January 19, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

“Resilience” best captures the behavior of financial markets during a week that, yet again, saw investor attention absorbed by international and domestic politics, amid both expected headlines and unforeseen developments.

From an international perspective, investors closely monitored headlines for clarity on whether Iran’s social unrest might trigger global intervention. Iran exported approximately 1.375 million barrels per day (mbpd) of oil in December. [1] Using our rough rule of thumb that a 1 mbpd change in supply equates to a ±US$3 per barrel price move, this implies a potential increase in energy prices of around US$4 per barrel – broadly consistent with the year-to-date move observed in Brent crude prices. Energy investors also kept a close eye on developments in Venezuela. This week, President Trump met Venezuelan opposition leader María Corina Machado at the White House, where she symbolically presented him with her 2025 Nobel Peace Prize medal in recognition of what she described as his support for Venezuelan freedom and decisive action during the country’s political crisis. Trump publicly praised the gesture as “a wonderful gesture of mutual respect.” [2]

Meanwhile, the United States has intensified its effective blockade of Venezuelan oil exports by targeting the so-called “shadow fleet” of tankers used to move sanctioned crude. US forces have seized six vessels in recent weeks as part of this enforcement campaign, underscoring Washington’s efforts to restrict unauthorized oil flows and tighten control over Venezuela’s energy exports.

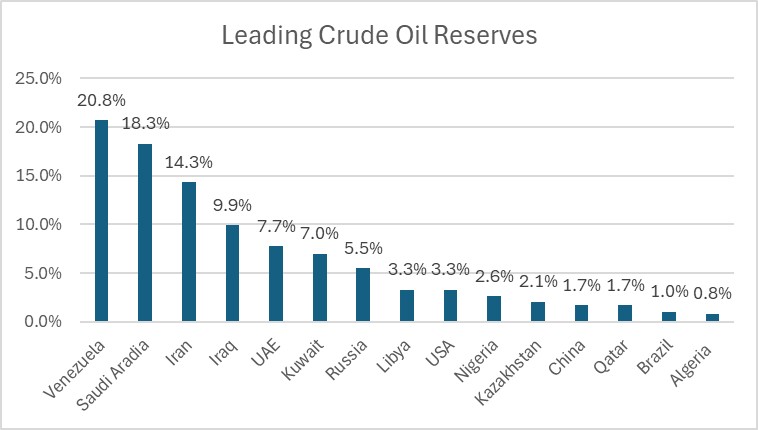

Looking ahead, the Trump administration has signaled its intent to maintain long-term oversight of Venezuelan oil sales, positioning the US as the central authority in coordinating and approving future exports. From a geopolitical perspective, this would significantly expand US influence over global oil markets given that the US and Venezuela account for roughly 24% of global reserves. If considered alongside Iran’s known reserves, US leverage would extend to close to 40% of global oil reserves –although it is important to note that these figures are theoretical, as the vast majority of these resources remain undeveloped and in the ground. [3] Nevertheless, the scale of such potential influence is likely to be viewed with concern by China and other major energy-importing nations. See Chart of the Week.

If not content with asserting influence over global energy, President Trump reiterated that Greenland is vital for national security, urging NATO to support his efforts to gain greater control of the Arctic territory. This followed a meeting last week between Vice President JD Vance, Secretary of State Marco Rubio, and the foreign ministers of Denmark and Greenland. After the talks, the parties agreed to establish working groups to explore possible avenues forward. However, Denmark’s foreign minister emphasized that a fundamental disagreement with the US remains, adding that any demands violating Denmark’s or Greenland’s sovereignty are “totally unacceptable.” [4]

Greenland’s significance lies in its strategic location: it sits between North America and Europe, providing a crucial position for monitoring the Arctic and North Atlantic. Its proximity to Russia allows the US to track military activity, including submarines and missile tests, both during the Cold War and today. Additionally, as climate change opens new Arctic shipping lanes, Greenland serves as a key point to oversee emerging airspace and maritime routes.

On a different front, a general election is now expected in Japan. Prime Minister Takaichi is expected to dissolve the lower house shortly after it reconvenes on January 23, hoping to capitalize on her high approval ratings and strengthen her slim parliamentary majority. If called, the election could take place in early to mid-February. The announcement pushed investors to increase the so-called “Takaichi trade” – anticipation of stable governance combined with proactive fiscal policies aimed at supporting economic growth.[5] This sentiment contributed to Japanese government bonds underperforming for the week, with the 10-year yield rising 9 basis points, while equities outperformed, with the Nikkei 225 gaining over 5% during the same period.

While investors in the US await the Supreme Court’s rulings on the legitimacy of tariffs and the Lisa Cook case, the White House maintains that mortgage-related allegations justified her removal. In a surprise move, Jerome Powell informed investors that the Federal Reserve (Fed) had been served grand jury subpoenas, potentially threatening criminal charges related to his testimony on renovations at the central bank’s headquarters. Powell characterized the subpoenas as part of the administration’s “ongoing pressure” on interest rates. [6]

The questioning – or potential erosion – of central bank independence represents a key tail risk for the US in 2026. However, the market’s muted reaction was likely influenced by vocal rebukes from several Republican senators, including Senator Thom Tillis, who sits on the Senate Banking Committee. Additionally, President Trump announced that he had no intention of firing Powell, further reducing market concerns.

