Insight | October 10, 2022

European High Yield – Timing your Entry Point

Capital at risk. The value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the full amount invested.

Despite a weakening macroeconomic backdrop, valuations in European high yield have reached what we believe to be interesting levels. Is now a good time to consider an allocation?

A combination of inflationary pressures, an abrupt commodity/energy shock and a change in central bank monetary policy have resulted in fixed income markets experiencing one of the largest corrections on record. Yet while increased levels of investor anxiety have been reflected in a broad market sell off, we believe the negative technical landscape, with non-stop outflows in European high yield markets year to date combined with fast-rising real yields, have generated valuations that warrant a more constructive outlook for total return.

In our view, there are several reasons why investors should consider an allocation into European high yield.

Valuations

Credit spreads are trading wider than their long-term average (including prior to 2015 when quantitative easing was introduced in Europe). Combined with the rise in yields, the asset class is now showing an average price below 83 (as of 30 September 2022).1 With bonds redeemable at par, this offers investors the potential for what we believe to be significant capital gains.

Fig. 1 European High Yield Spreads and Price

Source: ICE Index Platform. Data as of September 30th, 2022. ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index (HP4N). Muzinich views and opinion for illustrative purposes only, not to be construed as investment advice.

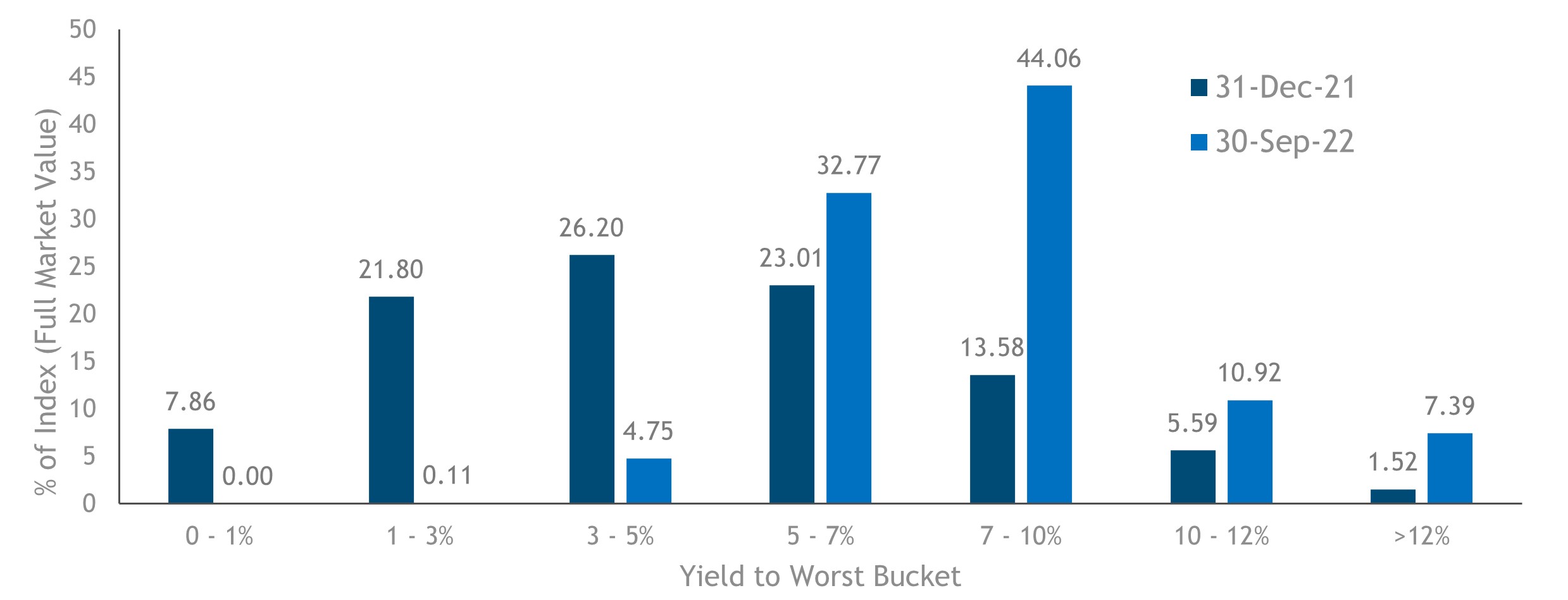

However, while yields are now significantly higher than they were at the start 2022, the number of distressed bonds with yields above 10% remains relatively small (Fig. 2), indicating the underlying fundamentals of the asset class remain relatively sound.

