Insight | May 13, 2022

Parallel Lending Investment Strategy; A Primer

Contents

1.Bank Deleveraging: Parallel Lending vs Alternative Lending

2.The Parallel Lending Market Size in the European Union

3.High Diversification and Granularity: Portfolio Resilience

4.Portfolio Credit Rating and the Wise Use of Leverage

5.Investment Tools: From Basel III Advanced Models to AI/Deep Learning Models (FinTech Innovation)

6.The Credit Fund Market Evolution

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

Bank Deleveraging: Parallel Lending vs Alternative Lending

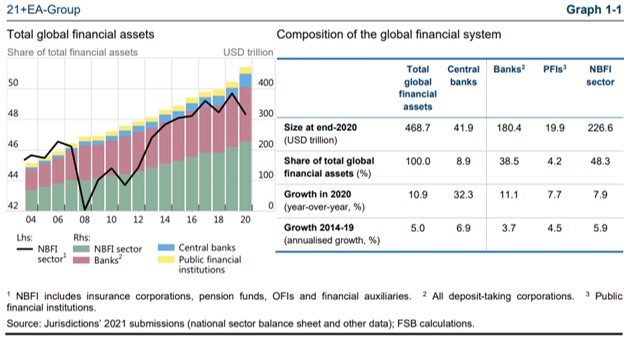

The growth of non-bank financial intermediation (“NBFI”) is a clear worldwide trend over the last 15 years. According to the Financial Stability Board (“FSB”), today the NBFI sector accounts for USD 226.6T (or 48.3% of global financial assets), more than bank financial assets of USD 180.4T (or 38.5% of global financial assets). Please see fig.1.

Fig. 1 - NBFI assets increased in absolute terms, but decreased as a share of total global financial assets

Source: Financial Stability Board – Non-Bank Financial Intermediation Report, December 2021

Source: Financial Stability Board – Non-Bank Financial Intermediation Report, December 2021

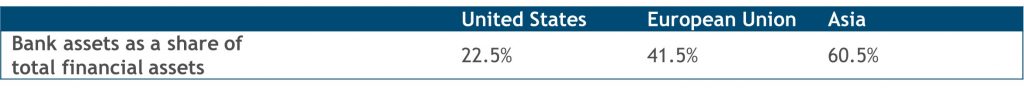

Its worth noting that the banking system’s share of global financial assets is materially different in the 3 main Economic Areas (US, EU and Asia).

Fig. 2 - Elaboration on the FSB dataset

Source: Muzinich, as of May 2022. For illustrative purposes only.

Source: Muzinich, as of May 2022. For illustrative purposes only.

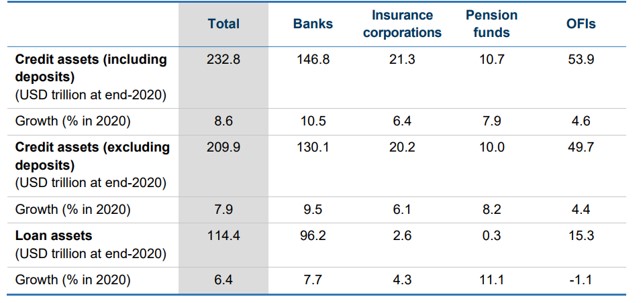

However, regardless of the region, the banking system still dominates worldwide credit assets. For instance, global loan assets amounted to USD 114.4T at the end of 2020, out of which banks represent USD 96.2T (84%) while NBFI’s loan assets amount to USD 18.2T (16%). Please see fig.3 below.

Fig. 3 – Credit Asset Composition and Growth in 2020, 21+EA-Group

Source: Financial Stability Board report. Non-Bank Financial Intermediation Report, December 2021. For illustrative purposes only.

Source: Financial Stability Board report. Non-Bank Financial Intermediation Report, December 2021. For illustrative purposes only.

As you can see in fig. 3, within the NBFI, the asset managers (also known in the FSB terminology as “other financial institutions” or “OFIs”) account (on behalf of their investors) for USD 15.3T of loan assets or 13% of global loan assets).

A bank’s lending decisions are driven by Basel Regulation (i.e., net return on Risk Weighted Assets (RWA) and internal credit rating models) and customer all-in profitability1. As a consequence, banks generally do not invest in loans with long bullet maturities or subordinated/junior components. Rather, banks try to reduce their investments in plain vanilla term loans in order to decrease assets with a high risk weighting in their financial statements.

