September 22, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

It was a busy week for central banks, with nine meetings in total. Five policy committees left rates unchanged, while the others cut rates by 25 basis points (bps). The main surprises came from Asia, where Bank Indonesia (BI) caught economists off guard by cutting its policy rate 25bps to 4.75% against expectations of no change. Economists had leaned on the conservative side, citing the need to maintain currency stability, but the central bank appears more focused on aligning with President Prabowo Subianto’s push for stronger growth. This latest move brings total easing to 150bps over the past 12 months. BI now expects 2025 growth to exceed the midpoint of its 4.6%–5.4% forecast range, supported by stronger momentum in the second half of the year.[1]

Elsewhere in Asia, the Bank of Japan (BoJ) signaled hawkish intent despite the backdrop of political turmoil. The central bank kept its target rate at 0.5%, in line with economists’ expectations. The decision came with a 7–2 vote split, as Hajime Takata and Naoki Tamura dissented in favour of a hike to 0.75%, consistent with their reputations as hawkish board members.[2]

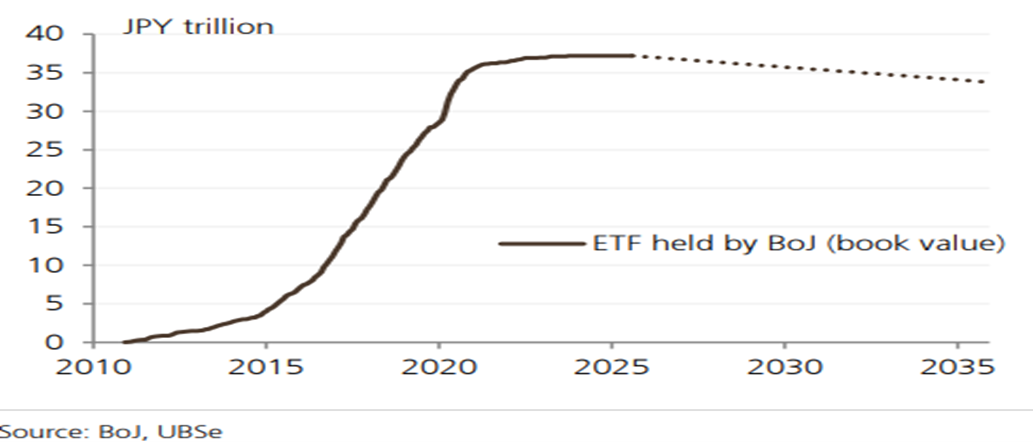

However, in a surprise move, the BoJ announced plans to begin selling its holdings of ETFs and J-REITs at an annual pace equal to about 0.05% of market trading volume. Don’t panic! At this rate, it would take more than 100 years to fully unwind its holdings, underscoring the BoJ’s intent to minimize disruption (see Chart of the Week).[3] Still, the decision is a clear show of confidence by the BoJ in the Japanese economy and its financial markets.

One of the key headwinds to tighter policy has been concern over US tariffs. Governor Ueda addressed the issue directly, noting Japan’s economy remains resilient, with employment and investment so far largely unaffected by tariff-related pressures. This leaves the BoJ’s next meeting a close call. The September Tankan survey will be closely watched as a confirmation of underlying economic strength and a potential green light for action. This sets up the possibility of a rate hike on October 30th, just one day after the US Federal Open Market Committee (FOMC) is considering cutting rates on October 29th, raising the prospect of a tectonic policy shift between the world’s largest and fourth-largest economies in opposite directions.

The main event in Europe was the Bank of England (BoE), where the Monetary Policy Committee (MPC) held its benchmark rate at 4% with a 7–2 vote split. The MPC reaffirmed that a gradual and careful approach to further policy loosening remains appropriate. It also voted to slow the sale of its balance sheet holdings in gilts from £100 billion to £70 billion between October 2025 and September 2026. With £49 billion expected from redemptions, implying around £21 billion in active sales. The BoE stressed that QT should not become a source of market volatility and noted in the minutes that sales will be skewed away from long-dated bonds.[4]

Perhaps the BoE also had one eye on the brewing storm in the UK’s public finances. Government borrowing in August came in far higher than expected, with the Office for National Statistics reporting £18 billion against a forecast of £12.5 billion, the highest August figure in 5 years. This pushed the deficit for the fiscal year starting in April to £83.8 billion, the second highest since records began in 1993, surpassed only during the pandemic in 2020.[5] At this point in the fiscal year, revenue is running £6.1 billion below forecasts while spending is broadly in line, putting Chancellor Reeves’ budget pledges off track and leaving her to face a very difficult budget on November 26th. Public sector net debt now stands at 96.4% of GDP.5

