September 29, 2025

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

Price action in financial markets this week was soft and subdued. Negative headlines slightly outweighed positive headlines, leaving insufficient momentum to push prices higher up the proverbial “wall of worry” that often accompanies a bull market. As a result, investors ended the week with more uncertainty than when it began. This was reflected in the steady grind higher of our preferred sentiment index, the VIX, which rose from 15 at the start of the week to 17. Commodity markets were the clear winners in this environment, with energy prices and precious metals leading gains as investors factored in rising geopolitical uncertainty and rising tension.

Central banks continued to play the role of “good cop” on the global stage, providing a source of stability. The six committee meetings held this week reinforced last week’s message that monetary policy is moving toward neutral levels. Two central banks eased policy by 25 basis points (bps), while the others remained on hold. The only surprise came from Sweden, where the Riksbank cut its key rate to 1.75%. However, the move was paired with guidance signaling no further reductions through 2028.[1]

In Switzerland, the Swiss National Bank left its benchmark at zero, with President Martin Schlegel acknowledging the pain caused by tariffs, but emphasizing the limited overall impact on the economy, with only 4% of Swiss exports directly affected.[2] Meanwhile, in China, loan prime rates were kept unchanged, underscoring the caution of the People’s Bank of China; despite sluggish August activity data, policymakers remain wary of fueling an overheating stock market.

In contrast, politicians continued to play the role of the global “bad cop,” and were prominently on display this week. NATO made it abundantly clear it would not tolerate further violations of its airspace, and is prepared to respond with full force, including the potential to shoot down Russian aircraft.

Meanwhile, Ukraine continued its attacks on Russian energy infrastructure, primarily targeting refineries. Estimates of shut-in refining capacity vary widely - from 200,000 barrels per day to over 1 million barrels per day; but the frequency and apparent effectiveness of the strikes are also adding to the geopolitical risk premium in oil. Energy prices increased by more than 3% this week.[3]

In the UK, Greater Manchester Mayor Andy Burnham, viewed as the main challenger to Prime Minister Keir Starmer, called for an additional £40bn in borrowing to fund housing projects.[4] The announcement spooked gilt markets, which continue to question the government’s fiscal discipline, resulting in this week’s 5- and 30-year gilt auctions attracting the lowest number of orders since at least 2022.[5]

Not to be outdone, the Trump administration announced additional tariffs. Starting October 1, 2025, the US will impose new duties of 100% on branded or patented pharmaceuticals, 50% on kitchen cabinets, 30% on upholstered furniture and 25% on heavy trucks. The timing is notable, perhaps a show of confidence or hubris, as the government faces the risk of a shutdown on the same day due to a funding impasse.

Republicans remain committed to the House-passed continuing resolution, while Democrats are pushing for a version that extends expiring Affordable Care Act subsidies and addresses other priorities. The administration has threatened layoffs rather than furloughs for some federal employees. A shutdown would also delay the critical September Nonfarm Payroll jobs report, scheduled for release on October 3.[6]

As for the “neutral cop,” the economists - the balanced and impartial enforcers - painted a mixed picture. The Euro Area composite Purchasing Managers’ Index (PMI) climbed to a 16-month high at 51.2, driven by the region’s buoyant services sector. However, the manufacturing component slipped back into contraction at 49.5, contrary to consensus expectations, underscoring the drag from trade tensions. France also weighed heavily on the index, with its composite PMI falling sharply to 48.4.[7]

In the US, the economy grew in the second quarter at its fastest pace in nearly two years as the government revised up its previous estimates led by consumer spending and business investment. Gross domestic product (GDP) was revised to a 3.8% annualized rate, up from the prior 3.3% estimate. Consumer spending - the main engine of growth - advanced at 2.5%, boosted by stronger outlays on transportation, financial services and insurance. Business investment rose 7.3%, driven by the largest increase in intellectual property products since 1999. Investment in data centers, which underpin artificial intelligence infrastructure, surged to a record annualized level of over US$40 billion.[8]

However, the positive US GDP data was tempered by an Organization for Economic Development (OECD) report highlighting the impact of President Donald Trump’s “reciprocal” tariffs. With duties affecting more than 90 trading partners, the average American tariff rate rose to about 19.5% in August - the highest level since 1933. The administration’s trade strategy is having global ripple effects, weighing on GDP growth worldwide and even more so in the US.[9]