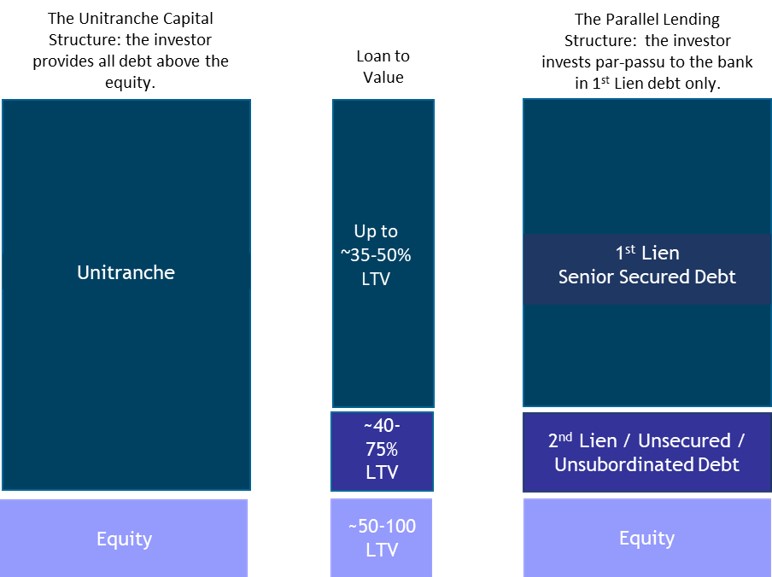

Because of this bank deleveraging, in the last 15 years asset managers have successfully launched alternative lending strategies which serve companies with tailor-made financing structures (e.g.: unitranche, mezzanine, junior debt) that banks are not able to structure and do not have in their books. Within these approaches, asset managers are the sole and main lender. The term “alternative” means a financing structure that is alternative to that of the banking system.

In the last few years, the asset management industry has developed a new private debt investment strategy: asset managers lend to companies alongside—and even pari-passu with—banks. The underlying assets are plain vanilla loans (e.g.: first liens, club loans), with the bank remaining co-invested up to the end of the term loan. This co-investment approach is named “parallel lending.” It can be beneficial for banks in any of the countries subject to the Basel Regulations, including, but not limited to, any bank in the European Union

This parallel lending business model is not only different from unitranche/junior lending, but also from the syndicated bank loan market. The syndicated loan market typically serves large companies, and banks maintain little or no exposure to a borrower, following an “originate-to-distribute” approach. By contrast, while parallel lending can and is used to finance large companies, many participants are focused on small and medium enterprises or “SMEs” defined within the European banking regulation as a company having no more than 3,000 employees. Further, the bank retains a meaningful share of the loan, and therefore has “skin in the game” and is more aligned with the asset manager.

Parallel lending is appealing to banks because under Basel Regulations, banks can optimize their Net Return/RWA ratios by sharing plain vanilla term loans with asset managers who lend under the same loan agreement as the bank (i.e.: same terms, collateral package, and covenants).

This sharing between banks and asset managers creates a win-win relationship because:

1. the bank continues to serve the client by providing profitable ancillary business (e.g., credit cards), while reducing their exposure to high-RWA financing;

2. the bank may reduce its counterparty exposure and invest the capital relief from asset sharing in new profitable business;

3. the asset manager may rely on the bank’s distribution network and on a very high number of sourced transactions. The asset manager may cherry pick and build, in a very short period of time, well-diversified and granular portfolios; and

4. even if the due diligence process of the asset manager is fully independent from the bank credit assessment, the bank remains co-invested and potentially able to provide to the company revolving credit facilities or other short-term financial support in case of a temporary stress.

The current parallel lending global potential market amounts to USD 96.2T (Fig. 3, above).

