Insight | March 14, 2022

Value In Credit?

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

At the end of last year, we wrote that markets were in a speculative phase (please click here). With the tragedy unfolding in Ukraine and persistent concerns about inflation, fear has now started to replace greed in markets, which may create interesting opportunities for long term investors. It is very difficult to time markets, but we believe a focus on fundamentals during periods of volatility helps provide a framework for good decision making.

Yields

Global credit markets have repriced significantly this year. In the US, the yield investors earn for lending to high yield companies has moved from 4.2% at the start of the year to about 6.1% today.1 In Europe, yields have moved from 2.9% to approximately 4.6% in Euros. 2

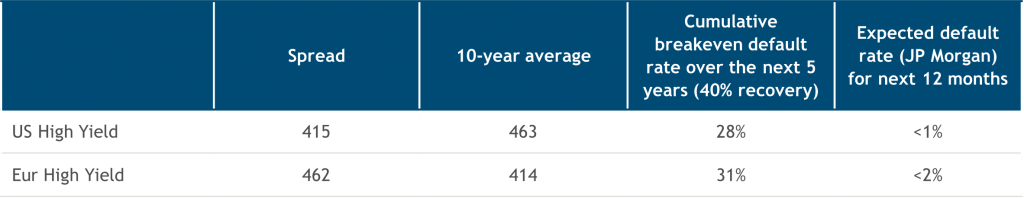

While earlier in the year most of the increase in yields was due to rising interest rates, spreads have now also significantly widened. In the US spreads are currently 415 vs 322bps at the start of the year.1 In Europe, the spreads are 462 bps compared to 341bps at the start of the year.2 Spreads in Europe are now wide of their 10-year average (414bps),2 while spreads in the US are currently inside the 10-year average (463bps).1

Spread levels allow a calculation for how high default rates have to be for investors to lose money. Currently European and US spreads imply cumulated default par value rates of 31% and 28%, respectively, over the next five years, assuming a 40% recovery rate. These five-year levels of cumulated defaults have not been seen over the last 15 years, even during the Great Financial Crisis; so, we believe investors are now beginning to have a margin of safety.

To further put this in perspective, as of March 2022, JP Morgan was expecting US default rates to be less than 0.75% and European default rates to be less than 2% for the next 12 months because of strong fundamentals. Will the situation in Ukraine effect default rates? US and European high yield markets have little direct exposure to Russia/Ukraine from a revenue perspective – in the US, virtually no companies in the high yield universe have meaningful exposure to Russia/Ukraine, and in Europe, corporates directly exposed to Russia/Ukraine are less than 1% of the universe; so, any effect on defaults would be indirect, such as from exposure to higher energy or commodity prices. It is difficult to imagine that such indirect exposure to Russia/Ukraine will cause defaults to spike to levels above the break-even calculation.

Fig. 1 – Yields Have Increased to Levels Implying Higher Future Default Rates*

Source: *ICE Index Platform, as of March 11, 2022. US High Yield: J0A0 and European High Yield: HEC0. **JP Morgan Default Monitor, as of March 1, 2022 and JP Morgan High Yield Talking Points, as of March 3, 2022. For illustrative purposes only.

Source: *ICE Index Platform, as of March 11, 2022. US High Yield: J0A0 and European High Yield: HEC0. **JP Morgan Default Monitor, as of March 1, 2022 and JP Morgan High Yield Talking Points, as of March 3, 2022. For illustrative purposes only.

Fundamentals

Generally, companies on both continents entered the year with strong balance sheets and sound liquidity profiles. Coming out of the 2020 Covid liquidity scare, companies pushed out maturities, so the need to refinance over the next couple of years is generally low.

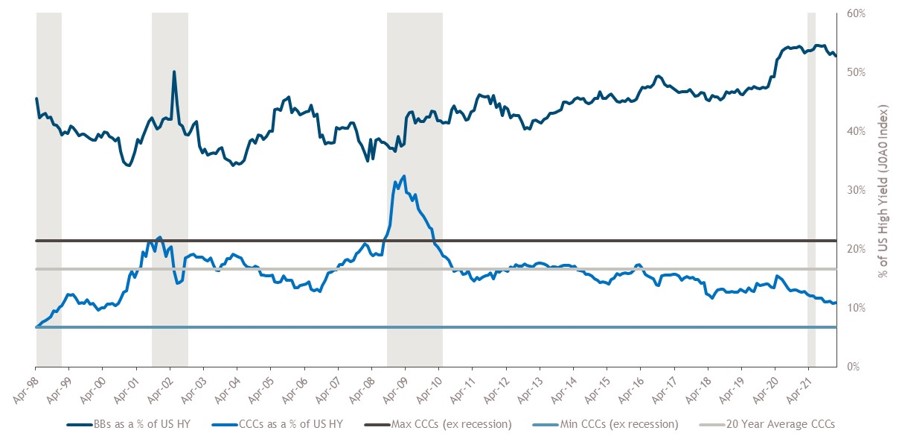

This is important because an inability to refinance is a key driver of defaults. In the US, only 4% of high-yield bonds need to be refinanced in the next two years.1 In addition, the quality of companies in the HY market have generally improved over the last few years, as illustrated in Fig. 2. In the US, 53% of the market is rated BB and 10% CCC. In Europe, 73% of the market is rated BB and 5% CCC.2

Fig. 2 – High Yield Ratings Migration is the Strongest in Twenty Years

Source: ICE Index Platform, as of January 31st, 2022. ICE BofA US Cash Pay High Yield Index (J0A0), ICE BofA CCC and Lower US Cash Pay High Yield Index (J0A3) and ICE BofA BB US Cash Pay High Yield Index (J0A1). For illustrative purposes only. Chart shows the face value of the J0A1 and J0A3 as a % of the face value of the J0A0, going back monthly for the past 20 years. Shaded areas represent recession periods. Indices selected as best available proxy to measure relative breakdown of rated bonds

