January 26, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

This week marked the one-year anniversary of the US administration under the stewardship of President Trump. The opening phase of a presidency – commonly referred to as the “first 100 days” – is widely regarded as a period of heightened political uncertainty and risk. The concept dates to Franklin D. Roosevelt, who assumed office while the US was mired in the Great Depression and advanced a sweeping package of legislation within his “first 100 days.” Since then, this period has been viewed as a window during which political goodwill is at its peak, opponents are still regrouping and elevated public optimism enables new leadership to advance its policy agenda.

As with many aspects of the Trump administration, established conventions have been rewritten. Twelve months on, the US political agenda continues to dominate global financial markets. This week, Greenland moved to the forefront and, in what is becoming a familiar pattern, initial “hard-ball” tactics quickly gave way to an accelerated deal-making process. In this case, it enabled President Trump to announce a framework agreement before the week was out.

Yet, judged purely by weekly price action, one could be forgiven for thinking it was a typically uneventful third week of the month – often characterized by limited economic data, subdued earnings releases and minimal central-bank activity. This was reflected in our preferred volatility gauges, the VIX and MOVE indices, both of which spiked briefly mid-week before mean-reverting to levels consistent with muted market concern going forward.

Navigating geopolitical uncertainty will remain a key theme in 2026, with the Trump Administration likely at the centre of unfolding events and we will continue to analyze developments through our growth–inflation shock lens. However, if we step back and strip away the noise, what other trends are financial markets truly signaling?

The trend revealing itself in global government bonds is of curve steepening, while there are ominous signs of a return of the bond vigilante. This week, the most notable underperformers were Japan and the UK.

In Japan, 30-year government bonds experienced their worst single-day sell-off on record,1 with yields rising 26 basis points (bps) to an intraday peak of 3.85% before retreating to close the week around 3.60%. For context, this places Japanese 30-year yields roughly 10bps above their German government bond equivalent.

Geopolitical developments from Greenland to Prime Minister Sanae Takaichi’s proposed snap election on 8th February – now being viewed as a higher-risk event than initially anticipated after her former coalition partners merged with the main opposition party – did have an effect. However, the primary driver of the negative market reaction appears to be the re-emergence of bond market vigilantes. In a notably expansionary move, Takaichi pledged to eliminate the tax on food to improve household affordability pressures.1

While such measures would provide near-term relief for households, they could complicate the Finance Ministry’s efforts to maintain fiscal balance. Bond investors were later reassured when the fiercely independent Bank of Japan delivered a mildly hawkish-leaning policy decision. As expected, the policy rate was left unchanged at 0.75%. However, the decision was an 8–1 vote, with a dissenting member advocating for an additional 25bps hike. Meanwhile, the accompanying outlook report revised up inflation expectations, projecting core-CPI to remain above 2% across the entire forecast horizon.2

In the UK, Gilts closed the week 7bps higher from the 5-year point outward. Inflation unexpectedly accelerated for the first time in five months, reigniting concerns that the central bank may have declared victory over pricing pressures too early. In December, consumer prices rose 3.4% year-over-year (YoY) with services inflation – closely watched by the Bank of England (BoE) – increasing to 4.5% from 4.4%, in-line with the BoE’s expectation of a 0.1% acceleration.3

However, bond-market vigilantes were closely following headlines that Greater Manchester Mayor Andy Burnham’s return to Westminster has suddenly become possible. Labour MP Andrew Gwynne’s resignation triggered a by-election in the Gorton & Denton constituency – part of Burnham’s political base.4 Burnham has long been viewed as a potential contender for the leadership of the Labour Party and is known for advocating higher public spending alongside lower taxes.

As for the US government bond market, long-end yields closed the week relatively unchanged. Bond-market vigilantes may have found some reassurance in the initial Supreme Court proceedings regarding the Trump administration’s attempt to remove Federal Reserve Governor Lisa Cook. While no verdict has been issued, the start of oral arguments suggested that some justices were questioning the administration’s position. Notably, Justice Brett Kavanaugh, appointed by the Trump administration, remarked that the move could “weaken, if not shatter, the independence of the Federal Reserve”.5

