October 14, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

Active management can unlock alpha in today’s European high yield market, argues Thomas Samson.

The European high yield (HY) market has shown remarkable technical strength this year, underpinned by robust investor demand,1 reflecting sizeable inflows over the past two years.

This sustained demand has supported performance and compressed spreads, leaving investors to grapple with a central question: how do you make the case for an asset class when performance is strong and spreads are tight?

We believe the answer lies in three enduring sources of return in European HY: carry/roll-down, new issues and – perhaps most importantly - dispersion.

1. Carry & roll-down

Yields remain elevated, above the 60th percentile.1 Spreads can stay tight for some time when fundamentals are sound and technicals are strong, in which time HY investors receive decent carry at these levels of yields. We believe a carry-like return outcome is credible in the current market setup.

Roll-down is the return an investor earns as a bond naturally ages and moves down the yield curve. As time passes and a bond’s maturity shortens, it migrates to typically lower point on the yield curve, translating to a higher bond price, i.e. additional return on top of the coupon.

2. New issue premiums

The new issue market has been buoyant, offering opportunities for investors to capture attractive new issue premiums. For investors seeking incremental yield in a low-spread environment, we believe participating in well-structured new deals remains one of the clearest ways to generate alpha.

3. Dispersion

Dispersion within European HY is currently particularly pronounced. Over the past decade, it has been rare to see more than half of the market trading significantly above or below the average spread. Yet that is exactly what we are currently seeing. In prior periods of tight spreads - such as 2017 or 2021 - dispersion was far lower, limiting the scope for active differentiation (Figure 1).

