Insight | February 21, 2021

China – 5 Cs in the Year of the Metal Ox - February 2021

We believe the calm and measured character of the ox is likely to be reflected in China’s economic and political stance in 2021, which could provide opportunities for investors

The Chinese New Year heralds the Year of the Ox. While we believe the West sees the bull as a symbol of market strength, in China the ox is a sign of diligence and perseverance.

In our view, China’s policymakers are likely to manage the economy with these ox-like characteristics; we could see more measured and targeted structural policies rather than a blanket-like aggregate approach.1

Cyclical Recovery

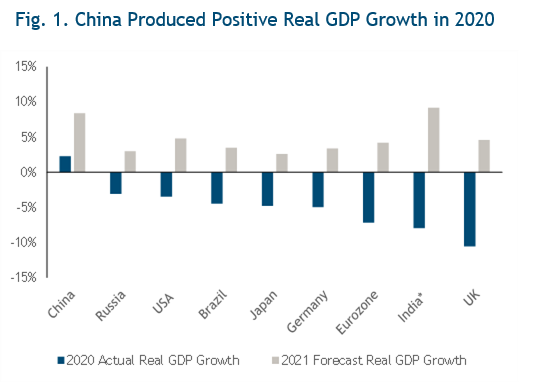

Despite the pandemic, China was the only country among the G-20 to produce positive GDP growth last year: 2.3% for 2020 and 6.5% in the fourth quarter. 2

Growth was driven by efficient suppression of the pandemic, strong recovery in exports (notably medical equipment and electronics) and government policy support.3 At the beginning of the pandemic, the People’s Bank of China (PBoC) loosened monetary policy. However, unlike other central banks, the PBoC did not resort to quantitative easing or negative rates and instead used myriad structural policies.4

For 2021 the International Monetary Fund expects growth of 8%+ for China, leading to comments from some market participants that this “viral expansion” is something that needs reigning in.5 This rate of growth is not only a recovery to pre-COVID-19 levels, but growth that is higher than its medium-term potential. Yet in our view, the PBoC is signalling the normalisation of monetary stimulus, not a hard adjustment.

Source: Bloomberg, as of 15 February 2021. Global Actual Real DGP Growth and Forecast. *India fiscal 21/22

Source: Bloomberg, as of 15 February 2021. Global Actual Real DGP Growth and Forecast. *India fiscal 21/22

In February, the PBoC reiterated its targeted structural approach; monetary policy was to be “precise, reasonable and moderate, striking a balance between economic recovery and risk prevention”.6

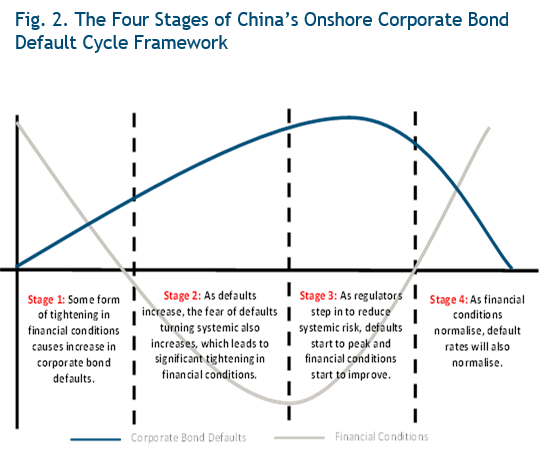

Moreover, we do not see the recent defaults of a few Chinese state-owned entities as the beginning of a credit crisis.7 Rather, we believe that economic recovery has allowed credit clean-ups to be back on the agenda.

In our opinion, the spillover from the onshore markets to the offshore credit markets presents an investment opportunity. While we believe Chinese high yield bonds have repriced wider on the back of fears of systemic defaults and a hard adjustment, defaults are likely to remain low.

As Fig. 2 highlights, we believe we are in Stage 4 of the default cycle - the normalisation of financial conditions and defaults.