The Parallel Lending Market Size in the European Union

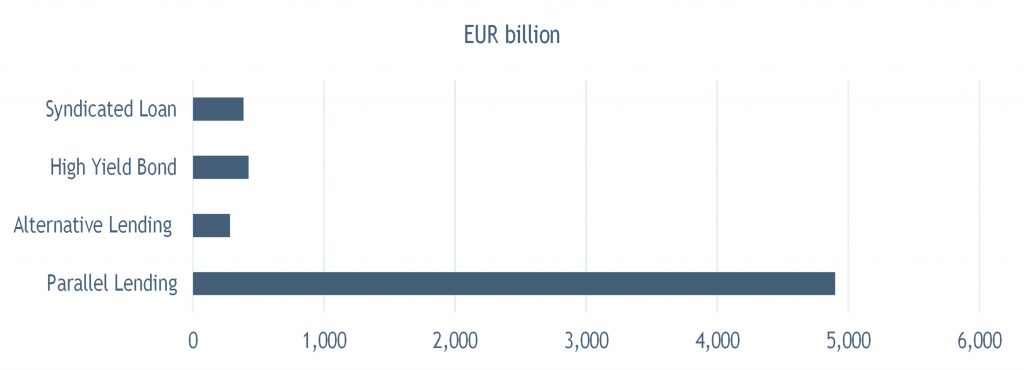

In the European Union, parallel lending’s potential market size can be estimated using loan data issued by the European Central Bank (“ECB”). The amount of loans to European non-financial corporates is EUR 4.9T, as of January 2022 (source: ECB: Statistical Data Warehouse). The EU bank loan market more than doubled over the last 20+ years (from EUR 2.3T in 1998 to EUR 4.9T in 2021).

As the below chart shows, the size of the European parallel lending market is significantly greater than other relevant European markets, such as the European alternative lending market, the European high yield bond market, and the European syndicated loan market:

Fig 4: European Lending Market Segments by Size

Sources: European Parallel Lending Market: EUR 4,900B (source ECB; Statistical Data Warehouse, January 2022); European Alternative Lending Market: EUR 283B (source: Amundi, March 2021); European High Yield Bond Market: EUR 425B (source: BofA Merrill Lynch European High Yield Constrained Index (HEC0) as of December 31st, 2021); European Syndicated Loan Market: EUR 387B (source: Credit Suisse Western European Leverage Loan Index (CSLLETOT) as of December 31st, 2021. For illustrative purposes only.

Sources: European Parallel Lending Market: EUR 4,900B (source ECB; Statistical Data Warehouse, January 2022); European Alternative Lending Market: EUR 283B (source: Amundi, March 2021); European High Yield Bond Market: EUR 425B (source: BofA Merrill Lynch European High Yield Constrained Index (HEC0) as of December 31st, 2021); European Syndicated Loan Market: EUR 387B (source: Credit Suisse Western European Leverage Loan Index (CSLLETOT) as of December 31st, 2021. For illustrative purposes only.

The Parallel Lending investment strategy mainly invests in first liens/club loans and senior secured assets. As fig. 5 illustrates, first lien loans are the safest asset in the loan market. In addition to seniority, the vast majority of first liens also benefit from being secured assets.

Fig 5 - Illustrative First Lien Loan in the Company Capital Structure

Source: Goldman Sachs Asset Management Private Credit, Senior Direct Lending Platform, April 2022, (pg. 11). For illustrative purposes only.

Source: Goldman Sachs Asset Management Private Credit, Senior Direct Lending Platform, April 2022, (pg. 11). For illustrative purposes only.

3. High Diversification and Granularity: Portfolio Resilience

With a parallel lending investment strategy, it is possible to build well diversified and granular portfolios, thanks to the win-win relationship between banks and asset managers. The minimum target of invested companies in a portfolio should be around 100; however, it is advisable to have a more diversified loan portfolio as the assets of a portfolio grow.

A well-diversified and granular portfolio helps protect capital while maximizing yield by capitalizing on two investing phenomena:

1. Portfolio tail risk minimization (or the black swan minimization) through diversification. This means ensuring that all the eggs are not in the same basket, but also that each egg is in its own basket, subject to in-depth, individual assessment.

2. Joint default probabilities are lower than the default probability for single holdings.

These are simple and common-sense actuarial techniques used by many market participants to control risk. For instance, insurance companies extending policies to multiple clients will apply these principles throughout their assessment process.

Fig. 6: The ability to build highly diversified parallel lending portfolios helps to reduce black swan risk.

4. Portfolio Credit Rating and the Wise Use of Leverage

Given the low-level of portfolio risk in a well-diversified parallel lending portfolio, it can potentially earn an investment grade credit rating, enabling banks to provide long-term leverage to the portfolio at very competitive interest rates.

We believe that under certain conditions and parameters, a levered parallel lending portfolio can remain in the investment grade zone.