According to the OECD, global GDP is projected to decline from 3.3% in 2024 to 3.2% in 2025 and further to 2.9% in 2026. The US, which imposed significant duties on many trade partners, is expected to see GDP growth drop from 2.8% in 2024 to 1.8% in 2025, and 1.5% in 2026. Much of this slowdown is attributed to higher tariff rates and a contraction in net immigration.[8]

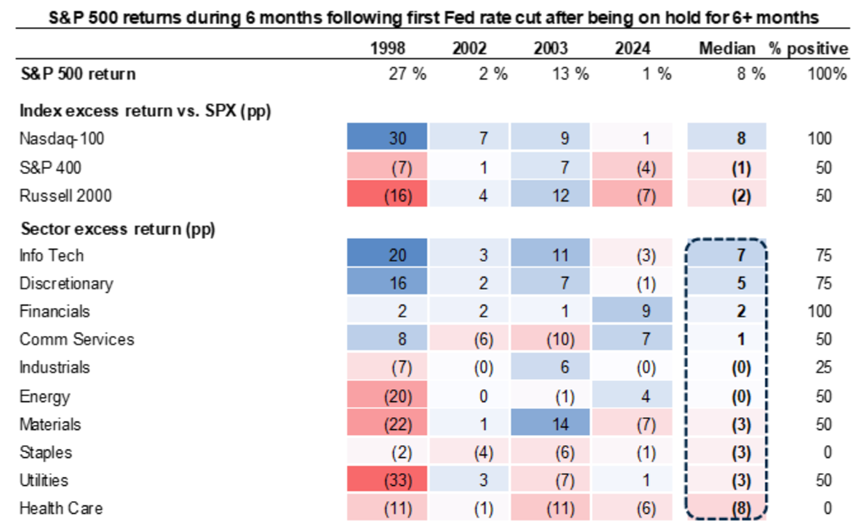

As for the “shadow cop,” quantitative research - which works behind the scenes and can indirectly influence investment decisions - remains optimistic. Over the past 40 years, there have been eight episodes during which the Federal Reserve cut rates after holding steady for six or more months. In half of those cases, the economy subsequently entered a recession. In the other four episodes, when the economy continued to grow - which remains the base case for the next twelve months - the S&P 500 delivered a median six-month return of +8% and a median 12-month return of +15% (see Chart of the Week).[10]

Chart of the Week: Without a recession, the bull market can continue to run

Source: Goldman Sachs Global Research, “Keep Buying Stocks When the Fed Cuts into a Growing Economy,” September 26, 2025. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Reference to the names of each company mentioned in this communication should not be construed as investment advice or investment recommendation of those companies. The opinions expressed by Muzinich & Co. are as of September 26, 2025, and may change without notice. All data figures are from Bloomberg, as of September 26, 2025, unless otherwise stated.

References

[1] Bloomberg News, ‘Sweden Cuts Rate to Three-Year Low, Signals End to Easing,’ September 23, 2025

[2] Bloomberg News, ‘Swiss National Bank Plays Down Tariff Fallout After Keeping Rate at Zero,’ September 25, 2025

[3] UBS Research & Commentary, ‘Fed Speak/Xi-Trump to Meet/China Holds LPR/US Congress In Recess Before Shutdown,

September 22, 2025

[4] Bloomberg News, ‘Gilt Market Becomes Easly Starmer-Burnham Battleground,’ September 25, 2025

[5] Bloomberg News, ‘Gilt auction demand lowest in two years in sign of pre-Budget jitters,’ September 25, 2025

[6] Citi Research US Economics, ‘The Daily Update—Seasonally stronger jobs,’ September 26, 2025

[7] UBS Global Research, European Economic Comment, ‘European PMIs: A mixed bag,’ September 23, 2025

[8] Bloomberg News, ‘US Notches Fastest Growth in Nearly 2 Years, Buoyed by Consumers,’ September 25, 2025

[9] Bloomberg News, ‘Full Effects of Trump Tariff Hikes Will Be Felt in 2026, OECD Says,’ September 24, 2025

[10] Goldman Sachs Global Investment Research, ‘Keep Buying Stocks When the Fed Cuts into a Growing Economy,’ September 26, 2025

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom. 2025-08-30-16842