Source: Morgan Stanley: Asia Primer, Asia Credit Strategy: 22 Years of China Corporate Bond Defaults January 10, 2021

Source: Morgan Stanley: Asia Primer, Asia Credit Strategy: 22 Years of China Corporate Bond Defaults January 10, 2021

COVID-19

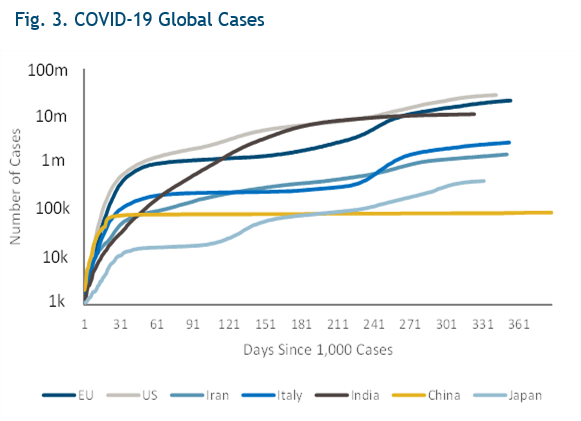

While 2020 was a huge struggle for the entire world in its efforts to manage and defeat COVID-19, we believe China’s management of the outbreak was notable in its efficiency. Targeted measures (draconian lockdowns and digital surveillance systems used for tracking) helped quell the virus, and its vaccination roll out is now underway. 8

So far, China’s economic recovery has been led by industrial production. In our view, the next leg of the recovery needs to come from increased domestic consumption, which will be predicated on keeping the virus in check.

Source: Bloomberg, as of 16 February 2021

Source: Bloomberg, as of 16 February 2021

Currency

We expect the approach of a measured ox in terms of China’s approach to currency management.

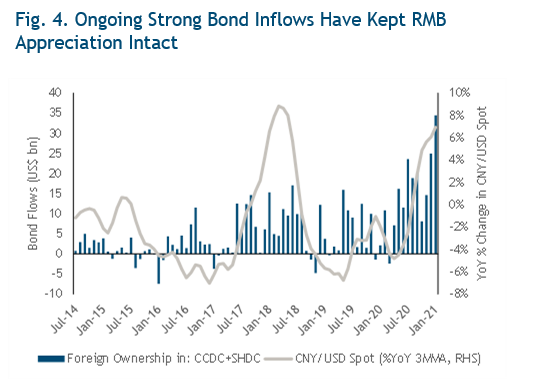

In 2020, the yuan strengthened close to 7% against the US dollar, in our view boosted by a V-shaped economic recovery, capital inflows and interest rate differentials.9

In January 2021, the PBoC rebalanced its currency basket, the China Foreign Trade System against which the yuan is managed, to lower the weighting of the US dollar in favour of the euro.10 This is the second adjustment since the basket was introduced in 2015 and, according to the PBoC, reflects China’s external trade conditions.11

It could be argued this move was in response to the new trade deal signed with the EU at the end of last year, but we believe overall it reduces the dependency on the US currency for China’s trade.

In a year of shrinking global foreign direct investment, China attracted US$163bn in 2020.12 Its domestic bond market received record inflows due to the inclusion of Chinese treasuries in government bond indices, while Chinese equities gained 26%.13

Whilst a further appreciation of the yuan is likely to be painful for exports and goes against the country’s wider policy of boosting domestic consumption, we believe policymakers are unlikely to resort to any drastic currency intervention.

In our view, a currency war may be too detrimental at the dawn of the Biden led US-China relationship. Lowering interest rates could also create difficulties, as we believe policymakers are trying to avoid aggregate policies that lead to blanket expansion. As a result, interest rates and the currency are likely to remain stable, in our opinion.

Against this steady backdrop we expect capital inflows to continue in 2021; while foreign holdings of Chinese treasuries have grown, there is room for further growth, also because of the phasing-in of these into the indices. 14

Most of the inflows into the China onshore renminbi (RMB) market have been in treasuries or policy bank bonds, and there is still limited appetite to go down the credit curve into RMB-denominated corporate bonds.15

We believe this is for two reasons. First, they are mostly bought by government bond mandates, and second, we believe there is still a lack of credit spread and rating differentiation among onshore China bonds issuers.

Hard currency China bonds are better suited for corporate credit investors, in our view, due to their liquidity, credit premium differentiation, and ratings.

Source: Deutsche Bank internal research, as of February 2020

Source: Deutsche Bank internal research, as of February 2020

Climate

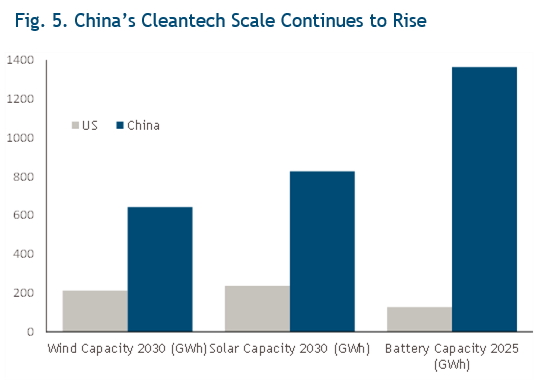

In 2020, China pledged to be carbon zero by 2060.16 The country is a large carbon emitter, but it is also a large investor in green energy with a US$165bn market in green bonds at the end of 2020, up from US$1bn in 2014.17