Fig. 2 While Yields Have Risen, the % of Distressed Bonds Remain Low

Source: ICE Index Platform. Data as of September 30th, 2022. ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index (HP4N). Muzinich views and opinion for illustrative purposes only, not to be construed as investment advice.

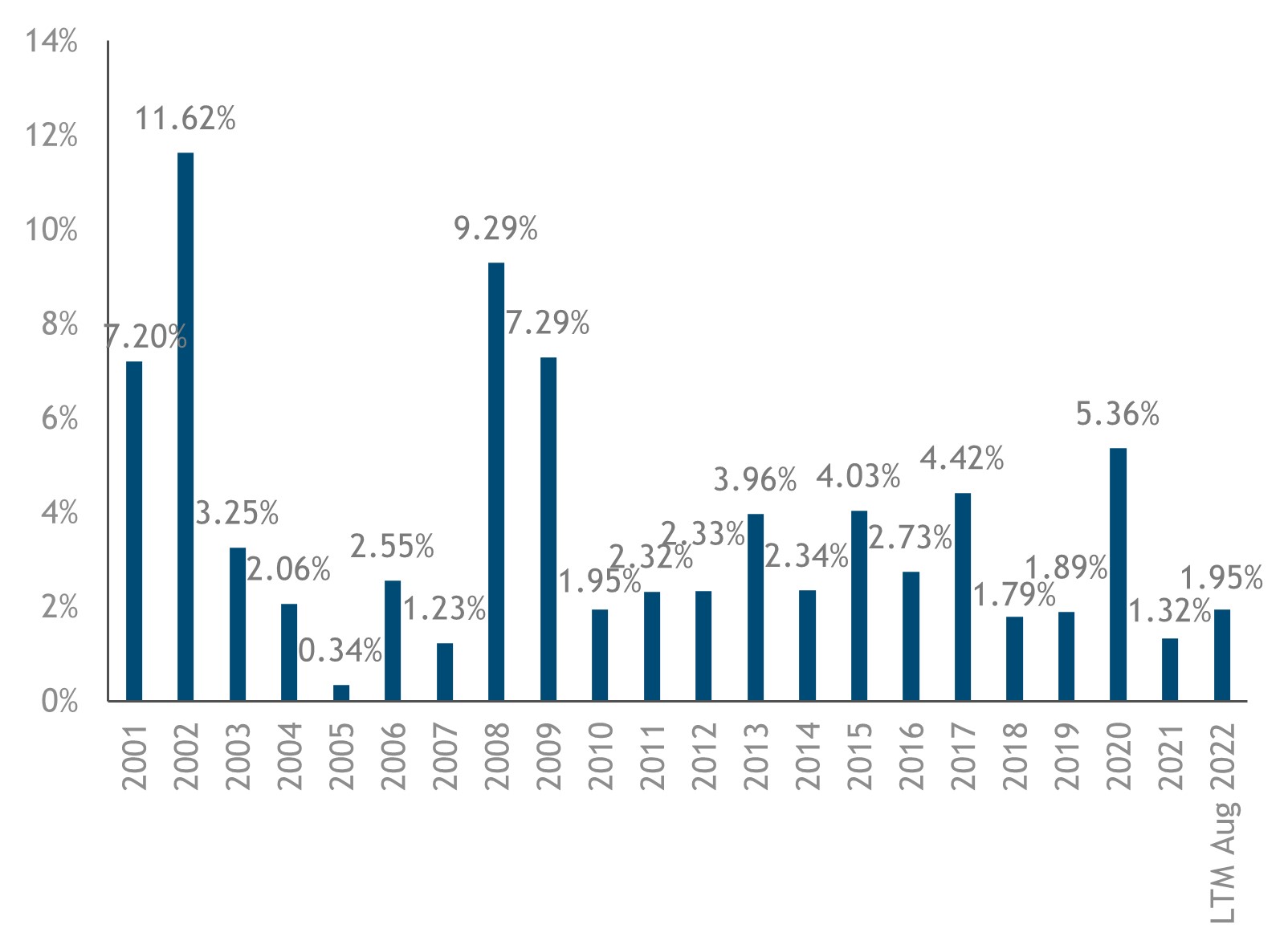

Contained Level of Defaults

A weakening macroeconomic backdrop is likely to affect corporates. The market already appears to be pricing in this scenario, given the low average price in the European high yield market. As Fig. 3 highlights, the last twelve-month default rate is currently around 2%, having oscillated between 2-5% over the last decade. While there is likely to be a rise in defaults, we believe default rates should be relatively contained (unless the recession becomes severe) for several reasons:

- Historically, defaults have never reached levels currently being priced into the market

Based on the current level of the iTraxx Crossover at 655bps, the market is implying a cumulative default rate of 44% over the next 5 years, assuming a recovery rate of 40%. This isn’t a level we have seen before; even during the great financial crisis, defaults peaked at just over 9% and then fell in the following 3 years (Fig. 3).

Fig. 3 Annual Default Rates

Source: Moody’s Europe Trailing 12-Month Issuer-Weighted Spec-Grade Default Rate Forecasts. Data as of August 31st, 2022. Most recent data available used. Muzinich views and opinion, not to be construed as investment advice.

