February 9, 2026

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

--------

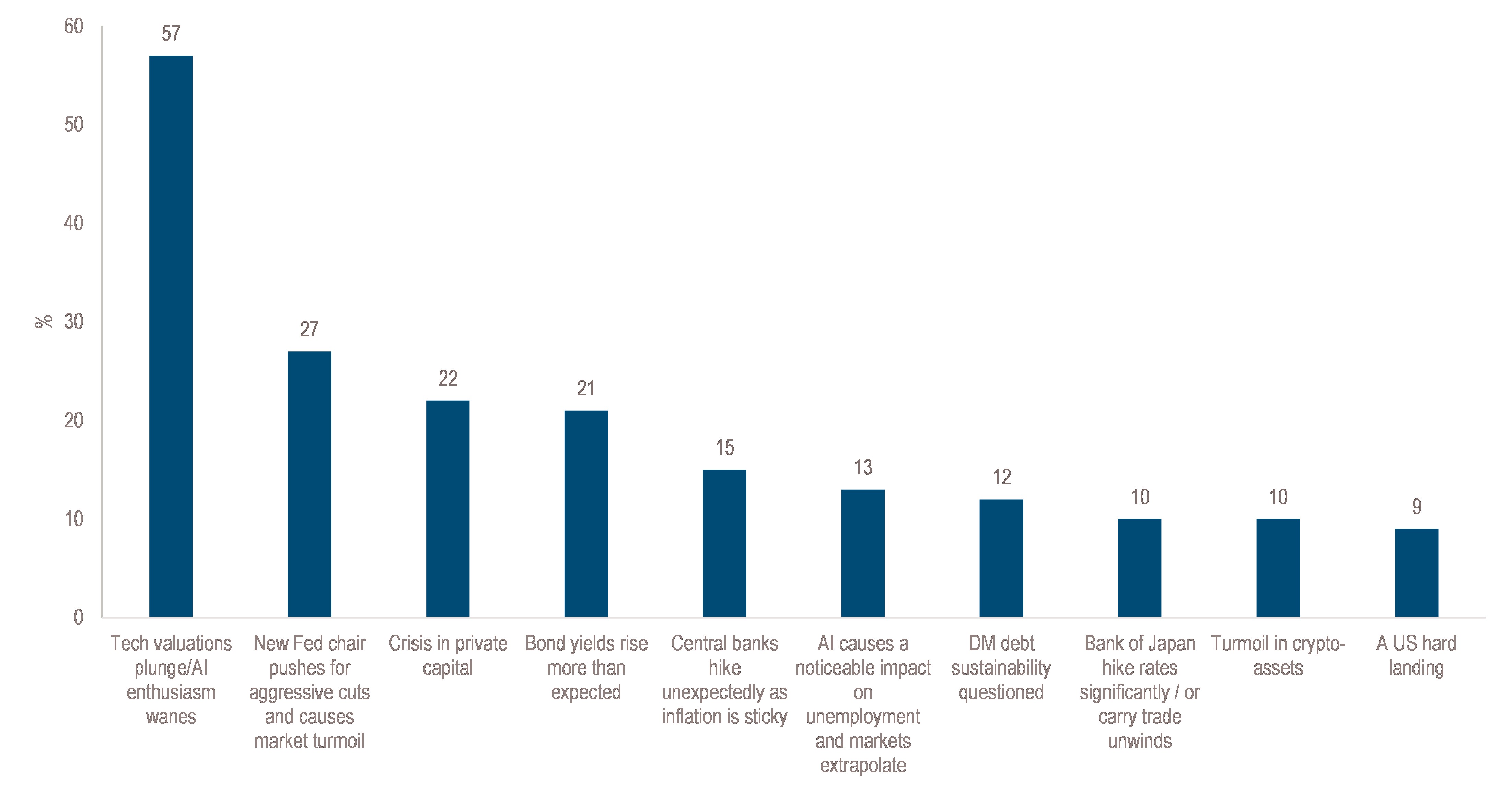

This week was anything but plain sailing for investors. It was not a full-blown storm, but a series of large swells forming beneath the surface. Typical of February, weak seasonality and deteriorating technical conditions saw investors focus on their favourite fear (see Chart of the Week). Concerns resurfaced around tech capex spending and the employment consequences of AI, with large swells beginning to appear in the software sector.