Source: ICE Index Platform, as of January 31st, 2022. ICE BofA US Cash Pay High Yield Index (J0A0), ICE BofA CCC and Lower US Cash Pay High Yield Index (J0A3) and ICE BofA BB US Cash Pay High Yield Index (J0A1). For illustrative purposes only. Chart shows the face value of the J0A1 and J0A3 as a % of the face value of the J0A0, going back monthly for the past 20 years. Shaded areas represent recession periods. Indices selected as best available proxy to measure relative breakdown of rated bonds

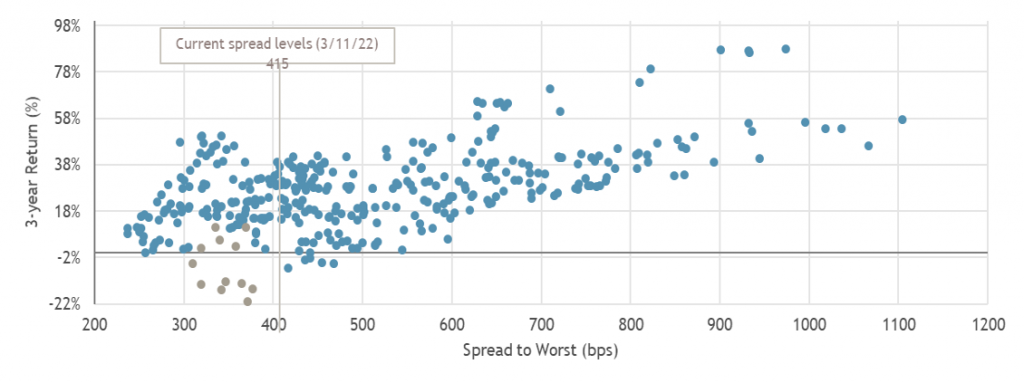

We do not try to predict how markets will evolve in the very short term, and geopolitics could certainly cause more volatility. But over time, the return for investors in corporate credit is driven by whether the coupon being earned outweighs the cost of defaults. As seen in Figure 3, when spreads have historically reached current levels, the vast majority of forward 3-year returns have been positive.

Aligned with this, we note that since the inception of Muzinich’s US high yield strategy composite in January 1991, Muzinich has delivered positive net results in 99.7% of the rolling five-year periods, measured monthly, regardless of spread conditions when the investment was made. Similarly, since June 1, 2000, our European high yield strategy has delivered positive net results 99.0% of the time. We believe bond math is starting to work in investors’ favour, creating opportunity for those that have a longer-term investment horizon.

Fig. 3 – Historically, Long-Term High Yield Investors Have Been Rewarded at Current Spread Levels

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Source: Muzinich analysis. Data as of March 11, 2022. For illustrative purposes only. Date range of data is September 30, 1988, to March 11, 2022. Returns are the cumulative 3-year returns for the ICE BofA ML US HY Cash Pay Index (J0A0). Spread-to-Worst of J0A0 index. Gray dots represent the period 7/31/2005 – 6/30/2006, leading up to the Great Financial Crisis. Strategies can lose money and will be impacted by market conditions

1.ICE Index Platform ICE BofA ML US Cash Pay High Yield “J0A0” Index, March 11, 2022

2.ICE Index Platform ICE BofA ML Euro High Yield Constrained “HEC0” Index, March 11, 2022

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of October 2021 and may change without notice.

Index Descriptions

J0A0 – The ICE BofA ML US Cash Pay High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt.

J0A1 – The ICE BofA ML BB US Cash Pay High Yield Index is a subset of the ICE BofA ML US Cash Pay High Yield Index (J0A0) including all securities rated BB1 through BB3, inclusive.

J0A3 – The ICE BofA ML CCC & Lower US Cash Pay High Yield Index is a subset of the ICE BofA ML US Cash Pay High Yield Index (J0A0) including all securities rated CCC1 or lower

HEC0 – The ICE BofA ML Euro High Yield Constrained Index contains all securities in the ICE BofA ML Euro High Yield Index (HE00) which tracks the performance of EUR denominated below investment grade corporate debt publicly issued in the euro domestic or Eurobond market, but caps issuer exposure at 3%.

Risk: Index performance mentioned in this material is for illustrative purposes only. You cannot invest directly in the index.

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Alternative investments can be speculative and are not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing and able to bear the high economic risks associated with such an investment. Investors should carefully review and consider potential risks before investing. Certain of these risks include: (a) Loss of all or a substantial portion of the investment;(b) Lack of liquidity in that there may be no secondary market for interests in the Fund and none is expected to develop in advance of an IPO; (c) Volatility of returns; (d) Restrictions on transferring interests; and (e) Potential lack of diversification and resulting higher risk due to concentration within one of more sectors, industries, countries or regions.

This material and the views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity; they are for information purposes only. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk

This discussion material contains forward-looking statements, which give current expectations of the Fund’s future activities and future performance. Further, no person undertakes any duty or obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Muzinich makes no representation or warranty (express or implied) with respect to the information contained herein (including, without limitations, information obtained from third parties) and expressly disclaims any and all liability based on or relating to the information contained in, or errors omissions from, these materials; or based on or relating to the recipient’s use (or the use by any of its affiliates or representatives or any other person) of these materials; or based on any other written or oral communications transmitted to the recipient or any of its affiliates or representatives in the course or its evaluation of Muzinich.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-03-14-8211