November 24, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

The two economic “Jenga blocks” investors were pressing on this past week were inflation and valuations. Equities rarely outperform when central banks turn more hawkish or when financial conditions tighten. In the US, this is being compounded by a lack of transparency due to a government data void following the shutdown, fueling concerns the Federal Reserve (Fed) may once again prioritize its inflation-fighting credentials at the expense of growth, with the experience of 2022 still fresh in investors’ minds.

Valuation concerns are centered on the market’s heavy reliance on a small group of mega-cap tech names. In the S&P 500, for example, the top eight companies - all closely tied to AI - now account for around 35.5% of the index, while just two sectors, information technology and communication services, together represent roughly 46.6%.[1] This suggests the index is being driven largely by a single macro theme: AI. This concentration comes at a time when investors are increasingly uneasy about stretched valuations, the circular nature of financing in AI-related deals, and the enormous capital being deployed into infrastructure with (as yet) limited visible returns.

Across Asia, disinflation seems to be a greater concern - except in Japan, where pressure continues to build on the Bank of Japan (BoJ) to tighten policy. Core consumer prices (ex. fresh food) rose 3%, compared with 2.9% in the previous month. Inflation has now run at or above the BoJ’s 2% target for 43 consecutive months, the longest stretch since 1992. [2] At the same time, the Japanese government has approved a ¥21.3 trillion stimulus package aimed at easing public discontent over rising living costs. [3]

In Europe, the UK has struggled with sticky inflation, so it was good news that inflation fell for the first time in six months in October, confirming the Bank of England’s (BoE’s) view that price pressures may finally have passed their peak. Headline CPI (Consumer Price Index) rose 3.6% year-over-year (YoY) - down from 3.8% in September, and in line with the BoE’s forecast. The moderation was driven largely by energy prices, which increased by less than they did a year ago. It was also encouraging to see services inflation edge down to 4.5%.[4]

Regulated prices, tax raises, energy costs and still-elevated food bills have been key drivers of the UK’s sticky inflation, so the BoE is likely to wait for the Labour government’s Autumn Budget on 26th November to assess whether fiscal policy further complicates the outlook. Barring any major budget surprise, the main lingering concern for the BoE will be food prices, where inflation ticked up to 4.9% in October from 4.5% the previous month. 4 Even so, softer labour-market data and sluggish growth are likely to tip the balance towards a December “Christmas present” in the form of a 25 basis point rate cut. Overnight interest-rate markets are currently pricing in a roughly 85% probability of such a move. [5]

For the eurozone, concerns about disinflation - and the risk of sliding toward deflation - continue to grow. The final euro area HICP (Harmonised Indices of Consumer Prices) reading for October confirmed the flash estimate of 2.1%, down slightly from 2.2% in September. [6] Disinflationary forces are expected to build in the months ahead, and rising downside risks to the inflation outlook are likely to bring the prospect of policy easing back onto the table in 2026 - a scenario not currently priced in - as the full impact of tariffs feeds through.