Other investors focused on the next Federal Reserve (Fed) Chair, Kevin Warsh, contemplating life without a guaranteed “central bank put.” Valuation swells emerged in commodities and digital assets. At the same time, other investors were also reminded of the implications of central-bank liquidity withdrawals and sticky inflation after the Reserve Bank of Australia raised policy rates. Meanwhile, government indebtedness – the wave with the potential to dwarf all others – continued to build, with uncertainty from elections in both Japan and Thailand, set for February 8, and a political storm intensifying around the UK government.

Across Asia, the standout news came from India, where the United States and India reached a trade agreement that significantly reduces tariffs on Indian exports. Under the deal, overall levies on Indian goods will fall from 50% to 18%, representing a substantial reduction for key sectors including textiles, machinery and other manufactured products. [1]

The agreement follows a phone call during which Prime Minister Narendra Modi agreed to halt purchases of Russian oil. India would also move to reduce its tariff barriers on US goods to zero, while committing to purchase more than US$500 billion worth of US energy, technology and agricultural products. The agreement marks a significant easing of trade tensions and a notable boost to India’s export outlook. [1]

In Europe, both the European Central Bank (ECB) and the Bank of England held policy meetings, with the ECB meeting proving relatively uneventful. The Governing Council left policy rates unchanged for a fifth consecutive meeting, keeping the deposit rate at 2.00%. President Christine Lagarde reiterated her familiar message that the central bank is in a “good place” on both interest rates and inflation. [2]

The main change in the ECB’s statement was a stronger emphasis on economic resilience. If there was any surprise from the meeting, it was the absence of any reference to the recent sharp deceleration in inflation. Headline HICP (Harmonised Index of Consumer Prices) inflation in the euro area slowed to 1.7% year-over-year (YoY) in January, down from 2.0% in December, undershooting recent forecasts.

Rather than acknowledging this disinflationary development, the ECB focused on factors supporting growth, including low unemployment, solid private-sector balance sheets, the gradual rollout of public spending on defence and infrastructure and the lingering supportive effects of past interest-rate cuts. Lagarde also played down the recent appreciation of the euro, suggesting policymakers remain comfortable. [3]

If the euro area has been a model of stability, the UK has been anything but. It’s been a soap opera. Fresh off the Peter Mandelson scandal, which has engulfed Prime Minister Keir Starmer and pushed his popularity to record-low approval ratings, the government now faces a series of mounting political challenges in the upcoming local elections. Betting markets now assign a 68% probability that Starmer will be replaced as Labour leader before 2027, with Labour MPs describing the mood within the governing party as increasingly mutinous. [4]

Adding to Labour’s woes, the Bank of England delivered an unwelcome surprise. The Monetary Policy Committee (MPC) voted 5 - 4 to keep the Bank Rate unchanged at 3.75%, with Governor Andrew Bailey once again providing the swing vote. While Bailey signalled a more aggressive easing bias – saying there “should be scope for some further reduction in Bank Rate this year” – the accompanying economic assessment painted a darker picture. [5]

The MPC minutes highlighted subdued economic growth and growing slack in the labour market, noting that upside risks to inflation have “become less pronounced.” The Bank expects inflation to return to its 2% target in April before falling below target for much of 2027, spending around four quarters under target. The growth outlook has also deteriorated materially: the Bank cut its 2026 GDP growth forecast to 0.9% from 1.2%, while growth in 2027 was revised down to 1.5% from 1.6%.[5] The overnight interest rate swap market is pricing in two, 25-basis-point policy cuts for 2026, with the next move – favoured for April – now a 93% probability, sharply higher than 43% at the start of the year. [6]

In the US, it was a key week for economic data and a heavy earnings calendar. On the economic front, the PMI (Purchasing Managers Index) reports were supportive, with both manufacturing and services beating expectations. The manufacturing index moved back into expansion, signalling possible resurgence in the sector.

