February 2, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

One month in, the long end of the government bond curve has underperformed – with the Japanese government bond curve steepening the most – while European government bonds outperformed their US peers across the curve. Corporate credit was a clear winner in fixed income, with emerging-market high yield as the standout performer. Within the investment grade space, European credit was the place to be, helped by its relative sovereign performance.

Commodities continued to move higher, with energy a notable surprise. Brent crude rose by roughly 15% over the period, lifting prices to around US$70 per barrel (pb), despite the median forecast for Q1 2026 sitting closer to US$60pb. The US dollar weakened broadly over the month, alongside depreciation across digital currencies. High-beta and commodity-linked currencies performed strongly, with both the Australian and New Zealand dollars appreciating by around 5% against the US dollar in developed markets, while the Brazilian real, outperforming in emerging markets, delivered a similar gain. [1]

Equity markets were defined by rotation. The “Magnificent Seven” underperformed the broader S&P 500, which itself lagged small-cap equities. Sector rotation led to leadership dominated by energy and materials, with financials as the laggard. Notably, energy now represents just 2.8% of the S&P 500 versus technology at 34%. Emerging-market equities delivered stellar outperformance, with key indices in Latin America and Asia rallying sharply. Korea’s KOSPI surged around 23%, while Brazil’s Ibovespa gained approximately 14%.

Economic and earnings data were robust, global financial conditions continued to loosen, and risk appetite remained unabated. Volatility spent most of the month at the lower end of recent ranges, signaling limited near-term uncertainty across fixed income and equity markets, despite the steady stream of political and geopolitical headlines generated by the US administration. It is fair to say that many investors will finish January with higher portfolio net asset values. The main exception may be international investors holding unhedged US Treasuries, for whom the combination of rising yields and US dollar weakness may have proved disappointing, despite the allocation’s historical role as a “safe haven.”

The surprise news of the week came from China, where shares in property developers surged after reports Beijing has effectively dismantled its “three red lines” policy, removing borrowing limits that had constrained developers and helped trigger a prolonged debt crisis in the sector. While largely symbolic, the move does little to resolve the deeper structural issues weighing on growth and confidence. Instead, it represents a final acknowledgment the tightening went too far in a property market that underpins household wealth and local government finances. [2]

The most anticipated event of the week, the Federal Open Market Committee (FOMC) policy meeting, proved somewhat anticlimactic. The FOMC held rates steady at 3.50–3.75%, in line with expectations, although Governors Miran and Waller dissented, favoring a 25 basis points (bps) cut. Chair Powell emphasized broad support for maintaining current policy and maintained his “Goldilocks” optimistic tone on the economy, as seen in December’s meeting, highlighting steady economic activity and signs of stabilization in the labour market.

Powell noted that while inflation remains above target, much of the current overshoot is tariff-related and is likely to peak in the second quarter of the year. He largely deflected questions on legal challenges, internal Fed dynamics, and his own future beyond May, while reaffirming a strong commitment to the Fed’s institutional independence.

However, investors can never let their guard down. True to his flair for the spotlight, President Donald Trump announced on his Truth Social platform that he intends to nominate Kevin Warsh as the next chair of the Federal Reserve (Fed). “I have known Kevin for a long period of time and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best,” Trump wrote. [3]

Warsh, who served on the Fed from 2006 to 2011, was historically an inflation hawk, favouring higher rates and criticizing the Fed’s balance-sheet expansion. Yet, in a recent appearance on Fox News, he suggested a different approach: “The Fed has the policy mix exactly wrong – it has a big balance sheet, like we’re in the ’08 crisis or the 2020 pandemic, and rates that are too high. It needs to shrink the Fed balance sheet and cut interest rates.” [4]

As we enter February, traditionally a tougher month for investor total returns, the key geopolitical event to watch will be developments in the Middle East. The arrival of a US aircraft carrier strike group in the region has given President Trump a range of forceful options against Iran, though questions remain over whether the deployment signals a genuine military mission or is intended primarily to pressure Tehran into negotiations. Trump referenced the flotilla this week, saying, “Hopefully we won’t have to use it. I told them two things: number one, no nuclear, and number two, stop killing protesters.” [5]

