Insight | February 18, 2022

Asia Credit – Bounding into the Year of the Tiger

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

The recent relaxation of Chinese property sector regulations, a lack of inflationary pressure, stronger external positions vs. the 2013 Taper Tantrum, and a focus on renewables, contribute to potential opportunities for investors within Asia credit.

Asia credit markets suffered a turbulent year in 2021, mainly driven by restrictive Chinese policy measures affecting many sectors including tech, education services, gaming, and finally, the property sector.

Chinese policymakers announced two policy priorities at the December Central Economic Work Conference (CEWC): stabilizing the property sector and stimulating economic growth.

They also highlighted little appetite for any growth hampering policies. Consequently, we think restrictive policy measures are peaking, and for the property sector, easing. We believe that more property market friendly policies in China have led to a recent turning point for investor confidence in the Chinese property sector.

Furthermore, in our view, the comparatively muted effects of global inflation on Asian markets, and renewable energy from India also warrant a closer look at the asset class.

As we move into the Year of the Tiger, which symbolizes strength, we believe Asian credit could offer investors an interesting opportunity in an asset class that is underpinned by largely strong credit ratings.

Property Sector Policies in China Are Easing

We are currently at an important turning point for confidence in the Chinese property sector, which we believe will have far reaching effects on the rest of the Asian credit market. With China focused on stabilizing the property sector and stimulating economic growth in 2022, we believe policy shocks, such as those as we saw in 2021, have peaked.

China’s property sector has been one of the driving forces of the country’s economic growth for some time, with housing activity accounting for c. 29% of GDP.1

Over the last several years, the government has been increasing policy restrictions; tightening liquidity and curbing demand to prevent price bubbles and to protect end-buyers.

Policies to limit banks’ exposure were implemented to “de-risk” the system and to prevent the sector from overheating. However, these credit restrictions only further eroded confidence in the sector, which had already suffered some high-profile failures.

With a bid to address a loss of confidence in the property sector, the People’s Bank of China (PBOC) eased the reserve requirement ratio twice in H2 2021. Furthermore, in January 2022, the PBOC cut the 5-year lending rate—the rate used as a benchmark for mortgages.

The bar for the PBOC to cut interest rates is generally high; the signaling effect from this cut cannot be denied. In January and February 2022, policymakers also announced they were lifting restrictions on usage of cash locked up in escrow accounts, further releasing liquidity into the cash-strapped sector.

As major cities across China start to cut mortgage rates, it should support and work in tandem with the escrow account review.

After five years of a policy focused on reducing macro leverage, regulators believe they have achieved their goal and believe it is now a good time to ease monetary policy and stabilize the housing sector.

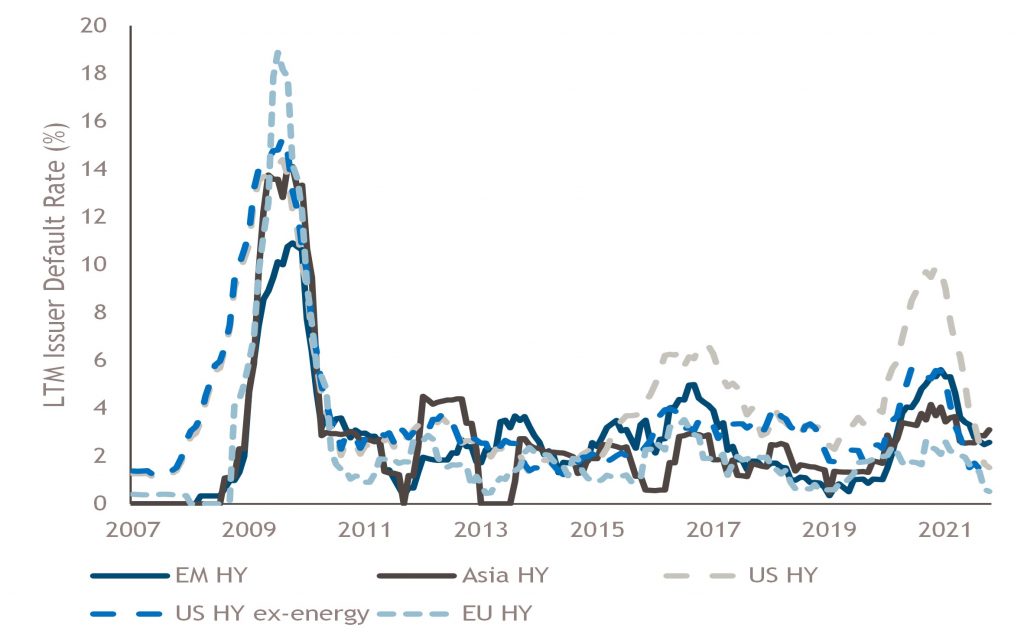

What about default risk? We do not expect the same high level of defaults (Fig. 1) this year as we saw in 2021 (c. US$60bn)2, although we are likely to see defaults from small marginal players and from a few medium-sized issuers that were already fairly stretched.