According to the Basel Banking Regulations, if a bank invests in an investment grade portfolio with a Single A rating, the minimum capital requirement is on average 4% of the assets, meaning that the maximum level of bank leverage is 25x (computed as total assets on net equity).

In our view, which is much more conservative than Basel Banking Regulations, we believe that a parallel lending credit portfolio, under certain conditions and parameters, can be considered investment grade with a leverage cap of 3x (computed as gross asset value on net asset value).

The key parameters are the following:

1. Maximum fund exposure to B+ and B credit risk is capped at 30%

2. Number of invested companies: higher than 100 (with an average 1% concentration limit or less)

3. Asset types: first lien, senior secured, average per-company leverage of 3x

4. Counterparty average credit risk is BB

5. High level of diversification (by geography and industry) for lower correlation risk

6. Net annual cash return/number of losses ratio must be higher than 10x

7. No exposure to B- or lower credit risk (as per the EBA leveraged lending guidelines)

5. Investment Tools: from Basel III Advanced Models to AI/Deep Learning Models (FinTech Innovation)

The due diligence process plays a fundamental role in the parallel lending business model.

In order for the asset manager to properly interact with the banking system, we believe two conditions must be met.

First, we believe that there is a value in the win-win relationship between the bank and the asset manager and that this value is increased by the full independence and non-obligation of the asset manager.

Second, the asset manager must have direct access to any company under consideration for lending, in order to carry out the due diligence process, and must have the same quantitative tools that are currently in use in the most advanced European banks (i.e., Basel III Advanced Internal Credit Rating Models), in order to avoid any form of information asymmetry.

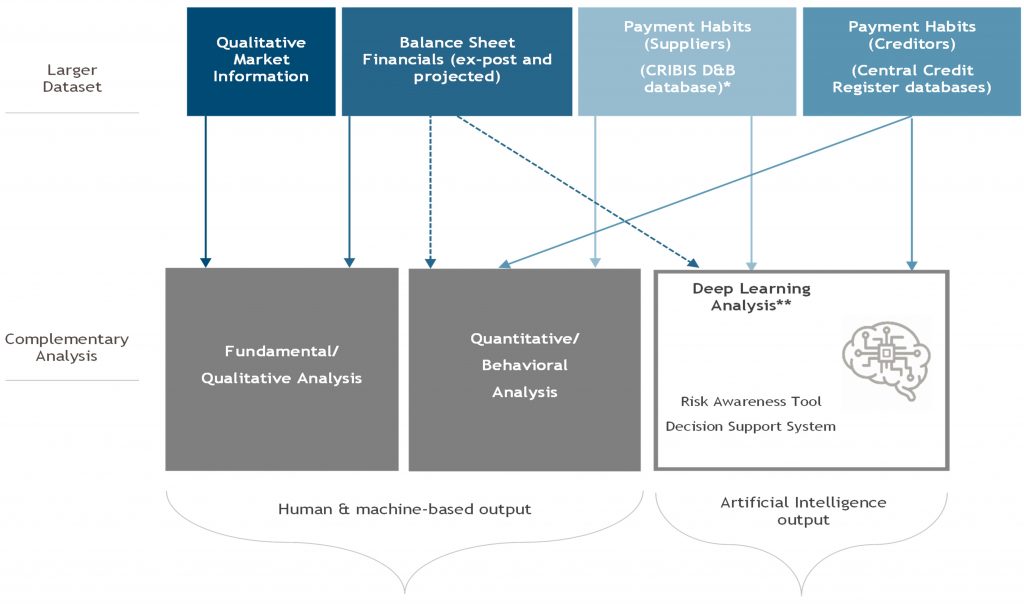

In terms for the investment process, we believe a three-pillar approach is most appropriate:

1. Pillar no.1: Qualitative/fundamental analysis (traditional, analyst-performed, research-based due diligence)

2. Pillar no.2: Basel III Advanced Internal Credit Rating Models (and risk-adjusted pricing tools)

3. Pillar no.3: new artificial intelligence (AI)/deep learning critical decision support systems (or advanced risk tools)

The final decision is taken by the investment committee and investment managers can rely on the output of the 3 types of investment analysis (see fig.5 above). Crucially, AI should be a tool for enhanced decision-making through augmented data analysis of enormous sample size, and not, in its own right, an algorithmic or “black box” credit selector.