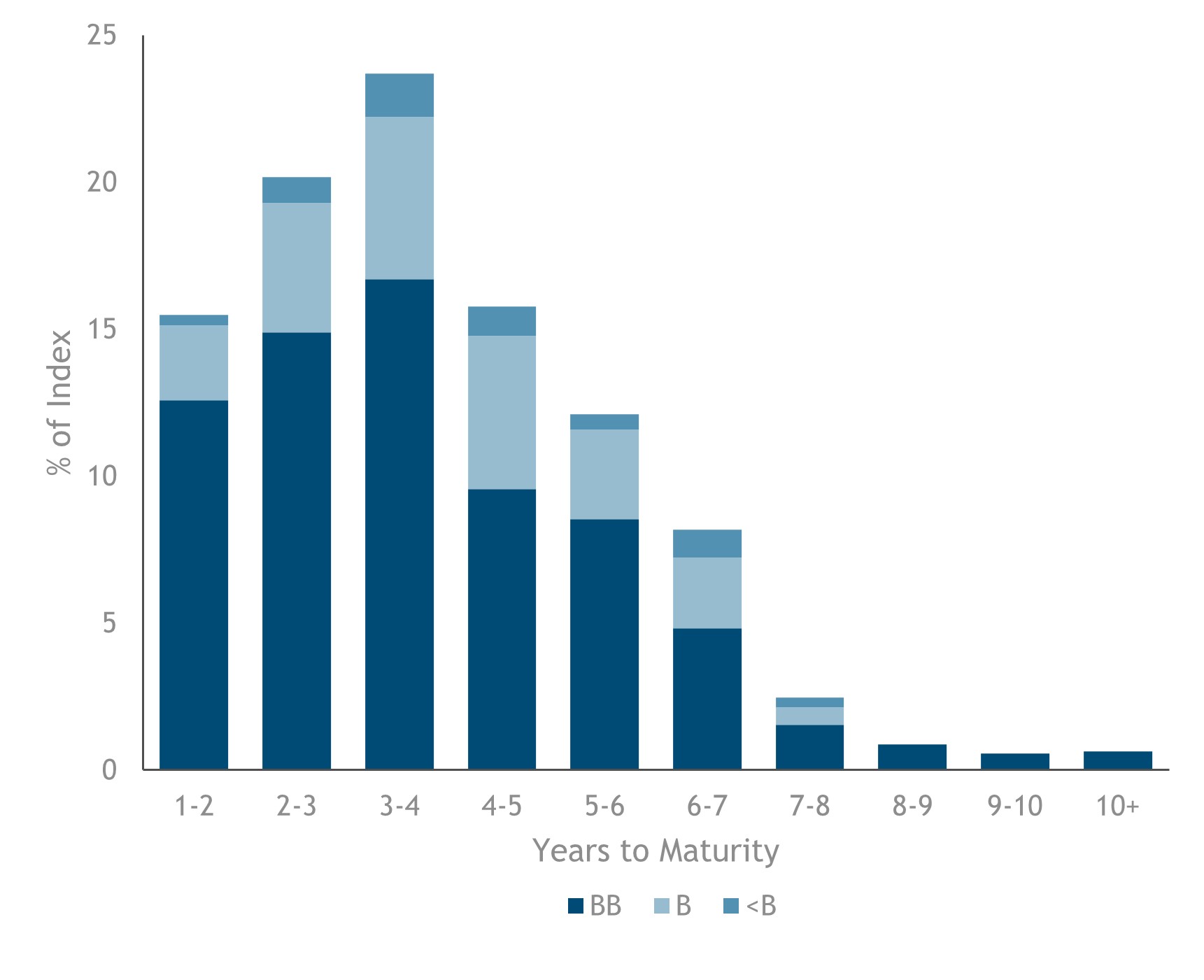

- No Wall of Maturity

There are also a limited number of issuers needing to refinance over the next 12-24 months because of significant issuance in 2021. This provides us further comfort that we are unlikely to see a near-term unexpected spike in defaults. In addition, BB rated bonds constitute a high proportion of the index maturing in the next 1-2 years, which usually have better access to market financing.

Fig. 4 No Wall of Maturity

Source: ICE Index Platform. Data as of September 30th, 2022. ICE BofA Euro High Yield Constrained Index (HEC0). For illustrative purposes only, not to be construed as investment advice.

Positioning a High Yield Portfolio for a Recessionary Environment

Clearly, risks remain, and the asset class is not immune from macroeconomic weakness in the months to come. As a result, we are pursuing a prudent strategy of under allocating to cyclical sectors such as retail and into more defensive areas such as healthcare, and telecoms.

Increasing exposure to higher quality credits with strong balance sheets while reducing exposure to smaller, less well-known issuers (which are less liquid and less supported by investors), Should also help provide protection during periods of elevated volatility. We shall continue, of course, to have a deep focus on fundamental credit analysis prior to investing, with a strong focus on capital preservation and downside protection.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of October 2022.

1.Source: ICE Index Platform. ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index (HP4N).

-

About the Author

Thomas Samson, Portfolio Manager

Thomas is a Portfolio Manager at Muzinich and has 22 years of corporate credit experience. Prior to joining Muzinich, Thomas worked as an investment analyst at Trafalgar Asset Managers, a distressed-debt hedge fund. Prior to that, he worked as a financial analyst at GE Capital. Thomas has a Masters in Finance from London Business School, holds the Chartered Financial Analyst designation and has an M.Sc. in Corporate Finance from the Institut d’Etudes Politiques de Paris, France.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

FOR PROFESSIONAL/ WHOLESALE CLIENTS & QUALIFIED/ ACCREDITED/ INSTITUTIONAL INVESTORS ONLY

Index Descriptions

HP4N – The ICE BofA ML BB-B European Currency Non-Financial High Yield Constrained Index contains all non-financial securities in The ICE BofA ML European Currency High Yield Index rated BB1 through B3, based on an average of Moody's, S&P and Fitch, but caps issuer exposure at 3%.

Important Information

Muzinich & Co.", “Muzinich” and/or the "Firm" referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2022-10-03-9478