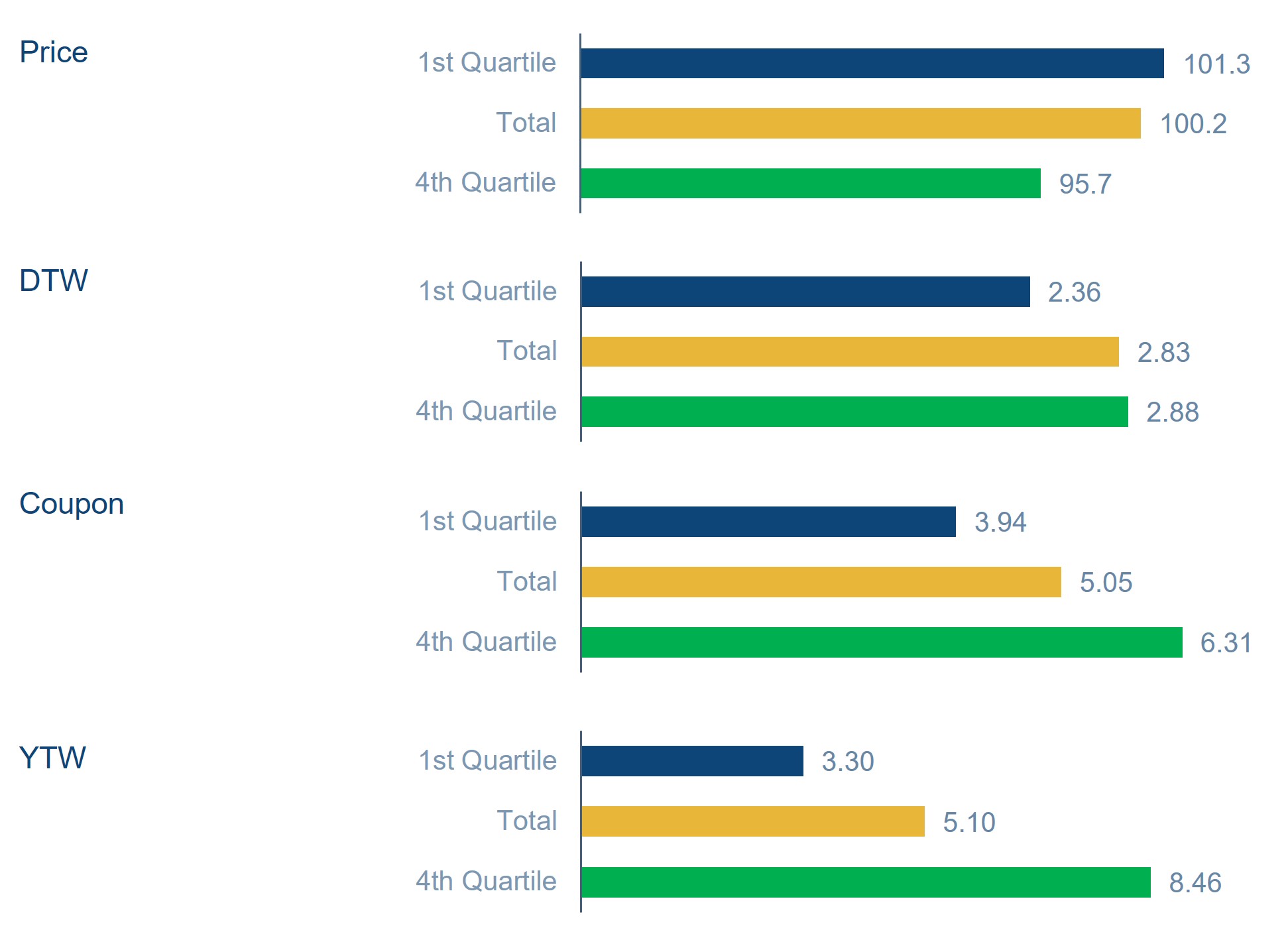

Today’s market is different. Breaking spreads into quartiles highlights that the first three quartiles are tightly compressed, while the fourth quartile trades above 600 basis points (Figure 2). This quartile is dominated by idiosyncratic stories: companies facing weakening balance sheets, challenged business models or sector-specific headwinds.

For active managers, this represents fertile ground. Rigorous credit analysis can separate genuine restructuring risks from mispriced opportunities - an advantage that passive vehicles, by design, cannot exploit.

Figure 2: 4th quartile spreads opportunity

Source: Muzinich calculations using data from ICE Index Platform. ICE BofA Euro High Yield Index (HE00). Data as of September 30th, 2025. For illustrative purposes only, not to be construed as investment advice.

Source: Muzinich calculations using data from ICE Index Platform. ICE BofA Euro High Yield Index (HE00). Data as of September 30th, 2025. For illustrative purposes only, not to be construed as investment advice.

Addressing the risk perception

Historically, a small proportion of the upper spread quartile has gone on to default. The breadth of this cohort often reflects market caution rather than imminent distress. Meanwhile, as Figure 2 highlights, the third quartile of bonds is trading materially below the average yield- a rare occurrence when spreads are this tight. With the overall market yield at roughly 4.7%, investors can still find bonds yielding 6 - 7% offering attractive relative value when selected with care via a focus on bottom-up credit analysis.2

The case for active management in European HY

The combination of compressed spreads, elevated dispersion and a healthy new issue market creates an environment uniquely suited to active management. Passive strategies, by contrast, are structurally constrained to hold both the winners and the losers in equal measure. Active investors, armed with fundamental analysis and selective allocation, can lean into dispersion, avoid pitfalls and harness the mispricings created by today’s unusual market dynamics.

In short, European high yield remains a compelling opportunity. Far from being a late-cycle trap, it offers a fertile landscape for those willing to apply selectivity and discipline. Tight spreads need not signal limited upside; instead, they highlight a market where differentiation is both possible and powerful.

References

1. ICE Index Platform, as of 29th September 2025. ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index (HP4N).

2. ICE Index Platform, as of 29th September 2025. ICE BofA Euro High Yield Index (HE00).

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of October 2025 and may change without notice.

--------

Index descriptions

HE00: ICE BofA Euro High Yield Index tracks the performance of EUR denominated below investment grade corporate debt publicly issued in the euro domestic or eurobond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody’s, S&P and Fitch) and at least 18 months to final maturity at the time of issuance. In addition, qualifying securities must have at least one year remaining term to maturity, a fixed coupon schedule and a minimum amount outstanding of EUR 250 million.

HP4N – The ICE BofA BB-B European Currency Non-Financial High Yield Constrained Index contains all non-financial securities in The ICE BofA European Currency High Yield Index rated BB1 through B3, based on an average of Moody's, S&P and Fitch, but caps issuer exposure at 3%.

Important information

Muzinich and/or Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. Muzinich views and opinions. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall.

Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only.

This discussion material contains forward-looking statements, which give current expectations of future activities and future performance. Any or all forward-looking statements in this material may turn out to be incorrect. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Although the assumptions underlying the forward-looking statements contained herein are believed to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurances that the forward-looking statements included in this discussion material will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Further, no person undertakes any obligation to revise such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-10-01-17057