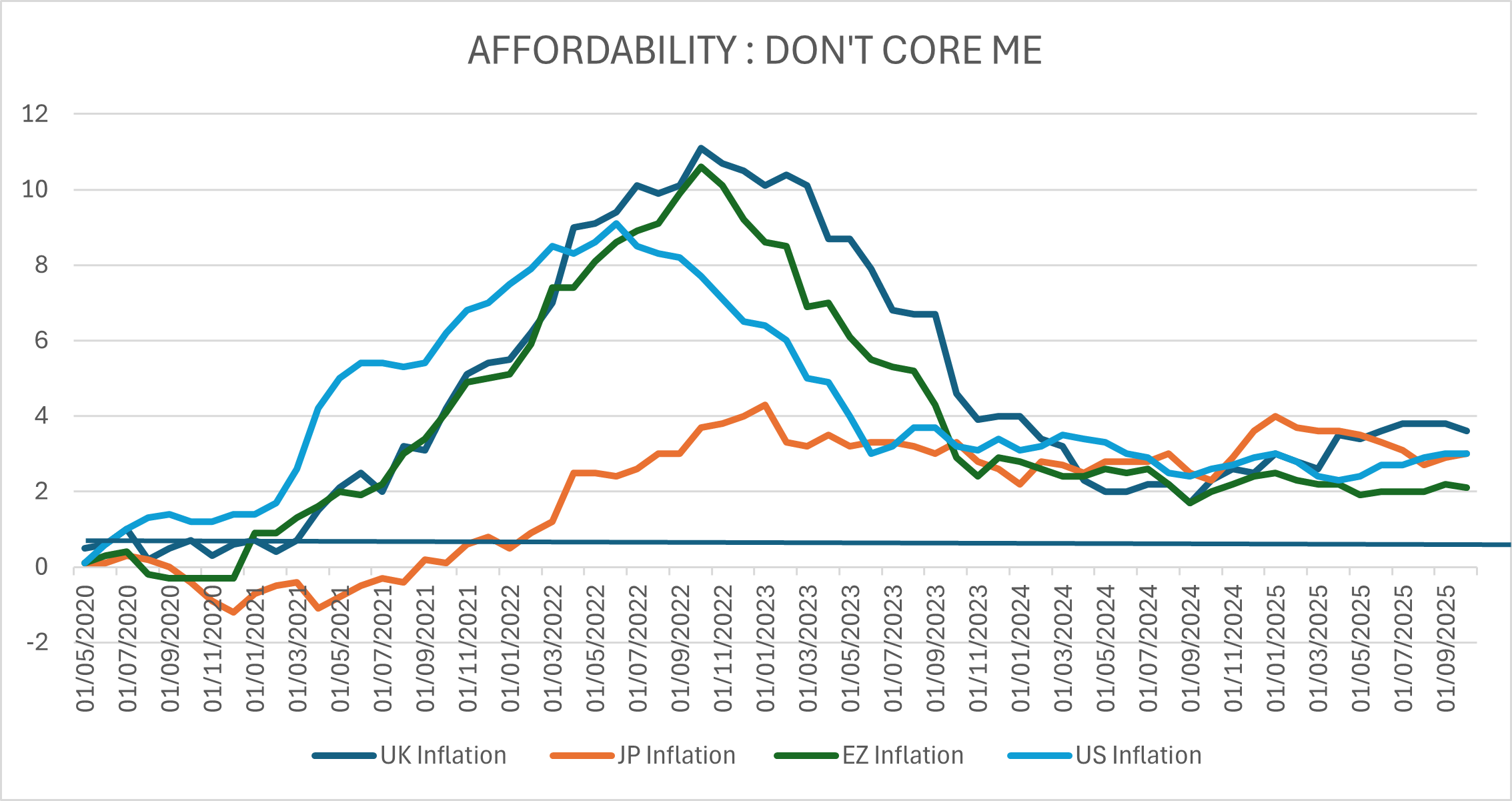

Meanwhile, in the US, affordability has suddenly become the center of policy makers’ attention. We are a little over 300 days into Donald Trump’s second term, a period that can only be described as “fast and furious” in policy terms given the unusually high volume of executive orders. Yet polls suggest that the administration’s efforts have not been warmly received. President Trump’s approval rating has fallen by 16% since taking office, with only around 40% of voters now approving of his performance. [7] While it is common for presidents to see support fade once the “honeymoon” period ends, in recent times no president’s approval has declined this quickly; polling indicates that every state, except Idaho, has moved against Mr. Trump. Combined with recent Democratic successes in the New York City mayoral race, and in state elections in both Virginia and New Hampshire, this might prompt the administration to rethink - or at least fine-tune - its policy approach, particularly with the midterms now less than a year away.

Disapproval appears centered on a common theme: concern over affordability, with the basic cost of living - driven by healthcare, food and housing - dominating voter sentiment. In a recent Reuters/Ipsos poll, around 40% of respondents said candidates’ positions on the cost of living would be the single most important factor in their vote next year. [8]

Flexibility, pragmatism and outright dynamism are unquestionably strengths of the administration, and it has responded accordingly. President Trump has rolled back tariffs on more than 200 food products, including staples such as coffee, beef, bananas and orange juice. [9] The administration is also considering a plan for the government to back 50-year mortgages to address the housing affordability crisis. [10]

President Trump has additionally told reporters he intends to move forward with a US$2,000 payment to lower-and middle-income Americans, funded by tariff revenues. However, the plan looks unrealistic, as the numbers do not add up: tariffs are projected to generate around US$200–300 billion a year in revenue, while a US$2,000 dividend paid to all Americans, including children, would cost roughly US$600 billion.[11] This will be welcome news for the Federal Open Market Committee (FOMC), and especially for its Chair, Jerome Powell, who has been under continuous pressure from the administration to loosen policy at an accelerated pace, even though the committee has been in breach of its inflation objective. The core Personal Consumption Expenditure Price Index (PCE) has been above 2% since March 2021, and current staff projections do not foresee a return to target - even by the end of 2027 - with core PCE projected at 2.1%.[12]

According to the minutes of the October FOMC meeting, released last week, officials judged it would likely be appropriate to keep interest rates steady for the remainder of 2025, implying a strong preference to remain on hold in December. [13] This cautious stance - now arguably supported by the administration - is driven by sticky inflation, loose financial conditions and a lack of timely data due to the government shutdown.