To meet their net zero target, the country will need to cut carbon emissions by at least 85% by 2060.18 They will need to invest RMB3-4trln (US$433-577bn) annually to meet this goal, and we believe green bonds could be a useful financing tool.19

We could see global green bond issuance near US$500bn, with Chinese issuers taking a large share, providing investors with a raft of opportunities in a fast-growing segment of the market.20

However cynical one might be on China’s carbon neutral targets, it is notable that China has already given specific province-level annual targets for renewables’ share of total power consumption up to 2030. 21

Source: BofA Global Research, Bloomberg NEF, as of 2 February 2021

Source: BofA Global Research, Bloomberg NEF, as of 2 February 2021

China-US Relations

It is too early to tell if the US/China relationship will likely change in substance or style following President Biden’s election.

China missed its Phase 1 trade deal commitments by 30%, due to the pandemic. Energy purchases lagged the most, while US agricultural products fared best. 22 As these targets were not met, we believe President Biden might extend the timeline or renegotiate.

However, we could see ongoing tensions between the two nations; Biden’s Climate Envoy John Kerry has already been critical of China’s 2060 carbon zero target, which is 10 years later than other emitters.23

In our view, it is clear from the new economic policies laid out in the Central Economic Work Conference in December 2020 that China is trying to look inward for future strength with less reliance on external industrial supply chains or technology, external demand, and even the country’s ability to feed itself.24

Policies like “Strengthen China’s ability to control industrial supply chains”, “Strengthen national strategic technologies” and “Expand domestic demand” all address this need for less reliance on the US or other countries. Even the recent rebalancing of the currency basket against which the yuan is managed is a symbol of reduced dependency on the US dollar.25

In our view, trade tensions and US sanctions on Chinese names have led to a cheapening in Chinese investment grade credits and as a result we believe tensions surrounding the status quo are already priced in.

A severe deterioration such as a hard-line stance on the Phase 1 trade deal would have a negative impact on markets, in our opinion.

This is not our base case, given that Biden will likely have more pressing domestic issues to deal with. However, to date none of the geopolitical tensions have appeared to dissuade flows into China, which could indicate investors’ underlying confidence in the country.

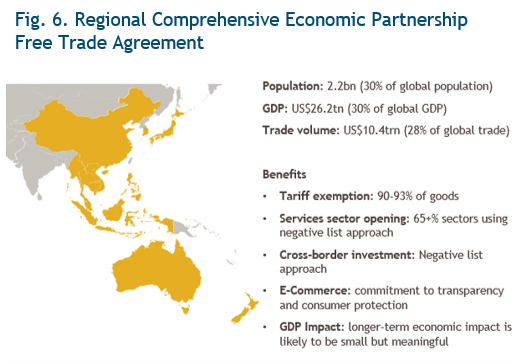

We believe we should also not underestimate the relevance of new trading partnerships signed late last year, such as China’s new trade deal with the EU and the Regional Comprehensive Economic Partnership. 26

Source: BofA, as of 16 November 2020

Source: BofA, as of 16 November 2020

Conclusion

Looking ahead, in the Year of the Ox we believe China will be a safe play on the reflation trade. Like the patient ox in Chinese folklore, we expect policymakers will take a prudent, measured approach to growth this year.

In our view China, like many other countries, is likely to produce a year of solid growth while also addressing bigger structural issues such as climate change, the consolidation of domestic consumption and the normalisation of financial conditions.

Footnotes:

1.https://www.economist.com/finance-and-economics/2021/02/13/china-leads-in-precision-guided-central-banking-does-it-work, 13 Feb. 2021

2.https://www.wsj.com/articles/china-is-the-only-major-economy-to-report-economic-growth-for-2020-11610936187, 18 Jan. 2021; http://www.stats.gov.cn/english/PressRelease/202101/t20210120_1812680.html, 17 Feb. 2021

3.http://documents1.worldbank.org/curated/en/297421610599411896/pdf/From-Recovery-to-Rebalancing-China-s-Economy-in-2021.pdf, Dec. 2020

4. https://www.economist.com/finance-and-economics/2021/02/13/china-leads-in-precision-guided-central-banking-does-it-work, 13 Feb. 2021