From an investment perspective, we believe property bonds have largely discounted the negative news and now appear at an attractive entry point. We also believe we have reached the bottom of the policy restrictions and it is unlikely we will see further pressure on the sector.

Fig.1 – Lower Default Rate

Source: Bank of America Merrill Lynch, Monthly Emerging Market Corporate Chart Book. Data as of December 31st, 2021. For illustrative purposes only.

Source: Bank of America Merrill Lynch, Monthly Emerging Market Corporate Chart Book. Data as of December 31st, 2021. For illustrative purposes only.

Inflation Less of a Concern

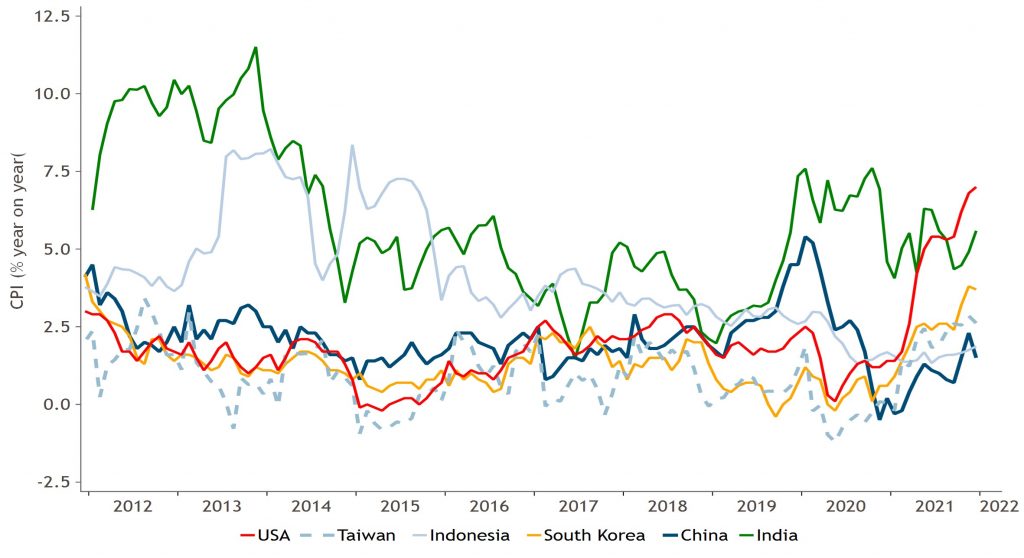

Developed markets are currently struggling with increasing inflationary pressure but we are not seeing similar large inflation overshoots across Asia – it appears the US inflation is being domestically fueled (Fig. 2). We believe there is a limited risk of a repeat of the 2013 Taper Tantrum.

Fig.2 – Inflation

Source: Macrobond, as of January 17th, 2022. For illustrative purposes only. Data based on Consumer Price Indices, YOY

Source: Macrobond, as of January 17th, 2022. For illustrative purposes only. Data based on Consumer Price Indices, YOY

While we expect Asian central banks to be hiking with the Fed—this is, in our view, driven by a desire to maintain credibility (i.e., keep currencies stable), rather than a need to combat inflation. The only region diverging from the Fed is China, which is easing.

However, the PBOC have stated that they are looking to be creative with their entire monetary policy toolkit and we expect to see easing through other forms (e.g., escrow account loosening which releases liquidity into the system without cutting interest rates).

Thailand is on hold at the time of the writing of this paper and South Korea had already moved ahead of the Fed for financial stability reasons.

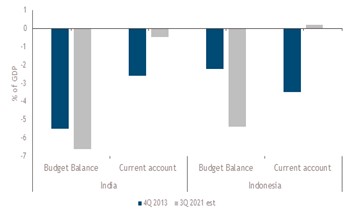

The most watched countries currently are India and Indonesia, whose external positions have significantly strengthened vs. 2013 with higher foreign exchange reserves and much smaller current account deficits.

In our view, Asian credit markets are driven more by unexpected macro shocks or an unexpected pace of Fed hiking. Furthermore, we see most interest rate hikes already priced into the market. We believe Asian sovereign balance sheets are in much better shape than they have been for some time.