Elsewhere in the FOMC minutes, there was an interesting discussion about current financial stability risks, with some officials commenting on “stretched asset valuations in financial markets.” Several policymakers pointed to “the possibility of a disorderly fall in equity prices, especially in the event of an abrupt reassessment of the possibilities of AI-related technology13.”

The timing was thus perfect for Nvidia, the world’s most valuable chipmaker and a key barometer of the AI sector, to report a blowout third-quarter earnings report that exceeded analyst expectations. Revenue rose 62% to US$57 billion for the period ending October 26, while earnings came in at US$1.30 per share, surpassing forecasts of US$55.2 billion in revenue and US$1.26 per share in profit. Nvidia’s data center unit was the primary driver, generating US$51.2 billion in revenue versus the US$49.3 billion expected, reflecting robust ongoing demand for AI infrastructure. [14]

Overall, it was a challenging week for total returns. The US dollar appreciated against most major currencies, tightening financial conditions; fixed income proved to be the most resilient asset class. Government bond curves steepened, with the front-end outperforming as yields declined in that segment of the curve. In credit markets, spreads widened slightly, but overall returns were cushioned by the drop in government bond yields and ongoing coupon income, with investment grade credit delivering modest positive outperformance.

Other assets fared less well. Commodity prices were weak, with energy prices falling as the US pushed for Russia and Ukraine to move toward ending the war; Ukrainian President Volodymyr Zelenskiy announced he has agreed to work on a peace plan drafted by the US, and Russia and expects to speak with Donald Trump in the coming days. [15]

Metal prices were dragged lower by the deteriorating global risk sentiment, with industrial metals underperforming precious metals. At the same time, digital currencies are having their worst month since June 2022, when the collapse of Do Kwon’s TerraUSD stablecoin triggered a chain of failures that ultimately contributed to the downfall of Sam Bankman-Fried’s FTX exchange. Bitcoin is now more than 30% below its October peak. [16]

At the core of the current correction in capital markets are equities and the US economy. Global equities had their worst week since “Liberation Week” in April, with a broad-based sell-off across regions. The Bloomberg World Large & Mid Cap Index fell by more than 3%, underscoring the extent of the risk-off move.

Chart of the Week: Affordability – Don’t Core Me

Source: Bloomberg, as of 21st November 2025. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

References

[1] S&P Dow Jones Indices, Equity S&P 500, as of October 31, 2025

[2] Bloomberg, ‘Japan’s October Data Keep BoJ on Track for Gradual Rate Hikes,’ November 20, 2025

[3] Bloomberg, ‘Japan Unveils Biggest Stimulus Since Covid in Bond Market Test,’ November 21, 2025

[4] Bloomberg, ‘UK Inflation in First Drop Since March Ahead of Budget,” November 19, 2025

[5] Bloomberg, as of November 21, 2024

[6] Bloomberg, “Euro-Area React: Sticky Core Inflation Now, Disinflation Ahead,’ November 19, 2025

[7] The Economist, ‘Donald Trump’s approval rating,’ November 21, 2025

[8] Reuters, ‘Cost-of-living worries haunt Americans ahead of midterms, Reuters/Ipsos poll finds,’ October 24, 2025

[9] Bloomberg, ‘Trump Cuts Food Tariffs on Beef, Coffee as Prices Vex Voters,’ November 14, 2025

[10] CNN Business, ‘The affordability crisis is forcing Trump to radically reshape his economic plan on the fly,’ November 14, 2025

[11] Fortune, ‘Tax wonks see Trump blowing his tariff revenue bonanza on half-baked plan to give Americans a $2,000 ‘dividend’,’ November 12, 2025

[12] Federal Open Market Committee (FOMC) Projections materials, September 17, 2025

[13] Bloomberg, Fed Minutes Show ‘Many’ Officials Lean Against December Cut, November 19, 2025

[14] Bloomberg, ‘Nvidia Downplays Bubble Fears, Though Post-Earnings Rally Fades,’ November 20. 2025

[15] Bloomberg, ‘Zelenskiy Says He Agreed to Work on US Draft Plan to End War,’ November 20. 2025

[16] Bloomberg, ‘Bitcoin Heading for Worst Month Since Crypto Collapse of 2022,’ November 21, 2025

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of November 21, 2025, and may change without notice. All data figures are from Bloomberg, as of November 21, 2025, unless otherwise stated.

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.