Fig 7 - Integrated Investment Process

Muzinich views and opinion for illustrative purposes only. Not to be construed as investment advice or an invitation to engage in any investment activity. Investment process, targets and objectives for illustrative purposes only, subject to change, and there is no guarantee that these targets and objectives will be achieved. *CRIBIS D&B provide access to Payment Behavior Analysis in the Dun & Bradstreet WorldWide Network, (payment habits of worldwide companies). **Deep Learning Analysis refers to credit risk tool used by Muzinich & Co. SGR, which is proposed to include an element of machine learning (in development).

Muzinich views and opinion for illustrative purposes only. Not to be construed as investment advice or an invitation to engage in any investment activity. Investment process, targets and objectives for illustrative purposes only, subject to change, and there is no guarantee that these targets and objectives will be achieved. *CRIBIS D&B provide access to Payment Behavior Analysis in the Dun & Bradstreet WorldWide Network, (payment habits of worldwide companies). **Deep Learning Analysis refers to credit risk tool used by Muzinich & Co. SGR, which is proposed to include an element of machine learning (in development).

The multi-layer neural network is one of the most powerful statistical tools we have today to analyse data—and to have the computer itself learn from the data—creating an artificial intelligence source that can be combined with human analysis to increase the accuracy and quality of our output over time. In short, computers analyse a tremendous volume of historic information in hunting for outlier companies that are likely to default under certain economic conditions based on the experience of companies that have preceded them.

A computer can assess far more data points about a company and about the economy than any human can and, over time, should become an increasingly refined predictor of which characteristics and signals matter most and are most predictive. The explicatory power of these neural networks can increase the capability to separate bad companies from good companies during a due diligence process.

The joint use of Basel III Advanced Credit Rating tools and neural network tools generates a material jump in the creditworthiness of the invested portfolio, as follows:

1. Basel III Advanced Credit Rating tools (Logistic Regressions): 1000 invested companies; 50 bad companies, Default Probability 5% (high yield portfolio)

2. Basel III Advanced Credit Rating tools & Deep Learning tools (Multi-Layer Neural Networks): 800 invested companies (after disqualification of 200 that that the multi-layer neural network identifies as carrying potential default characteristics).

a) Remaining; 2 bad companies not identified by the multi-layer neural network or human analysts.

b) Default probability; 0.25% (lower than 0.5%, meaning that the credit risk can be considered equivalent to investment grade)

While it was unlikely that all 200 of the companies we rejected will actually default as statistically, we know that only 5% of the first 1000 will have defaulted, we are willing to “over-exclude” weak companies for a more resilient portfolio.

The jump from (1) to (2) is called human augmentation, meaning we have augmented our human capability to identify and separate bad companies from good companies during a due diligence process.

The final investment decision remains a human-based decision made after credit analysis and presentation to an investment committee, however fund managers can rely on more sources of information/analysis, such as internal credit rating tools and AI/deep learning tools.

6. The Credit Fund Market Evolution

We expect growing market relevance of credit funds based on parallel lending business models, due to the following potential benefits:

1. IRR potential above 10%2 net in the levered versions: A competitive yield when compared with other similarly-rated fixed income portfolios.

2. Low volatility in a rising rate environment: No daily mark to market. Portfolio valuations are based on the current-pay status of the loans.

3. Low interest rate risk: The majority of parallel lending loans are floating rate.

TARGET RISK: The targets presented are an estimate of potential future returns based on a variety of factors and assumptions. The return objective will vary based on the performance of the underlying investments and the targets shown above are therefore not an exact indicator.

These potential benefits are supported by the following structural features:

1. The secular trend of bank deleveraging: Abundant supplies of loans in the underserved SME market makes both broad diversification and rapid cash deployment possible

2. Sound capital protection: Loans are first lien, pari-passu with the banks who retain skin in the game and who are restricted to a pool of better-quality loans by the regulators

3. Innovations in credit analytics: A vast, under-mined universe of credit data on SMEs lays ready for harvesting to enhance the accuracy of the credit underwriting.

Risk: There can be no guarantee that the investment strategy will be successful, and the value of the investment may go up as well as down.

We therefore expect that the new generation of well-diversified investment grade credit funds based on parallel lending to gain significant market share. Especially in an environment in which concerns with both recession and inflation dominate, a well-diversified portfolio of senior credit (i.e., more protected in a recession) that is also floating rate (i.e., protected from rising rates to combat inflation) has broad appeal.