External positions are much stronger, despite governments having had to use their budgets for support during the COVID-19 pandemic. Reserves and current accounts are healthier (Fig. 3), and there are stricter rules around dollar borrowing.

Fig.3 – Current Accounts are Improving

Source: Bloomberg, as of September 30th, 2021. Most recent data available used. For illustrative purposes only

Source: Bloomberg, as of September 30th, 2021. Most recent data available used. For illustrative purposes only

While we are witnessing a gradual tightening of financial conditions across Asia, inflation is within expectations, reducing the risk of a sell-off as occurred with the Taper Tantrum of 2013.

Opportunities in Indian Renewables

Among the many sectors and countries to choose from in Asia, we see interesting opportunities in Indian credit markets. In 2020/2021 India faced a potential sovereign downgrade and the prospect of losing its investment grade rating, which hung ominously over its head.

However, the country managed the incredible challenge of vaccinating an enormous population and acted fast to stimulate the economy, so it is now enjoying a robust recovery and the prospect of a downgrade has faded.

This backdrop is also benefiting corporates where we are seeing very strong earnings.

Despite the flight-to-quality price action as investors fled China and sought India as an alternative, sending prices higher, we believe India continues to offer diversification benefits and we still see undervalued opportunities that have positive growth catalysts. Refinancing pressure is also limited. We believe short dated high yield credit, especially in the renewable energy sector (which has a strong ESG bid) is the “sweet spot” for carry.

The Indian renewable energy sector is growing, and due to aggressive government targets to decrease the country’s reliance on fossil fuels, is likely to benefit from significant growth and development over the next decade.

Risk: Diversification does not assure a profit or protect against loss.

A Strong Outlook

While the global pandemic is far from over, we have already seen a strong rebound in many Asian economies. Countries with huge populations, such as India, have dealt remarkably well with their vaccination programs.

While many still have a long way to go in terms of vaccinating their populations, overall, we believe Asian economies are recovering well from the pandemic and this is likely to continue. At the same time, Asian credit spreads are wide relative to other markets and follow a narrative that remains somewhat uncorrelated with developed market inflationary concerns; we believe countries in Asia are therefore unlikely to undertake aggressive rate hikes to cool overheated economies.

There is also value to be found in certain segments of the market, such as Chinese property, where we believe there are many strong, stable credits that have been hurt by contagion but whose underlying fundamentals remain solid and are likely to benefit from policy changes. Meanwhile, some sectors and countries are benefiting from larger global trends such as concerns around climate change, which is likely to drive up investment in renewable energy.

While risks such as COVID-19 variants and geopolitical tensions warrant monitoring, our outlook for Asian credit markets is in keeping with the strength symbolized by the Year of the Tiger.

1. “The Size of China’s Real Estate Sector”, Kenneth Rogoff and Yuanchen Yang, Harvard, December 21st, 2021

2.Standard Chartered Global Research report ‘Looking into the Eye of the Tiger’ published January 4th, 2022.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of February 2022 and may change without notice.

Index Descriptions

ADOL -The ICE BofA Asian Dollar Index tracks the performance of U.S. dollar denominated sovereign, quasi-government, corporate, securitized and collateralized debt publicly issued in the U.S. domestic and eurobond markets by Asian issuers.

ADHY - ICE BofA Asian Dollar High Yield Index tracks the performance of sub-investment grade U.S. dollar denominated sovereign, quasi-government, corporate, securitized and collateralized debt publicly issued in the U.S. domestic and eurobond markets by Asian issuers.

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Alternative investments can be speculative and are not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing and able to bear the high economic risks associated with such an investment. Investors should carefully review and consider potential risks before investing. Certain of these risks include: (a) Loss of all or a substantial portion of the investment;(b) Lack of liquidity in that there may be no secondary market for interests in the Fund and none is expected to develop in advance of an IPO; (c) Volatility of returns; (d) Restrictions on transferring interests; and (e) Potential lack of diversification and resulting higher risk due to concentration within one of more sectors, industries, countries or regions.

This material and the views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity; they are for information purposes only. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk

This discussion material contains forward-looking statements, which give current expectations of the Fund’s future activities and future performance. Further, no person undertakes any duty or obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Muzinich makes no representation or warranty (express or implied) with respect to the information contained herein (including, without limitations, information obtained from third parties) and expressly disclaims any and all liability based on or relating to the information contained in, or errors omissions from, these materials; or based on or relating to the recipient’s use (or the use by any of its affiliates or representatives or any other person) of these materials; or based on any other written or oral communications transmitted to the recipient or any of its affiliates or representatives in the course or its evaluation of Muzinich.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-02-17-8052