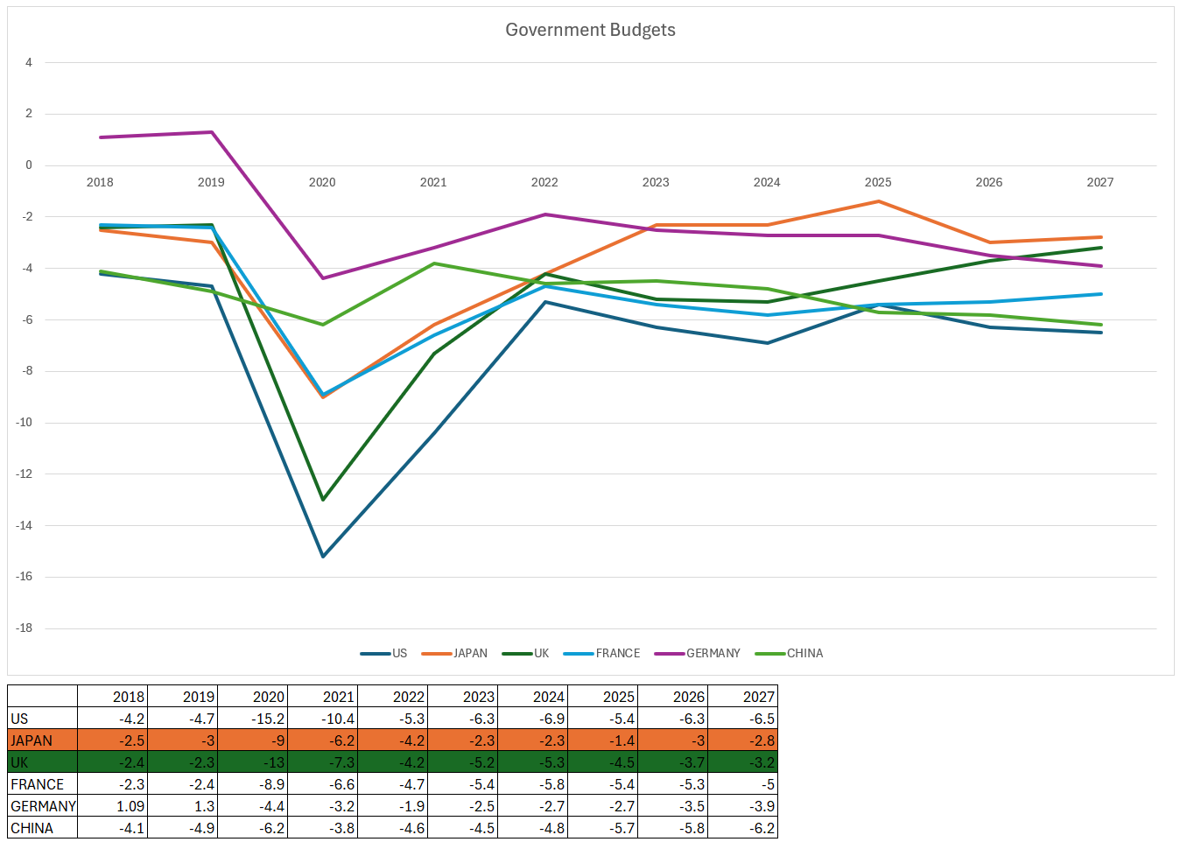

With government curves steepening, raising funding costs and bond-market vigilantes on high alert, it is advisable for governments to ensure central bank independence while maintaining fiscal discipline. Consider this week’s two underperforming government bond markets: compared with other major bond markets such as the US, Germany, France and China, their projected budget deficits are the most conservative. In fact, for FY26, Japan is set to run a primary balance surplus for the first time in 28 years.6 See the Chart of the Week for details.

It may be the safest option is to rotate out of government bonds and into the corporate bonds. Corporate balance sheets are in much better shape, exposure is more concentrated at the front end of the curve (2–7 years), and in the case of emerging markets, the asset class remains under-owned and continues to outperform in both credit and equities year-to-date.

Chart of the Week: Japan and UK Fiscal in good shape?

Source: Bloomberg, as of January 23, 2026. For illustrative purposes only.

Source: Bloomberg, as of January 23, 2026. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] Bloomberg Opinion, as of 21st January 2026. “Return of the Three-Headed Bond Monster Over Tokyo: John Authers”

[2] Bloomberg, “BOJ REACT: Ueda Caught Between Yen Risks and Rate Patience,” January 23, 2026

[3] Bloomberg, “UK REACT: Short-Lived CPI Rise Won’t Shift BOE’s Rate Path,” January 21, 2026

[4] ITV News, “Why the path to Westminster is not so simple for Andy Burnham,” January 23, 2026

[5] Bloomberg, “Supreme Court Appears Wary of Trump Bid to Fire Fed’s Cook,” January 21, 2026

[6] CLSA Benthos, “Elections & bond chaos made simple,” January 22, 2026

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of January 23, 2026, and may change without notice. All data figures are from Bloomberg, as of January 23, 2026, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.