However, it was the labour market reports that set a poor precedent for US assets. According to the Job Openings and Labor Turnover Survey (JOLTS), total job openings fell far more than expected, declining by 386,000 in December to 6.54 million, the lowest level since 2020. December marked the second consecutive month with more unemployed workers than job openings, the ratio of openings to unemployed workers fell to 0.87, leaving this key Fed indicator at its lowest level since early 2021. [7] While vacancies rose in construction and manufacturing, openings for white-collar workers tumbled. The report showed that the job-opening rate for finance workers fell to 2% in December, the lowest since the survey began 15 years ago, and in professional and business services, openings reached their lowest level since April 2020, and, aside from the early days of the pandemic, the lowest since early 2014. [8]

The outplacement firm Challenger, Gray & Christmas, Inc. added to swelling labour market concerns, reporting the largest number of job cuts for any January since the depths of the Great Recession in 2009. Companies last month announced 108,435 job cuts, a 118% increase from a year earlier. Nearly half of the announced job cuts were tied to just three companies: Amazon.com Inc., United Parcel Service Inc., and Dow Inc. Amazon plans to cut 16,000 corporate positions as part of a restructuring, while UPS said it would shed up to 30,000 roles. Chemical maker Dow intends to eliminate about 4,500 positions, and other firms, including Peloton Interactive Inc. and Nike Inc., also announced workforce reductions. [9]

Earning announcements have been going strong; so far, 69.8% of the S&P 500’s market capitalization has reported 4Q earnings. Earnings are beating estimates by 5.2% on aggregate, with 71% of companies topping projections, and EPS (earnings per share) are on pace for 12.3% growth. This would mark the fifth consecutive quarter of double-digit YoY earnings growth for the index. [10]

However, spending plans announced during earnings calls by Amazon and Alphabet generated investor concern. Amazon.com Inc.’s shares dropped after the company revealed plans to spend US$200 billion this year on data centres, chips and other equipment, raising worries that its massive bet on artificial intelligence (AI) may not pay off in the long run. [11]

Similarly, Alphabet Inc. is poised to invest more in 2026 than it has in the past three years combined, financing an unprecedented expansion of data centres critical to its AI ambitions. Google’s parent company said capital expenditures could reach US$185 billion this year, far exceeding analysts’ expectations of US$119.5 billion and doubling last year’s spend. [12] In total, Alphabet, Amazon, Meta and Microsoft are projected to invest over US$600 billion in capex this year, a sum larger than the entire GDP of countries such as Sweden, Norway or Belgium, underscoring the staggering scale of their AI and infrastructure wave! [13]

Chart of the Week: Pick Your Fear?

Source: Deutsche Bank Research, as of February 4, 2026. For illustrative purposes only.

Past performance is not a reliable indicator of current or future results.

References to specific companies is for illustrative purposes only and does not reflect the holdings of any specific past or current portfolio or account.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of February 6, 2026, and may change without notice. All data figures are from Bloomberg, as of February 6, 2026, unless otherwise stated.

References

[1] Bloomberg, “Trump, Modi Reach Trade Deal Slashing India Tariffs to 18%,” February 2, 2026

[2] Bloomberg, “Lagarde Plays Down Impact of Euro Rally as ECB Holds Rates,” February 5, 2026

[3] Bloomberg, “ECB REACT: Focus on Resilience Keeps Downside Risks Building,” February 5, 2026

[4] Bloomberg, as of February 6, 2026

[5] Bloomberg, “Dovish Bank of England Hold Spurs Bets on Faster Rate Cuts,” February 5, 2026

[6] Bloomberg, as of February 6, 2026

[7] Bloomberg, “US REACT: Drop in Openings Points to Fading Wage Pressures,” February 5, 2026

[8] Bloomberg, “US INSIGHTS: White-Collar Job Openings Plummet – In One Chart,” February 5, 2026

[9] Bloomberg, “US Companies Announce Most Job Cuts for a January Since 2009,” February 5, 2026

[10] UBS Global Research, “4Q25 Earnings Brief: February 06,” February 6, 2026

[11] Bloomberg, “Amazon Falls After Vow to Spend $200 Billion on AI This Year,” February 5, 2026

[12] Bloomberg, “Alphabet Plans Record Spending in Race to Dominate AI Market” February 5, 2026

[13] Bloomberg, “Amazon Sinks on $200 Billion Capex ‘Sticker Shock’: Street Wrap,” February 6, 2026