1. Basel Regulations apply to 28 member states including as of May 10, 2022

2.Please see the notes and assumptions section at the end of this document.

Notes and Assumptions

The target unlevered net return is based on a target gross return of 5.25% excluding management fees of 0.65%, administrative expenses of 0.10%, and expected losses of 0.15-0.25%, the cost of leverage is in the range 150bps-200bps according to the Loan-to-Value (or Debt/GAV). The underlying target gross return is calculated using an internal proprietary model based on average issuer rating and is consistent with average rating of BB. The levered return further assumes a debt/NAV ratio of 230% (or 70% of total gross exposure is financed). For illustrative purposes only. Not an invitation to engage in any investment activity. All targets and guidelines are subject to change at the discretion of the Investment Manager without notice, and there is no guarantee that these will be achieved.

Disclaimer

There is no guarantee that the Aims will be realized or that investors will not lose money. Return potential, strategy objectives, aims or other indication of levels of return or yield sought by a particular strategy or with respect to investments (“Aims”) are based on a variety of factors and assumptions and involve significant elements of subjective judgment and analysis. You should understand that these Aims are intended to provide insight into the level of risk that Muzinich is likely to seek with respect to an investment or strategy. As such, Aims should be viewed as a measure of relative risk, with higher Aims reflecting greater risk. They are not intended to be promissory or predictive. Aims are estimates based on a variety of assumptions, which generally include but are not necessarily limited to, Muzinich’s assumptions about: current and future asset yields and projected cash flows related thereto investments and Strategies, current and future market and economic conditions, prevailing and future interest rates, including the cost of use of leverage, where applicable, capitalization rates, supply and demand trends, volume of development, redevelopment, acquisition and/or disposition activity, development margins and the terms and costs of debt financing, historical and future credit performance for investments or strategies, and other factors outside of Muzinich’s control. Aims are inherently subject to uncertainties and the assumptions on which they are based may prove to be invalid or may change without notice. Other foreseeable events, which were not taken into account, could occur. You should not rely upon the Aims in making an investment decision. Although Muzinich believes that there is a sound basis for the Aims presented, no representations are made as to the accuracy of such Aims or the performance of any investment, account or strategy. There can be no assurance that any particular Aim will be realized or achieved

Important Information

FOR PROFESSIONAL CLIENTS/QUALIFIED/ACCREDIT INSTITUTIONAL INVESTOR USE ONLY. NOT FOR ONWARD USE OR DISRIBUTION. CONFIDENTIAL

Risk warning. Alternative investments can be speculative and are not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing and able to bear the high economic risks associated with such an investment. Investors should carefully review and consider potential risks before investing. Certain of these risks include: (a) Loss of all or a substantial portion of the investment; (b) Lack of liquidity in that there may be no secondary market for interests in the Strategy; (c) Volatility of returns; (d) Restrictions on transferring interests; and (e) Potential lack of diversification and resulting higher risk due to concentration within one of more sectors, industries, countries or regions.

"Muzinich & Co.", “Muzinich” and/or the "Firm" referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

Before making a decision to invest, a prospective investor should carefully review information respecting Muzinich and such investment and consult with its own legal, accounting, tax and other advisors in order to independently assess the merits of such an investment as nothing in these materials should be construed as a product recommendation or as investment, legal, or tax advice. No legally binding terms shall be created until definitive documentation is executed and delivered. This presentation is being provided solely for informational purposes. By accepting this presentation, the recipient (i) acknowledges that the information contained herein is confidential and intended solely for the intended recipients and their authorized agents and may not be disclosed or distributed to any other person in any fashion without the prior written consent of Muzinich, (ii) agrees not to use the information contained herein for any purpose other than to evaluate a potential investment in any product described herein, and (iii) shall be deemed to have agreed to the following: The material in this presentation is directed only at entities or persons in jurisdictions or countries where access to and use of this information is not contrary to local laws or regulations. Any products or service may not be licensed in all jurisdictions and these materials do not constitute an offer or solicitation to sell or a solicitation of an offer to buy any product or service (nor shall any product or service be offered or sold to any person) in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities law of that jurisdiction. No regulator or government authority has reviewed this document or the merits of the products and services referenced herein. All of the information contained herein is believed to be accurate as of the date(s) indicated, is not complete, and is subject to change at any time. Certain information contained herein may be based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich & Co.; its accuracy or completeness cannot be guaranteed.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-05-10-8543