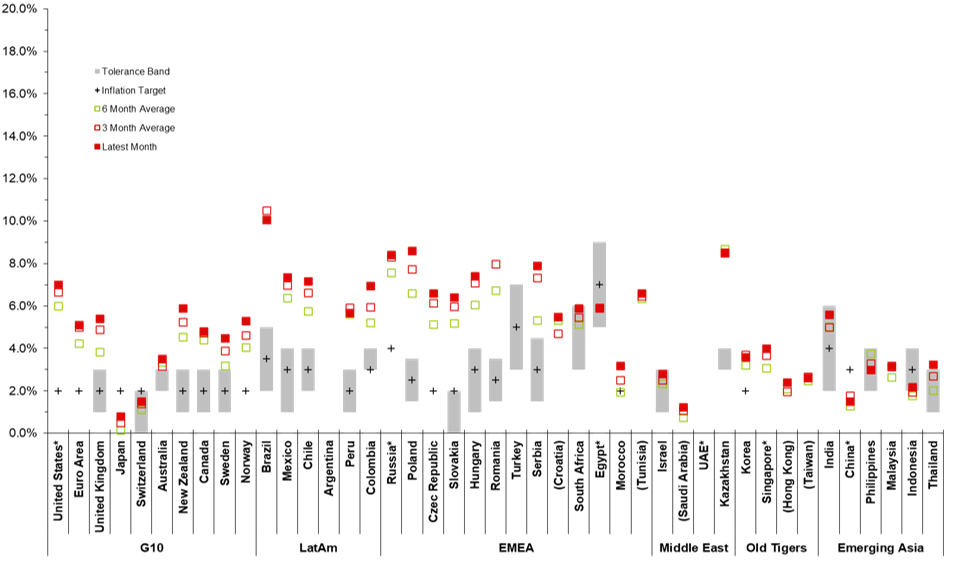

This week we dusted off our favourite EM inflation models (see chart). I confess that I never envisaged using it for G10 central banks but found the model very effective in predicting the direction and speed of EM central bank monetary policy cycles.

Inflation

Source: Bloomberg, Muzinich & Co. (aggregated monetary policy data from global central banks), as of 4th February 2022. *Indicates target from secondary source (i.e. not central bank data).

The preferred scenario for central banks is for inflation to be within its target range; in this regime they can do nothing, where “confidence” in controlling the economy is clear to be seen. Take Israel as an example. This may also explain why the South African tightening cycle has been so shallow.

Historically, a bad scenario for EM central banks is when inflation is above its target band, combined with the latest consumer price index (CPI) print (red box) being greater than the 3-month average (red outline box), which is greater than the 6-month moving average (green outline box).

This pattern can clearly be seen for the eurozone and UK. This pattern also questions the credibility of central banks to control inflation and kick start a hiking cycle. If we review the Brazilian CPI box plot, the latest reading is lower than the 3- and 6-month averages which are basically the same.

This is a good sign that the monetary tightening has effectively brought inflation into check and helps explain why the Copom has now signaled a slowing of its tightening cycle.8 The Copom is skilled at fighting inflation, something it has had to deal with for decades.

The question is, are developed market central bankers going to follow the short very aggressive approach of Brazil? In March 2021, the Selic rate was 2%, consensus for the Selic rate is now to peak 15-months later 10% higher. 9 Yet the cost is considerable. Economic growth is forecast to slow down with the consensus Bloomberg growth forecast for Brazil at 0.7% for 2022, well below economic potential of 3%. 10 Only time will tell.

---

1. European Central Bank, as of 3rd February 2022

2. Financial Times, as of 1st February 2022

3. Bank of England, as of 3rd February 2022

4. ICE BofA ML Euro High Yield Index (HE00), ICE BofA ML US Cash Pay High Yield (J0A0), ICE BofA ML Euro Corporate Index (ER00), ICE BofA ML US Corporate Index (C0A0), as of 4th February 2022

5. ICE BofA ML High Grade Emerging Markets Corporate Plus (EMIB), ICE BofA High Yield US Emerging Markets Liquid Corporate Plus Index (EMHY) as of 3rd February 2022

6. Trading Economics, as of 2nd February 2022

7. RUSSIA CDS USD SR 5Y Cbil Currency, as of 3rd February

8. Central Bank News, as of 2nd February 2022

9. Trading Economics, as of 2nd February 2022

10. Bloomberg Survey, as of 31st January 2022

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of October 2021 and may change without notice.

Index Descriptions

C0A0 - The ICE BofA ML US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have an investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

HE00 - The ICE BofA ML Euro High Yield Index tracks the performance of EUR dominated below investment grade corporate debt publicly issued in the euro domestic or eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of EUR 250 million.

J0A0 - The ICE BofA ML US Cash Pay High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt, currently in a coupon paying period that is publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $250 million.

ER00 – The ICE BofA ML Euro Corporate Index tracks the performance of EUR denominated investment grade corporate debt publicly issued in the eurobond or Euro member domestic markets. Qualifying securities must have an investment grade rating (based on an average of Moody’s, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one year remaining term to final maturity, a fixed coupon schedule and a minimum amount outstanding of EUR 250 million.

EMIB – The ICE BofA ML High Grade Emerging Markets Corporate Plus index is a subset of the ICE BofA ML Emerging Markets Corporate Plus Index (EMCB) including all securities rated AAA through BBB3, inclusive.

EMHY - The ICE BofA High Yield US Emerging Markets Liquid Corporate Plus Index is a subset of The ICE BofA US Emerging Markets Liquid Corporate Plus Index including all securities rated BB1 or lower. The ICE BofA US Emerging Markets Liquid Corporate Plus Index tracks the performance of U.S. dollar denominated emerging markets non-sovereign debt publicly issued in the major domestic and eurobond markets.

You cannot invest directly in an index, which also does not take into account trading commissions or costs. The volatility of indices may be materially different from the volatility performance of an account.

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Alternative investments can be speculative and are not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing and able to bear the high economic risks associated with such an investment. Investors should carefully review and consider potential risks before investing. Certain of these risks include: (a) Loss of all or a substantial portion of the investment;(b) Lack of liquidity in that there may be no secondary market for interests in the Fund and none is expected to develop in advance of an IPO; (c) Volatility of returns; (d) Restrictions on transferring interests; and (e) Potential lack of diversification and resulting higher risk due to concentration within one of more sectors, industries, countries or regions.

This material and the views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity; they are for information purposes only. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk

This discussion material contains forward-looking statements, which give current expectations of the Fund’s future activities and future performance. Further, no person undertakes any duty or obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Muzinich makes no representation or warranty (express or implied) with respect to the information contained herein (including, without limitations, information obtained from third parties) and expressly disclaims any and all liability based on or relating to the information contained in, or errors omissions from, these materials; or based on or relating to the recipient’s use (or the use by any of its affiliates or representatives or any other person) of these materials; or based on any other written or oral communications transmitted to the recipient or any of its affiliates or representatives in the course or its evaluation of Muzinich.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-01-31-7921