--------

Important Information

Muzinich & Co., “Muzinich” and/or the “Firm” referenced herein is defined as Muzinich & Co. Inc. and its affiliates. This material has been produced for information purposes only and as such the views contained herein are not to be taken as investment advice. Opinions are as of date of publication and are subject to change without reference or notification to you. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy. The value of investments and the income from them may fall as well as rise and is not guaranteed and investors may not get back the full amount invested. Rates of exchange may cause the value of investments to rise or fall. Emerging Markets may be more risky than more developed markets for a variety of reasons, including but not limited to, increased political, social and economic instability, heightened pricing volatility and reduced market liquidity. Any research in this document has been obtained and may have been acted on by Muzinich for its own purpose. The results of such research are being made available for information purposes and no assurances are made as to their accuracy. Opinions and statements of financial market trends that are based on market conditions constitute our judgment and this judgment may prove to be wrong. The views and opinions expressed should not be construed as an offer to buy or sell or invitation to engage in any investment activity, they are for information purposes only. Any forward-looking information or statements expressed in the above may prove to be incorrect. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation that the objectives and plans discussed herein will be achieved. Muzinich gives no undertaking that it shall update any of the information, data and opinions contained in the above.

United States: This material is for Institutional Investor use only – not for retail distribution. Muzinich & Co., Inc. is a registered investment adviser with the Securities and Exchange Commission (SEC). Muzinich & Co., Inc.’s being a Registered Investment Adviser with the SEC in no way shall imply a certain level of skill or training or any authorization or approval by the SEC.

In the United Arab Emirates (UAE) (excluding the Dubai International Financial Centre (DIFC) and the Abu Dhabi Global Market (ADGM): This document, and the information contained herein, does not constitute, and is not intended to constitute, a public offer of securities in the United Arab Emirates (“UAE”) and accordingly should not be construed as such. The Units are only being offered to a limited number of exempt Professional Investors in the UAE who fall under one of the following categories: federal or local governments, government institutions and agencies, or companies wholly owned by any of them. The Units have not been approved by or licensed or registered with the UAE Central Bank, the SCA, the Dubai Financial Services Authority, the Financial Services Regulatory Authority or any other relevant licensing authorities or governmental agencies in the UAE (the “Authorities”). The Authorities assume no liability for any investment that the named addressee makes as a Professional Investor. The document is for the use of the named addressee only and should not be given or shown to any other person (other than employees, agents or consultants in connection with the addressee’s consideration thereof).

In the United Arab Emirates (UAE) (including the Dubai International Financial Centre and the Abu Dhabi Global Market): This information does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment products in the UAE and accordingly should not be construed as such. Furthermore, this information is being made available on the basis that the recipient is an entity fully regulated by the ADGM Financial Services Regulatory Authority (FSRA), and acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the UAE Central Bank, the Dubai Financial Services Authority, the UAE Securities and Commodities Authority, the Financial Services Regulatory Authority or any other relevant licensing authority or governmental agency in the UAE. The content of this report has not been approved by or filed with the UAE Central Bank, the Dubai Financial Services Authority, the UAE Securities and Commodities Authority or the Financial Services Regulatory Authority.

Issued in the European Union by Muzinich & Co. (Ireland) Limited, which is authorized and regulated by the Central Bank of Ireland. Registered in Ireland, Company Registration No. 307511. Registered address: 32 Molesworth Street, Dublin 2, D02 Y512, Ireland. Issued in Switzerland by Muzinich & Co. (Switzerland) AG. Registered in Switzerland No. CHE-389.422.108. Registered address: Tödistrasse 5, 8002 Zurich, Switzerland. Issued in Singapore and Hong Kong by Muzinich & Co. (Singapore) Pte. Limited, which is licensed and regulated by the Monetary Authority of Singapore. Registered in Singapore No. 201624477K. Registered address: 6 Battery Road, #26-05, Singapore, 049909. Issued in all other jurisdictions (excluding the U.S.) by Muzinich & Co. Limited. which is authorized and regulated by the Financial Conduct Authority. Registered in England and Wales No. 3852444. Registered address: 8 Hanover Street, London W1S 1YQ, United Kingdom.