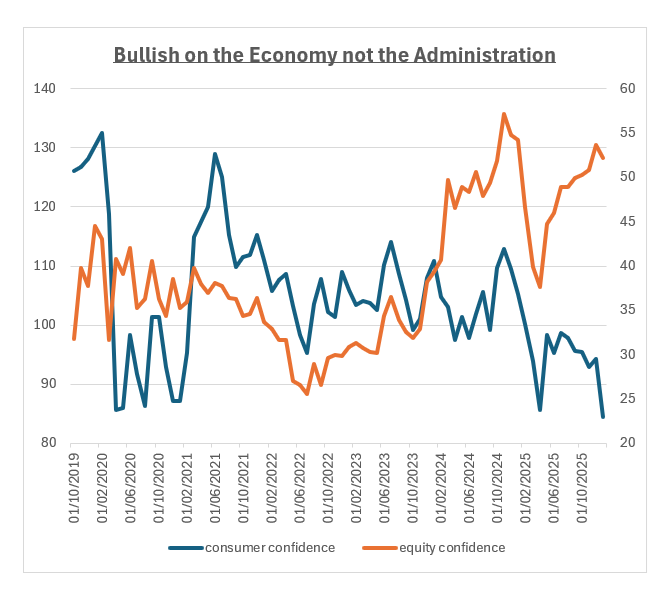

On the macroeconomic front, the key indicator to watch will be the US dollar; a sovereign currency is often viewed as a barometer of both the economy’s health and confidence in the administration running it. This week’s consumer confidence report may have shed light on the debate surrounding the US dollar. The overall index plunged to levels not seen since COVID-19, with survey responses citing “war” among the top concerns. Yet a subcomponent measuring consumer sentiment toward equities shows the population remains unusually bullish on the stock market (see Chart of the Week). This divergence suggests that while worries may be centred on leadership, confidence in the economy itself remains strong. [6] As a result, demand for US assets remains robust, but international investors now seek to hedge against administration-related risks, contributing to US dollar depreciation.

An alternative explanation for the US dollar’s decline was elegantly articulated by Canadian Prime Minister Mark Carney at the World Economic Forum’s annual meeting in Davos. He argued the rules-based international order is no longer functioning as a reliable framework for global cooperation. Instead, the emerging geopolitical landscape points toward a system of national or regional capitalism, in which sovereign states prioritize self-sufficiency and strategic alliances over globalization. [7]

This shift raises the possibility of an erosion – or even an end – of Pax Americana, under which US dominance has long defined the international system. Historically, this dominance has granted the US access to cheap and abundant external financing; by the end of Q3 2025, the US net international investment position stood at a deficit of US$27.6 trillion. [8] If this is the case, the depreciation of the US dollar may only be in its early stages. It will be particularly fascinating to see how the newly appointed FOMC chair, Kevin Warsh, manages to shrink the Fed’s US$6.58 trillion balance sheet, especially given the committee’s decision to halt its runoff in Q4 was due to liquidity pressures in the US banking system. In this new geopolitical and financial paradigm, international investors will likely be reluctant to take on further exposure without a meaningful increase in the risk premium.

Chart of the Week: Bullish on the Economy not the Administration

Source: Bloomberg, as of January 30, 2026. For illustrative purposes only.

Source: Bloomberg, as of January 30, 2026. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] Bloomberg, Brent median forecast price (function CPFC), as of January 30, 2026

[2] Bloomberg, “China Builders Ceased Reporting ‘Three Red Lines’ Years Ago,” January 29, 2026

[3] Bloomberg, “Trump Picks a Reinvented Warsh to Lead the Federal Reserve,” January 30, 2026

[4] Bloomberg, “From Hawk to Dove: Kevin Warsh’s Transformation on Fed Rates,” July 15, 2025

[5] Bloomberg, “Trump’s Options for Iran Strike Grow Even With Goals Unclear,” January 30, 2026

[6] Bloomberg, “US REACT: Confidence Shock Overdone? Consumers Keep on Spending,” January 27, 2026

[7] World Economic Forum Annual Meeting, Forum in Focus, “Davos 2026: Special address by Mark Carney, Prime Minister of Canada,” January 20, 2026

[8] US Bureau of Economic Analysis (BEA), International Investment Position, released January 16, 2026

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of January 30, 2026, and may change without notice. All data figures are from Bloomberg, as of January 30, 2026, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

In the United Arab Emirates (UAE) (excluding the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM): This document, and the information contained herein, does not constitute, and is not intended to constitute, a public offer of securities in the United Arab Emirates (“UAE”) and accordingly should not be construed as such. The Units are only being offered to a limited number of exempt Professional Investors in the UAE who fall under one of the following categories: federal or local governments, government institutions and agencies, or companies wholly owned by any of them. The Units have not been approved by or licensed or registered with the UAE Central Bank, the SCA, the Dubai Financial Services Authority, the Financial Services Regulatory Authority or any other relevant licensing authorities or governmental agencies in the UAE (the “Authorities”). The Authorities assume no liability for any investment that the named addressee makes as a Professional Investor. The document is for the use of the named addressee only and should not be given or shown to any other person (other than employees, agents or consultants in connection with the addressee’s consideration thereof).

In the United Arab Emirates (UAE) (including the Dubai International Financial Centre and the Abu Dhabi Global Market): This information does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment products in the UAE and accordingly should not be construed as such. Furthermore, this information is being made available on the basis that the recipient is an entity fully regulated by the ADGM Financial Services Regulatory Authority (FSRA), and acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the UAE Central Bank, the Dubai Financial Services Authority, the UAE Securities and Commodities Authority, the Financial Services Regulatory Authority or any other relevant licensing authority or governmental agency in the UAE. The content of this report has not been approved by or filed with the UAE Central Bank, the Dubai Financial Services Authority, the UAE Securities and Commodities Authority or the Financial Services Regulatory Authority.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.