5.https://www.imf.org/en/Publications/WP/Issues/2019/11/27/Chinas-Productivity-Convergence-and-Growth-Potential-A-Stocktaking-and-Sectoral-Approach-48702, 27 Nov. 2020; https://www.economist.com/finance-and-economics/2021/01/18/chinas-economy-zooms-back-to-its-pre-covid-growth-rate, 18 Jan. 2021

6. http://www.xinhuanet.com/english/2021-02/08/c_139730858.htm, 8 Feb. 2021

7. Source: HSBC Global Research, China Onshore Insights, 13 Jan. 2021

8.https://www.europarl.europa.eu/thinktank/en/document.html?reference=EPRS_BRI(2020)659407, 11 Dec. 2020

9. Bloomberg CNYUSD, as at 31 Dec. 2020

10. https://www.reuters.com/article/us-china-yuan-index/china-adjusts-cfets-index-basket-cutting-dollar-weighting-idINKBN1YZ0OJ?edition-redirect=in, 31 Dec. 2020

11. IBID

12. https://unctad.org/news/global-foreign-direct-investment-fell-42-2020-outlook-remains-weak, 24 Jan. 2021

13. https://www.chinabondconnect.com/en/Data/Market-Data.html; Shanghai Shenzhen CSI 300 Index, as of 31 Dec. 2019

14. https://www.caixinglobal.com/2021-01-08/chart-of-the-day-overseas-investors-flock-to-chinas-bond-market-101648419.html, 8 Jan. 2021

15. HSBC Global Research China Onshore Insights 13 Jan. 2021

16. https://nytimes.com/2020/09/22/climate/china-emissions.html, 22 Sept. 2020

17. https://www.fitchratings.com/research/corporate-finance/china-corporates-snapshot-december-2020-china-green-bond-market-to-stay-robust-amid-policy-support-23-12-2020

18. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2020-country-insight-china.pdf, 2020 edition

19. https://www.lse.ac.uk/granthaminstitute/news/chinas-green-finance-strategy-much-achieved-further-to-go/, 24 Oct. 2018

20.https://www.institutionalassetmanager.co.uk/2021/01/26/294959/green-bond-issuance-track-almost-double-2021-market-estimates-suggest, 26 Jan. 2021

21. https://www.caixinglobal.com/2021-02-16/china-to-roll-out-provincial-renewables-targets-101663841.html, 16 Feb. 2021

22. BofA Global Research, US-China Trade Series #34 What to expect under the Biden Administration, 27 Jan. 2021

23. https://time.com/5933657/john-kerry-china-climate-change/ 27 Jan. 2021

24.https://www.chinabankingnews.com/2020/12/21/chinas-central-economic-work-conference-outlines-8-key-missions-for-2021/ 21 Dec. 2020

25. https://www.reuters.com/article/china-yuan-basket/chinas-tweaks-to-cfets-index-basket-could-drive-yuan-higher-analysts-idUSL4N2JF100, 4 Jan. 2021

26.https://policyexchange.org.uk/rcep-what-the-new-trade-bloc-means-for-the-indo-pacific-and-the-uk/ 4 Dec. 2020

----------------------------------------------------------------------------------------------------------------------------------

Important Information

Muzinich & Co. referenced herein is defined as Muzinich & Co., Inc. and its affiliates. This document has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past results do not guarantee future performance. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. This document and the views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity; they are for information purposes only. Opinions and statements of financial market trends that are based on market conditions constitute our judgement as at the date of this document. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Certain information contained in this document constitutes forward-looking statements; due to various risks and uncertainties, actual events may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained in this document may be relied upon as a guarantee, promise, assurance or a representation as to the future. All information contained herein is believed to be accurate as of the date(s) indicated, is not complete, and is subject to change at any time. Certain information contained herein is based on data obtained from third parties and, although believed to be reliable, has not been independently verified by anyone at or affiliated with Muzinich and Co., its accuracy or completeness cannot be guaranteed. Risk management includes an effort to monitor and manage risk but does not imply low or no risk. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability; heightened pricing volatility and reduced market liquidity. In Europe, this material is issued by Muzinich & Co. Limited., which is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ. Muzinich & Co. Limited. is a subsidiary of Muzinich & Co., Inc. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission. Muzinich & Co., Inc.’s being a registered investment adviser with the Securities Exchange Commission (SEC) in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

Index Descriptions

You cannot invest directly in an index, which also does not take into account trading commissions or costs. The volatility of indices may be materially different from the volatility performance of an account or fund.

Shanghai Shenzhen CSI 300 Index - The CSI T300 Index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges. Index has a base level of 1000 on 12/31/200