Meanwhile, as President Trump dined with UK royalty, the FOMC—for the first time in Trump’s second term—delivered a rate cut, lowering the federal funds rate by 25bps to 4.00–4.25%, in line with expectations. The decision drew only one dissent—from newly appointed Governor Miran, a Trump pick—who favoured a 50bps move. The lack of further opposition signaled broad unity among the remaining 11 voting members.

Chair Powell described the move as a risk-management cut, signaling slightly less concern about upside inflation risks and greater sensitivity to downside risks in the labour market. The median dot plot pointed to two further 25bps cuts this year, although the balance was finely split: nine participants projected one or fewer, while ten participants anticipated two or more. While in the press conference Powell stressed the dot plot should not be viewed as a policy signal, underscoring that participants do not debate or attempt to reach agreement on the projections.[6]

In the updated staff projections from June, growth was revised higher across the forecast horizon. Expectations for 2025 and 2026 were raised by 0.2 percentage points (pp) to 1.6% and 1.8%, respectively, while the 2027 forecast edged up by 0.1pp to 1.9%, and a new 2028 projection was introduced at 1.8%. Employment and inflation forecasts were left largely unchanged, with unemployment expected to peak this year at 4.5%, while inflation is not projected to reach the Committee’s 2% target until 2028.[7]

Two notable takeaways from the press conference stood out. First, Chair Powell noted that a combination of declining labour supply—driven by demographics, post-COVID effects and shifting immigration patterns—and easing labour demand, influenced by productivity gains from AI and uncertainty around tariffs, have created an unusual balance in the job market. As a result, the breakeven pace of monthly job gains needed to keep the unemployment rate steady is now minimal, possibly in the range of between 0 and 50k.[8]

The second discussion point came from the newly appointed committee member, Stephen Miran, who suggested in his Senate testimony that the Federal Reserve (Fed) carries a “third mandate,” that in addition to pursuing price stability and maximum employment, the Fed should also aim to moderate long-term interest rates.[9] Chair Powell pushed back firmly on this notion, stressing that policymakers view moderate interest rates as a natural outcome of stable inflation and maximum employment. “As far as I’m concerned,” he said, “there’s no thought of treating that condition in a different way.”8

After last week’s political tsunami of negative headlines, it was reassuring to see central banks reasserting common sense and stability. The common thread across their decisions was confidence in a robust growth outlook and inflation remaining broadly anchored. Each committee is at a different stage of the journey, but the shared goal is to guide monetary policy toward neutral levels, a destination they expect to reach over the next 12 to 18 months.

Chart of the Week: Don’t Panic—ETFs held by the BoJ (book value), pace of sale is so slow, it would take 113 years to sell out

Source: UBS Global Research, “Japan Economic Perspectives,” September 19, 2025. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of September 19, 2025, and may change without notice. All data figures are from Bloomberg, as of September 18, 2025, unless otherwise stated.

References

[1] Bloomberg, ‘INDONESIA REACT: Central Bank Favors Growth, Sidelines Rupiah,’ September 17, 2025

[2] Bloomberg, ‘BoJ REACT: ETF Sales, Dissent, Hawkish Ueda Hint at Oct. Hike,’ September 19, 2025

[3] UBS Global Research, ‘Japan Economic Perspectives,’ September 19, 2025

[4] Bloomberg, “BoE REACT: Rate Hold to Turn to Long Pause, No QT Surprises,’ September 18, 2025

[5] Bloomberg, ‘UK Budget Deficit Overshoots Forecast in New Blow to Reeves,’ September 19, 2025

[6] Bloomberg, ‘Fed Cuts Rates by Quarter-Point; Powell Cites Weakness in Jobs,’ September 17, 2025

[7] Federal Open Market Committee Projections materials, accessible version, September 17, 2025

[8] Bloomberg, ‘Unofficial Transcript of Chair Powell’s FOMC Press Conference,’ September 17, 2025

[9] Senate Committee on Banking, Housing, and Urban Affairs, ‘Stephan Miran, Opening Remarks,’ September 16, 2025

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-08-16-16779