Given the magnitude of recent headlines, investors may be surprised to see that our preferred measures of equity and government bond volatility – the VIX and MOVE indices – remain low, signaling a high level of confidence and an environment conducive to taking risk. This may be because the headlines, while attention-grabbing, are unlikely to materially affect either economic growth or inflation. Meanwhile, economic data releases that have been relegated in importance in the current geopolitical, headline-driven environment are painting a picture of robust global activity and normalizing of prices.

Last week, China’s reported stronger-than-expected December export growth indicates that its export engine continued to support the economy in the final quarter of 2025. Non-US markets again more than offset the tariff-driven slump in exports to the United States, as global trade normalizes. [7]

In Europe, after two years of contraction, the statistical office confirmed a modest rise in GDP in 2025. German GDP increased by 0.3% from a year earlier. Consensus projections for 2026 are even more optimistic, at around 1%, as a combination of lower interest rates, rising real incomes, and fiscal spending is expected to drive growth. While in the UK, investors were surprised by a better-than-expected November GDP print, suggesting that the economy managed to expand in the final quarter of 2025[8]. Momentum is expected to pick up in 2026 as budget-related uncertainty eases and inflationary pressure recedes. Consensus growth estimates for the UK also center around 1%.

For the US, the December consumer price report confirmed that tariff pass-through has peaked. The headline CPI index rose just 0.31%, while the core CPI increased 0.24%, both well below expectations. [9] Although a soft labour market remains a key risk for the US economy, weekly initial jobless claims fell to 198k in the week ending January 10, bringing the 4-week moving average to 205k, the lowest level in nearly 2 years. The NFIB Small Business Optimism Index ticked higher, reflecting more optimistic expectations for business conditions ahead. [10] Activity indicators further support this trend: the New York Fed’s Empire State manufacturing survey rose to 7.7 in January, and the Philadelphia Fed’s manufacturing business outlook survey increased to 12.6 – both signaling a pickup in economic activity. [11]

Chart of the Week: US to Control Global Oil Reserves?

Note: Data excludes oil sands, which are mainly exploited by Canada.

Source: OPEC (Organization of the Petroleum Exporting Countries)/CNN, as of January 3, 2026. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] Bloomberg, as of January 16th, 2026

[2] Bloomberg, “Trump Praises Venezuela’s Machado for Giving Him Her Nobel Medal,” January 15, 2026

[3] CNN Business, “Trump says US is taking control of Venezuela’s oil reserves. Here’s what it means,” January 3, 2026

[4] Newsweek, “Denmark Says It Has ‘Fundamental Disagreement’ With US After Talks,” January 14, 2026

[5] UBS Global Research, as of 16th January 2026. Japan Equity Strategy & Thematic Research.

[6] Bloomberg, “Powell Probe Stirs Republican Outcry, Jeopardizing Trump Agenda,” January 12, 2026

[7] Bloomberg, “CHINA REACT: Upside Export Surprise Hints at Resilient 2026,” January 13, 2026

[8] Bloomberg, “GERMANY REACT: Modest 2025 Growth, Fiscal Help to Spur Rebound,” January 15, 2026

[9] Bloomberg, “US REACT: Weak CPI Adds to Proof Tariff Pass-Through Has Peaked,” January 13, 2026

[10] National Federation of Independent Business (NFIB), “Uncertainty declines to lower level since June 2024,” January 13, 2026

[11] Deutsche Bank, “Early Morning Reid, Macro Strategy,” January 16, 2026

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of January 16, 2026, and may change without notice. All data figures are from Bloomberg, as of January 16, 2026, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

In the United Arab Emirates (UAE) (excluding the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM): This document, and the information contained herein, does not constitute, and is not intended to constitute, a public offer of securities in the United Arab Emirates (“UAE”) and accordingly should not be construed as such. The Units are only being offered to a limited number of exempt Professional Investors in the UAE who fall under one of the following categories: federal or local governments, government institutions and agencies, or companies wholly owned by any of them. The Units have not been approved by or licensed or registered with the UAE Central Bank, the SCA, the Dubai Financial Services Authority, the Financial Services Regulatory Authority or any other relevant licensing authorities or governmental agencies in the UAE (the “Authorities”). The Authorities assume no liability for any investment that the named addressee makes as a Professional Investor. The document is for the use of the named addressee only and should not be given or shown to any other person (other than employees, agents or consultants in connection with the addressee’s consideration thereof).

In the United Arab Emirates (UAE) (including the Dubai International Financial Centre and the Abu Dhabi Global Market): This information does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment products in the UAE and accordingly should not be construed as such. Furthermore, this information is being made available on the basis that the recipient is an entity fully regulated by the ADGM Financial Services Regulatory Authority (FSRA), and acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the UAE Central Bank, the Dubai Financial Services Authority, the UAE Securities and Commodities Authority, the Financial Services Regulatory Authority or any other relevant licensing authority or governmental agency in the UAE. The content of this report has not been approved by or filed with the UAE Central Bank, the Dubai Financial Services Authority, the UAE Securities and Commodities Authority or the Financial Services Regulatory Authority.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.